Risk Analysis Methods: Understanding the Term

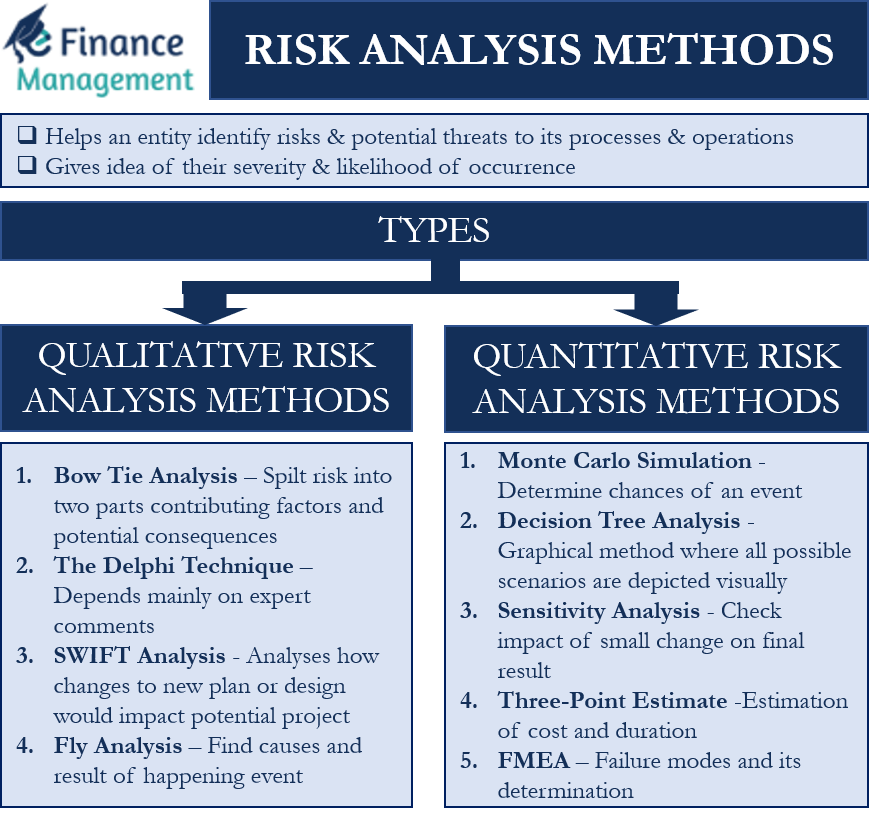

In a business, there are different types of threats and risks. There are different reasons and factors that give rise to these threats, such as the nature of business, political scenarios, economic tailwinds, environmental issues, and more. It is highly crucial for an entity to identify such risks beforehand in order to stay ahead of the competition. This is where risk analysis comes in handy. Risk analysis primarily helps an entity identify risks and potential threats to its processes, operations, market, technological changes, etc. Along with identifying, risk analysis gives an idea of their severity and their likelihood of occurrence. There are different risk analysis methods that an entity can use for risk analysis.

Types of Risk Analysis Methods

Entities can select from different risk analysis methods depending on the nature of their business, type of project, and more.

We can categorize the risk analysis methods into two categories. These two categories are qualitative risk analysis methods and quantitative risk analysis methods.

Entities use qualitative methods to analyze and keep a watch on their day-to-day risks. In this, we use past data and expertise to come up with the impact and likelihood of a risk on a scale or a risk matrix. The scale generally ranks a project from zero to one, where one represents highly likely. Also, the qualitative risk analysis serves as the base for the quantitative risk analysis.

Quantitative risk analysis, on the other hand, is the statistical analysis of the risks. Such methods assist risk managers in making decisions on reducing uncertainty, as well as in controlling risks. Quantitative analysis determines the likely outcomes for a project and the chance of achieving the goals of the project. All this helps to reduce uncertainty. It also assists management in developing cost schedules and setting realistic targets.

Now that we have an idea of what risk analysis is and its classification let us look at different risk analysis methods.

Qualitative Risk Analysis Methods

Following are the most popular qualitative risk analysis methods:

Bow Tie analysis

We first need to observe a potential risk in this method and then split that risk into two parts. The first part lists all contributing factors to that risk, and the second part shows all the potential consequences. Using this information, the management needs to come up with measures to address the contributing factors and the consequences.

For instance, a software company that faces frequent power outages can use the bow-tie analysis. It would first need to find the events that could cause a power outage and then find how they would impact its employees and customers. Then it would need to find out all possible ways to overcome the power outage and what they should do in case of a power outage.

The Delphi Technique

This method is similar to brainstorming as it depends mainly on the expert comments. Experts assist in evaluating, identifying, and analyzing the risks. Following expert opinion, the team would create a record of all the risks, including potential risks and consequences. For instance, if an entity is foraying into a new geographical market, it can use the opinion of a person who is local to that market.

The SWIFT Analysis

We can also call it a “structured what-if technique.” In this method, the team members get instructions to develop a “what if” scenario. Such a method is useful for approving designs or technical plans. This method primarily analyses how changes to a new plan or design would impact the potential project. The teams can use “what if” questions to determine the impact. For example, when the government introduces a new rule. So, an entity can use the SWIFT analysis to determine what changes it needs to make to comply with the new rule and whether or not those changes are effective. And how they can nullify or mitigate the adverse impact of that rule on its operations.

The Fly Analysis

It is a very practical approach to risk management and can help assess risk at all levels. This method approaches risk analysis in two ways. The first involves finding the causes that could result in a happening of an event. And the second is finding the consequences that an event would lead to. Then the team researches each event and consequence separately. All this eventually helps to reduce the chances of occurring of that event and its likely consequences. We also call this method a probability/consequence matrix.

Quantitative Risk Analysis Methods

Following are the popular quantitative risk analysis methods:

The Monte Carlo Simulation

It is a mathematical model that considers a massive number of similar random experiments to arrive at a conclusion. Eventually, this simulation helps determine the chances of an event.

The Decision Tree Analysis

Decision tree analysis is a graphical method where all possible scenarios are depicted visually. An entity draws all potential outcomes of a proposed decision to draw a decision tree. After an entity lists all possible outcomes and their probability of occurrence, it then becomes easy to select the best possible action. As is the experience now, any visual presentation is much more easier to understand and absorb swiftly and that will help again for a quick decision.

The Sensitivity Analysis

Such a method enables an entity to check what impact a small change in the key factor can have on the final result. To implement sensitivity analysis, it is very important to have a functional relationship between the initial and final values.

Three-Point Estimate

This method suits the estimation of cost and duration. In this, the entity makes three types of estimates. And these three types are: Optimistic, Pessimistic, and Most Likely.

Failure Mode and Effects Analysis (FMEA)

This method involves assessing as many components as one can so as to find potential failure modes. Along with the failure modes, one also needs to determine their causes and effects.

Final Words

Risk analysis is an extremely crucial part that contributes to the overall success of an organization. Thus, it is very important for an entity to select the right risk analysis method. This is because choosing the right method goes a long way in determining the success of the project. Usually, the risk analysis and management experts decide on the method that best suits a project.