Gordon Growth Model is a part of the Dividend Discount Model. This model assumes that both the dividend amount and the stock’s fair value will grow at a constant rate. To put it in simple words, this model assumes that the dividend paid by the company will grow at a constant percentage.

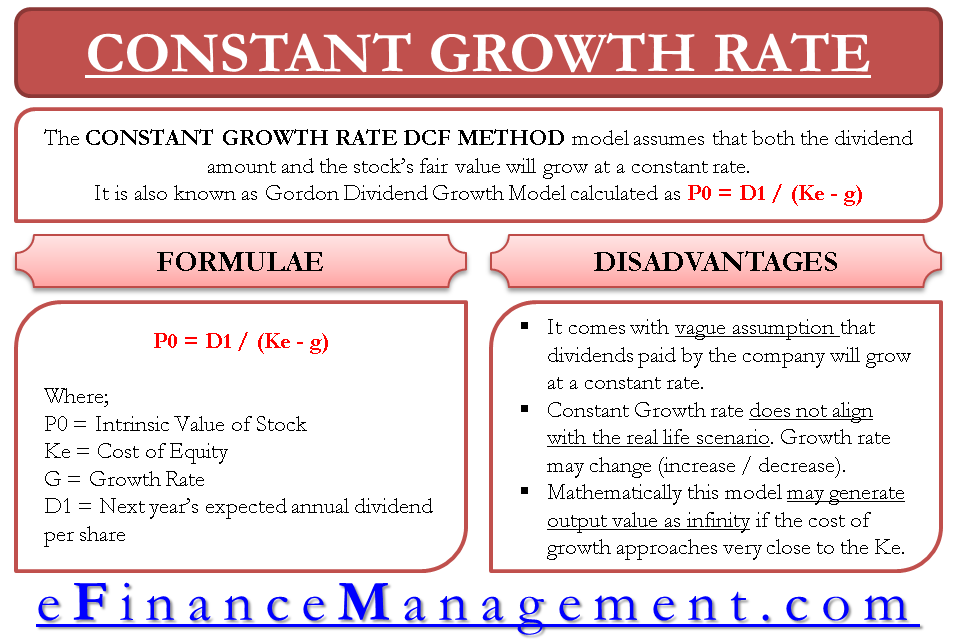

Gordon’s growth model, also known as the ‘Constant Growth Rate DCF Model,’ has been named after Professor Myron J. Gordon. As the name implies, this model works on the underlying assumption that the company will continue to pay the dividend amount as a fixed multiple of growth in the future, as it is paying now. It is an appropriate model to value companies that increase their dividend by a fixed rate every year. Let us now look at how to calculate the value of the stock using a constant growth model:

Formula for Gordon Growth Model / Constant Growth Rate DCF Method

Stock Value (p) = D1/ (k-g)

Where p = Intrinsic value of the stock/equity

k = Investors required rate of return, discount rate

g = Expected growth rate (Note: It should be assumed to be constant)

D1= Next year’s expected annual dividend per share

When k and g, i.e., investors required rate of return and expected growth rate, do not change over the years, so the stock’s fair/intrinsic value will increase annually by the rate of dividend increase. To put it in simple words, both the dividend amount and the stock price/value will increase at a constant growth rate.

Let us look at the example below to better understand the concept of the constant growth model.

Example for Calculating Value of Stock Using Gordon’s Growth Model

Let us say a stock pays a dividend of $ 5 this year. The dividend has been growing at the rate of 10% annually. Assuming a 15% required rate of return; the value of the stock can be calculated as follows:

Stock Value (p) = D1/ (k-g)

In the given example;

Current year Dividend D0 = $ 5

k = 15% i.e. 0.15

g = 10% i.e. 0.10

| Year | Expected Annual Dividend | Discount Rate | Expected Growth Rate | Stock Value |

| 1 | $5*(1+0.10) = $5.5 | 15% | 10% | $ 5.5/(0.15-0.10) = $ 110 |

| 2 | $5.5(1+0.10) = $6.05 | 15% | 10% | $ 6.05/(0.15-0.10) = $ 121 |

| 3 | $6.05(1+.10) = $6.655 | 15% | 10% | $ 6.655/(0.15-0.10) = $ 133.1 |

| 4 | $6.655(1+.10) = $7.3205 | 15% | 10% | $ 7.3205/(0.15-0.10) = $ 146.41 |

Year 1 Dividend will be = $ 5 x (1+10%) ^1 = $ 5.50

In Year 2 Dividend will be = $ 5.50 x (1+10%) ^1 = $ 6.05

Year 3 Dividend will be = $ 6.05 x (1+10%) ^1 = $ 6.655

And in Year 4 Dividend will be = $ 6.655 x (1+10%) ^1 = $ 7.3205

To sum up the calculations, 110*1.1 = 121, 121*1.1 = 133.1 & 133.1*1.1=146.41 respectively for each year. Hence the stock value grows by a constant rate of 1.1 over the next 4 years and will continue to grow by 10% for all the forthcoming years. According to the constant growth model, if the stock’s value is $110 for the next year, but if the stock is trading at $100, then it is undervalued.

Variations in the Price of the Stock Calculated Under Gordon’s Constant Growth Rate DCF Model

- Assuming the company does well in the next year and grows at a growth rate of more than 10%, let us say 12%, the price of the stock will be:

p = $ 5.5/ (0.15-.012) = $ 183.33

- Conversely, if the company does not do very well and the growth rate goes down, let us assume it goes down to 8%. The price of the stock will be:

p = $ 5.5/ (0.15-0.08) = $ 78.57

The model is applied and used for its simplicity and suitability for companies with stable growth and established dividend payout ratios. However, the model comes with a set of limitations, which one needs to know to enable a better understanding of the model.

Disadvantages of Gordon Growth Model

- The constant growth model of equity valuation under discounted cash flow model assumes that the dividends paid by the company will grow at a constant rate. This is not a true assumption for declining or growing companies.

- Also, constant growth means the company would continue to grow at a constant rate till eternity, which does not align with a real-world scenario, and the said approach can lead to estimation errors.

- The growth rate in an industry is the key input. Mathematically this model may generate output value as infinity if the cost of growth approaches very close to the cost of equity, and the value may go negative if the growth rate goes above the cost of equity.

Conclusion

The equity valuation model helps the investors to make calculative investment decisions. Suppose the fair or intrinsic value of the stock calculated using these models is higher than the stock price at which it is being traded. In that case, it is advisable to buy the stock as it is undervalued, and the price is expected to go up in the future.

Similarly, if the fair or intrinsic value of the stock is lower than the traded price of the stock, then the stock is overvalued, and the price is expected to go down in the future, and one may look to sell the stock.