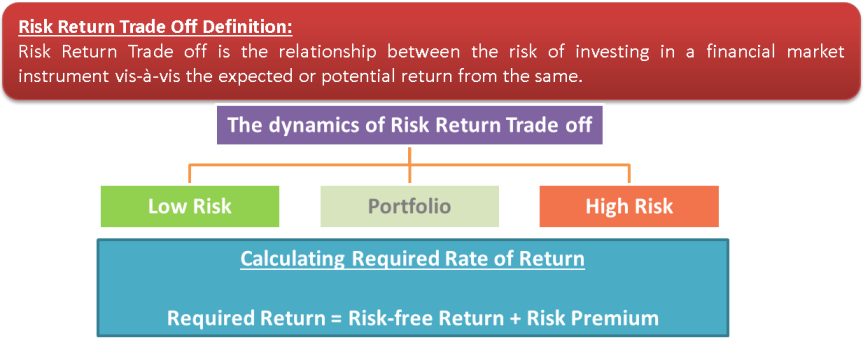

Risk-Return Tradeoff is the relationship between the risk of investing in a financial market instrument vis-à-vis the expected or potential return from the same.

Risk-Return Tradeoff: Definition

While making investment decisions, one important aspect among the various attributes to consider is what one is getting in return for the investment being made. Though this is one of the first things, investors think of. Another aspect, though comparatively less discussed but equally as important, is the quantum of risk being taken while investing.

The relationship between these two aspects of investment is known as the Risk-Return Tradeoff. The theory deals with how much an investor is willing to risk in order to increase the chances of higher returns.

Risk-Return Tradeoff in-depth

‘Risk’ is inherent in every investment, though its scale varies depending on the instrument. On the other hand, return is the most sought after yet elusive phenomenon in the financial markets. In order to increase the possibility of higher returns, investors need to increase the risk taken. On the other hand, if they are content with low returns, the risk profile of their investment also needs to be low.

Things to Note

It is vital to note here that increasing risk does not guarantee a higher return; it just raises the possibility of it. Thus, if an investor seeks a higher return, he’d need to increase the assumed risk. Else higher returns can’t be achieved.

To find the optimal combination of risk and return in a portfolio for a given investor, it is essential to understand the risk-taking ability, investment objective, and the time horizon available to achieve it.

Standard Deviation

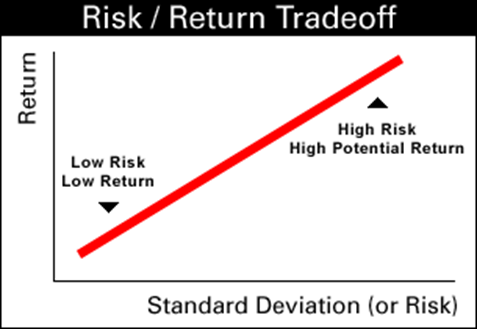

One of the simplest measurements of risk in the investment world is via standard deviation, which measures the deviance of returns from its mean over a given period of time. Risk can be considered to be the appetite for taking losses. A higher standard deviation indicates increased risk in an investment which signals that there are higher chances of losing one’s capital in the investment.

As far as returns are concerned, they are a reward for parting with one’s money since the reward in financial markets is not certain. While investing, an investor part with his money based on the ‘expected return’ from the asset class.

The dynamics of Risk-Return Tradeoff

The graph below is a Risk-Return Tradeoff the graph. It shows the relationship between these two variables while investing.

Low Risk

The bottom-left corner of the graph shows a low return for low-risk financial instruments. Government-issued bonds, for instance, US Treasuries, are considered to be the lowest risk financial instruments. Because they are backed up by the federal government. But due to the relatively non-speculative nature of the bonds, they have low returns than bonds issued by corporations. In fact, while assessing the expected return of instruments, the return on government bonds is considered to be the risk-free rate.

Also Read: Opposite of Risk Aversion

High Risk

As we move along the upward sloping line in the graph, the risk rises, and so does the potential return. This is understandable as investors parting with their money for riskier assets would demand better returns than risk-free security; else, they have no reason to take that risk. This is the reason why the bonds issued by governments and corporations for the same duration have different yields as corporate bonds. There is also a default risk priced into them, which is not the case with federal bonds.

Portfolio

It may seem like government bonds should form a significant portion of an investment portfolio given their near risk-free nature and the stability of returns. However, much higher returns provided by other instruments like high yield bonds and other asset classes like equities are what induce investors to assume higher risk even though there is a possibility of capital loss there.

Calculating Required Rate of Return

One question that stands out for an investor while deciding about investing in security is its required rate of return. For a given level of risk, what is the level of return that an investor would find attractive enough to part with his money? The answer lies in calculating the risk premium.

The market risk premium is in addition to the risk-free rate of return. The relationship between these variables is as follows:

Required Return = Risk-free Return + Risk Premium

The higher the standard deviation (or any other tool for assessing the risk) of an instrument, the higher the risk premium is. This pushes up the required rate of return.

Fixed Income Returns

In the fixed income universe, the risk premium of government bonds is nearly zero; hence the required return is equal to the risk-free rate of return. There is some risk premium for investment-grade corporate bonds primarily due to default risk. And thus, the required rate of return is higher than comparable government bonds. Meanwhile, there is a much higher risk premium for high yield bonds as their credit ratings are of speculative grade, and thus, these bonds offer the highest yields among the three.

Equities Return

The same argument can be extended to equities vis-à-vis fixed-income investments. And within the equities universe itself between blue-chip stocks, mid-cap stocks, and small-cap stocks. And penny stocks and also between developed market equities and emerging market stocks.

Securities from Lowest to Highest Risk-Return

Broadly speaking, the risk-return tradeoff from the lowest to the highest for conventional asset classes and instruments can be as follows. The following list is only indicative, not exhaustive:

- Government bonds

- Municipal bonds

- Investment-grade corporate bonds

- High-yield corporate bonds

- Blue-chip stocks and large-cap funds

- Mid-cap stocks and funds

- Small-cap stocks and funds

- Overseas equities (only for less developed stock markets compared to one’s home country)

- Futures & Options

Continue reading – How to Evaluate Investments and their Attributes?

Sanjay, I am always impressed whenever I open my email box and see eFinanceManagement because it comes with a lot of goodies, ever ready to widen my scope of knowledge on fundamental financial issues. I have not had such a huge online access to key finance and management issues like this before. Sanjay and family, I truly appreciate your efforts so far.

Thanks.