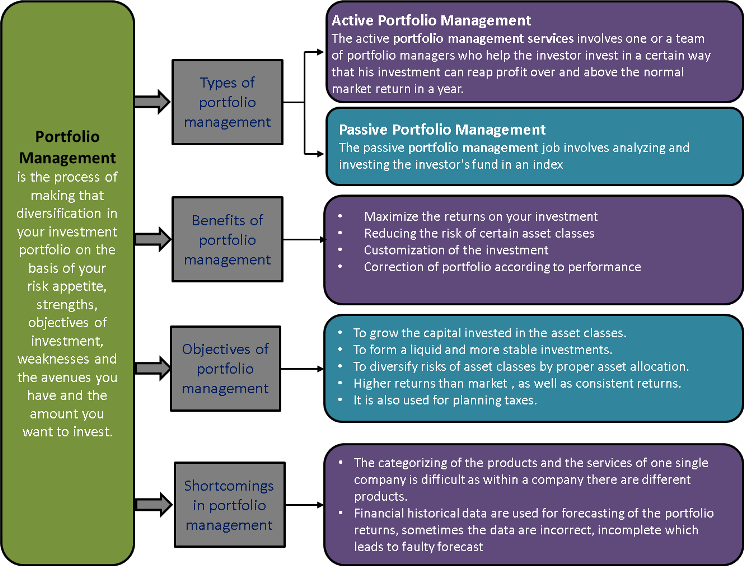

Diversification of your assets and investments reduces risks, and it has been a proven phenomenon. In simple words, Portfolio Management is the process of making that diversification in your investment portfolio on the basis of your risk appetite, strengths, objectives of investment, weaknesses and the avenues you have, and the amount you want to invest. Portfolio Management Services is one of the most sought-after services in the world of investment. It helps an investor customize their investments according to their need and abilities.

What is a Portfolio?

The word portfolio in the investment world means the grouping of assets according to the risk and return of individual assets and the group as a whole. It comprises equities, bonds, alternative investments like real estate or gold, and others. The portfolio is like a pie with different shares of each of the investment classes. The percentages of each of these investment classes are made according to the objectives of the investor and the risk-return element of the investments.

What is Portfolio Management?

Portfolio Management is the decision-making process for investments that decide which asset to invest in, how many shares of that asset should be in your investment portfolio, the expected returns and the anticipated risks of the individual assets, and its correlation with the other asset group in the portfolio. The main motto behind Portfolio Management is to increase the returns and reduce the risks by diversifying the investments into different asset classes. If one asset class is giving negative returns, it can be overshadowed by the positive returns of another asset class. The choice of assets according to the risk-taking capability of the investor, his objectives, and his opportunities are taken into consideration for making a decision about his investment.

What are Portfolio Management Services?

The financial professionals who have expertise in the process of portfolio management provide portfolio management services. This service includes assessing the investment objectives of the investor, analyzing the risk appetite of the investor, his financial background, ability to invest, and the opportunities he has. After analyzing these abovementioned things, the portfolio manager helps him identify the classes of assets to invest in according to the analysis of the investor. The primary job of the portfolio manager is to reduce the risk of the investor’s investment by selecting the right stocks according to the analysis and thereby increasing the returns or the earnings on the investment.

Also Read: Portfolio Management

There are two types of portfolio management services

Active Portfolio Management Services

The active portfolio management services involve one or a team of portfolio managers who help the investor invest in a certain way that his investment can reap profit over and above the normal market return in a year. It is achieved by researching the asset classes in-depth and then making an investment decision.

Passive Portfolio Management Services

The passive portfolio management job involves analyzing and investing the investor’s fund in an index (market index like Dow Jones or NASDAQ100). This is thus also known as the process of indexing.

Read Active vs Passive Portfolio Management for more details.

Features of Portfolio Management Services

Allocation of Assets

This is the base for portfolio management where assets with low correlation with each other are mixed in a certain way so that the risk and return profile of the investor are Investors who have a huge risk appetite can settle for a more volatile group of assets. In contrast, risk-averse investors can go for subtle or stable investment classes.

Diversification of Investment

Diversification is necessary since it is not possible for any investor or portfolio manager to predict how one single asset class will behave or return over a longer period of time due to various ambiguities in the market and the volatility. It is to divide the amount invested in different asset classes, which are least correlated with each other.

Also Read: Portfolio Management Process

Investment/Asset Rebalancing

Since markets are not the same every year, the asset allocation needs to be rebalanced according to the market prediction for a similar period. Another scenario is that over time, the ratio of asset classes in the portfolio changes on its own due to the accumulated returns. For example, in the beginning, you invested 60% in shares and 40% in FDs, but with the passage of time, the ratio changed to a 75:25 ratio, putting your investment at risk. The portfolio manager keeps an eye on the portfolio. Whenever they feel that the portfolio has crossed the level of the investor’s risk appetite, they rebalance it accordingly.

Objectives of Portfolio Management Services

- To grow the capital invested in the asset classes.

- And to form a liquid and more stable investments.

- To diversify the risks of the asset classes by proper asset allocation.

- Higher returns than the market, as well as consistent returns.

- It is also used for planning taxes.

Process of Portfolio Management Services

The detailed process which justifies the portfolio management services meaning is enumerated below:

- The first step is to identify the objectives or the motto behind an investor’s investment.

- The funds available to him which he can invest.

- Finding assets that will match the objectives of the investor.

- Preparing a full investment policy according to the analysis of the investor.

- Monitoring the portfolio continuously.

- Rebalancing it over and over again when the required ratio of asset allocation changes.

- Discuss with the client/investor the analysis of his investment from time to time and how to optimize the returns.

- Based on the performance of the portfolio and the updated objectives of the investor, the portfolio manager must rebalance the portfolio.

Benefits of Portfolio Management Services

The benefits or the portfolio management services returns are as follows:

Maximize the Returns on Your Investment

If you hire a prudent portfolio manager, he can optimize or maximize the returns on your portfolio. There are different types of returns, it can be either short-term return or long term, it must go according to the goals of the corporate entity etc.

Reducing the Risk of Certain Asset Classes

The market is volatile, and thus the most attractive asset/asset classes pose a higher level of risk as well. But with proper portfolio management, the risk can be reduced while maximizing the profit by proper diversification and asset allocation.

Customization of the Investment

It is another advantage of active portfolio management services. You as an investor can discuss and decide on the shares/companies/ asset classes you want to invest in rather than investing in a market index.

Correction of Portfolio According to Performance

Due to market volatility, if the portfolio doesn’t make returns according to the anticipated values, the portfolio can be corrected/ rebalanced at any point in time to maximize the returns and reduce the risk.

Shortcomings in Portfolio Management Services

There are certain drawbacks as well of portfolio management services:

- The categorizing of the products and the services of one single company is difficult as within a company there are different products.

- Financial historical data are used for forecasting portfolio returns. Sometimes the data are incorrect and incomplete, which leads to faulty forecasts.

Very nice