Portfolio management is the key skill that one requires for managing investment effectively. Irrespective of whether they are an individual or HNI (High Net Worth Individual) or a big MNC (Multinational Company). Different attributes of investment alternatives are analyzed, and the objective of investment guides where and how much money to allocate to each of the alternatives. Investing in more and more assets with different attributes diversifies the risk of a portfolio, thereby increasing the reasonable assurance of the returns.

For understanding portfolio management (PM), it is important to understand the term ‘portfolio,’ the meaning of PM, who is a portfolio manager, what does PM service involves the classification of PM services, objectives, and the importance of PM.

What is Portfolio and Portfolio Management (Definition)?

The portfolio is a collection of investment instruments like shares, mutual funds, bonds, FDs, other cash equivalents, etc.

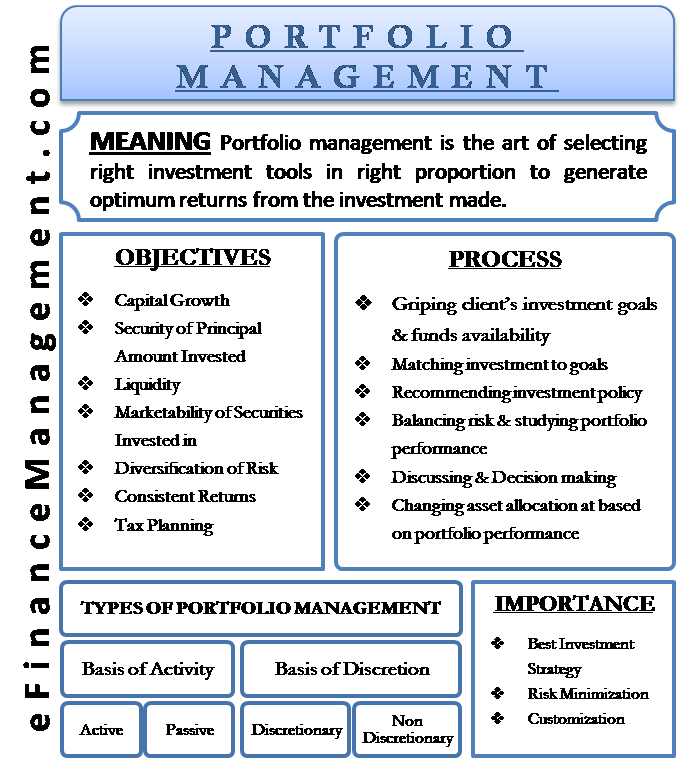

Portfolio management is the art of selecting the right investment tools in the right proportion to generate optimum returns with a balance of risk from the investment made.

In other words, a portfolio is a group of assets. The portfolio gives an opportunity to diversify risk. Diversification of risk does not mean that there will be an elimination of risk. With every asset, there is an attachment of two types of risk; diversifiable/unique/unexplained/unsystematic risk and undiversifiable/market risk/explained/systematic risk. Even an optimum portfolio cannot eliminate market risk but can only reduce or eliminate the diversifiable risk. As soon as risk reduces, the variability of return reduces.

Also Read: Portfolio Management Services

Best PM practice runs on the principle of minimum risk and maximum return within a given time frame. A portfolio is built based on an investor’s income, investment budget, and risk appetite keeping the expected rate of return in mind.

Objectives of Portfolio Management

A portfolio manager should keep the following objectives of investments in mind while building a portfolio based on an individual’s expectations. The choice of one or more of these depends on the investor’s personal preference.

- Capital growth

- Security of principal amount invested

- Liquidity

- Marketability of securities invested in

- Diversification of risk

- Consistent returns

- Tax planning

Investors hire portfolio managers and avail of professional services to manage portfolios by paying a pre-decided fee for these services. Let us understand who a portfolio manager is and the tasks involved in managing a portfolio.

Who is a Portfolio Manager?

A portfolio manager is a person who understands his client’s investment needs and suggests a suitable investment mix to meet his client’s investment objectives. This tailor-made investment plan is recommended keeping in mind the risk-return trade-off.

Also Read: Portfolio Management Process

Process in Portfolio Management

The portfolio management process is not a one-time activity. The portfolio manager manages the portfolio regularly and keeps his client updated with the changes. It involves the following tasks:

- Understanding the client’s investment objectives and availability of funds.

- Matching investment to these objectives.

- Recommending an investment policy.

- Balancing risk and studying the portfolio performance from time to time.

- Taking a decision on the portfolio investment strategy based on discussion with the client.

- Changing asset allocation from time to time based on portfolio performance.

See Advantages of Portfolio Management

Why is Portfolio Management Important?

It is important due to the following reasons:

- PM is a perfect way to select the “Best Investment Strategy” based on age, income, the capacity for risk-taking of the individual, and investment budget.

- It helps to gauge the risk taken as the process of PM keeps “Risk Minimization” as the focus.

- “Customization” is possible because an individual’s needs and choices are kept in mind, i.e., when the person needs the return, how much return expectation a person has, and how much investment period an individual selects.

- Taking into account changes in tax laws, investments can be made.

- When investment is made in fixed income security like preference share or debenture or any other such security, then in that case investor is exposed to interest rate risk and price risk of security. PM can take the help of duration or convexity to immunize the portfolio.

Types of Portfolio Management

Portfolio management services are classified into two broad categories:

On the basis of a level of activity viz.- active & passive portfolio management

Active & Passive Portfolio Management

Active PM refers to the service when there is the active involvement of portfolio managers in buy-sell transactions for securities. It ensures meeting the investment objectives of the investor. Whereas Passive PM refers to managing a fixed portfolio where the portfolio performance matches the market index (i.e., market).

The portfolio manager can also use portfolio revision strategies.

On the basis of discretionary powers allowed to portfolio managers- discretionary & non-discretionary

Discretionary & Non-Discretionary Portfolio Management

Discretionary Portfolio Management refers to the process where PM has the authority to make financial decisions. It makes those decisions for the invested funds on the basis of the investor’s investment needs. Apart from that, he also does the entire documentary work and filing. Non-discretionary PM refers to the process where a portfolio manager acts just as an advisor for which investments are good and unprofitable. And the investor takes the decisions.

Also, read – Portfolio Management Theories.

Quiz on Portfolio Management

I got all the doubts cleared by reading the article on the website, so it’s good

Informative. Continue to share useful information.

Thank you. More wisdom.God bless.

Explanation in the very easy words nice

This blog is definitely rather handy since I’m at the moment creating an internet floral website.

I’ve read this post and I wish to read even more things about it!

Good job.. Easy to go through..

Then whether he is an individual or HNI or a big MNC.

Why does it say ….he……. how about SHE.

Good explanation.Thank you!

very good

Why is it useful to establish a secondary portfolio objective?