The portfolio management process is an ongoing way of managing a client’s portfolio of assets. There are various components and sub-components of the process that ensure a portfolio is tailored to meet the client’s investment objectives well within his constraints. Portfolio managers need to chart out specific strategies for portfolio management to maintain the risk-return trade-off.

Definition of Portfolio Management Process

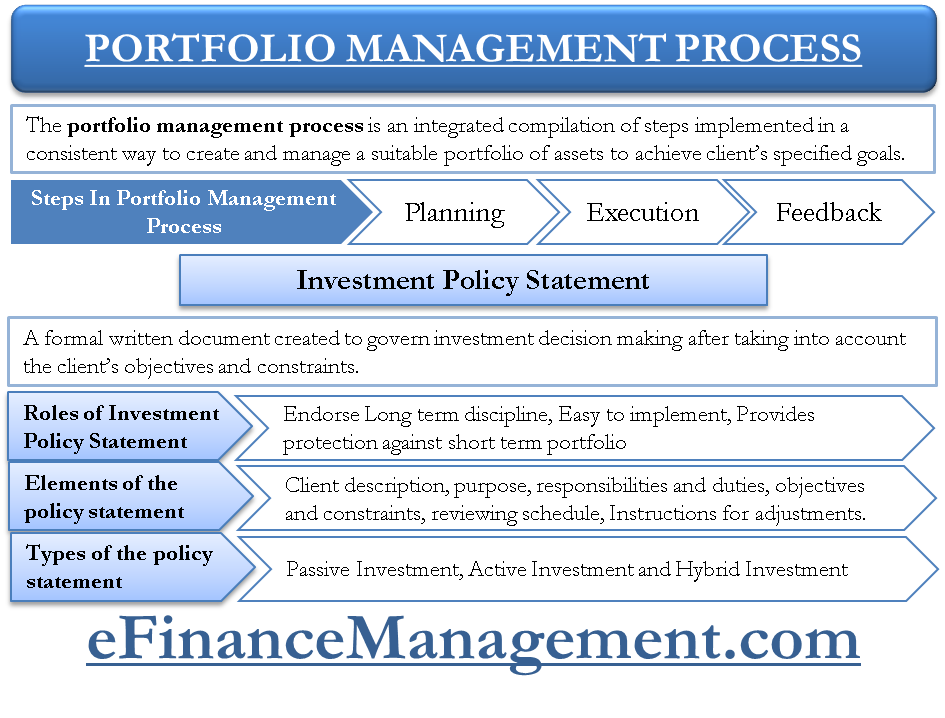

The portfolio management process is an integrated compilation of steps implemented consistently to create and manage a suitable portfolio of assets to achieve a client’s specified goals.

Portfolio Perspective

The portfolio perspective is the key fundamental principle of portfolio management. According to this perspective, portfolio managers, analysts, and investors need to analyze the risk-return trade-off of the whole portfolio and not of the individual assets in the portfolio. The individual investments carry an unsystematic risk, which is diversified away by bundling the investments into one single portfolio. The whole portfolio carries only the systematic risk caused by the influence of economic fundamentals on the returns of a stock. GDP growth, consumer confidence, unexpected inflation, business cycles, etc., are examples of such economic fundamentals. The portfolio managers, analysts, and investors should only be concerned with the systematic risk of the whole portfolio. In fact, all the equity pricing models are based on the fact that only systematic risk is factored.

Steps of the Portfolio Management Process

The portfolio management process has the following steps and the sub-components:

Planning

This is the most crucial step as it lays down the foundation of the entire process. It comprises of these tasks:

- Identification of Objectives and Constraints: Identifying the client’s investment objectives and any constraints are the foremost task in the planning stage. Any desired outcomes that the client has regarding return and risk are the investment objectives. Any limitations on the investment decisions or choices are the constraints. Both are specified at this stage.

- Investment Policy Statement: Once the objectives and constraints are identified, the next task is to draft an investment policy statement.

- Capital Market Expectations: The third step in the planning stage is to form expectations regarding capital markets. Risk and return of various asset classes are forecasted over the long term to choose portfolios that either maximize the expected return for certain levels of risk or minimize the portfolio risk for certain levels of expected return.

- Asset Allocation Strategy: This is the last task in the planning stage.

- Strategic Asset Allocation: The investment policy statement and the capital market expectations are combined to determine the long-term weights of the target asset classes, also known as strategic asset allocation.

- Tactical Asset Allocation: Any short-term change in the portfolio strategy due to the change in circumstances of the investor or the market expectations is tactical asset allocation. If the changes become permanent and the policy statement is updated to reflect the changes, there is a chance that the temporary tactical allocation becomes the new strategic portfolio allocation.

Execution

Once the planning stage is completed, execution of the planned portfolio is the next step. This consists of these decisions:

- Portfolio Selection: The capital markets’ expectations are combined with a decided investment allocation strategy to choose specific assets for the investor’s portfolio. Generally, portfolio managers use the portfolio optimization technique while determining portfolio composition.

- Portfolio Implementation: Once the portfolio composition is finalized, the portfolio is executed. Portfolio executions are equally important as high transaction costs can reduce the portfolio’s performance. Transaction costs include both explicit costs like taxes, fees, commissions, etc., and implicit costs like bid-ask spread, opportunity costs, market price impacts, etc. Hence, the portfolio execution needs to be appropriately timed and well-managed.

Feedback

Any changes required due to the feedback are analyzed carefully to ensure that they are as per the long-run considerations. The feedback stage has the following two sub-components:

Also Read: Portfolio Management Services

- Monitoring and Rebalancing: The portfolio manager needs to monitor and evaluate the risk exposures of the portfolio and compares them with the strategic asset allocation. This is required to ensure that investment objectives and constraints are being achieved. The manager monitors the investor’s circumstances, economic fundamentals, and market conditions. Portfolio rebalancing should also consider taxes and transaction costs.

- Performance Evaluation: The investment performance of the portfolio must be evaluated regularly to measure the achievement of objectives and the skill of the portfolio manager. Both absolute returns and relative returns can be used as a measure of performance while analyzing the performance of the portfolio.

Investment Policy Statement

A formal written document was created to govern investment decision-making after considering the client’s objectives and constraints. This statement is formulated in the planning stage of the process, as mentioned above.

Role: The investment policy statement has the following roles to play:

- Endorse long-term discipline in all portfolio decisions.

- Easily implemented by both currents as well as future investment advisors.

- Protect against short-term portfolio reallocation in case the changing markets or the performance of the portfolio causes overconfidence or panic.

Elements: An investment policy statement has several of these elements:

- A complete client description providing enough background so that any investment advisor can understand the client’s situation.

- A purpose with respect to investment objectives, policies, goals, portfolio limitations, and restrictions.

- Identification of responsibilities and duties of all the parties involved.

- A formal statement depicting objectives and constraints.

- A schedule for reviewing the performance of the portfolio and the policy statement.

- Ranges of asset allocation and guidelines regarding rigidity and flexibility when devising or modifying the asset allocation.

- Instructions for adjustments in the portfolio and rebalancing.

Types of Investment Strategies

Strategic asset allocation is a part of the asset allocation in the planning stage. The following are the approaches used to execute the strategic asset allocation:

- Passive Investment: These strategies comprise portfolios that do not respond to any changes in expectations. Buy and hold, and indexing is examples of such passive strategies.

- Active Investment: These strategies respond much more to changing expectations. They aim to benefit from the differences between the beliefs of a portfolio manager concerning the valuations and those of the marketplace. Making investments according to a particular style of investment and generating alpha are examples of such active investments.

- Hybrids: These include an enhanced index, risk-controlled active, and semi-active strategies, which are hybrids of active and passive strategies. Index tilting is one example of a hybrid strategy, where the portfolio manager tries to match the risk attributes of a benchmark portfolio but at the same time deviates from the same benchmark portfolio allocations to earn superior returns.

Conclusion

The portfolio management process is a set of comprehensive steps that need to be followed with complete dedication and understanding to achieve the stated objectives. The investment policy statement is a crucial component of this process and is a key aspect in creating a portfolio or evaluating the performance of any portfolio. Both the client and the investment advisor need to share the same expectations and outlook of the portfolio.

Any discrepancy might defeat the purpose of portfolio management.

Quiz on Portfolio Management Process