What is a Secured Loan?

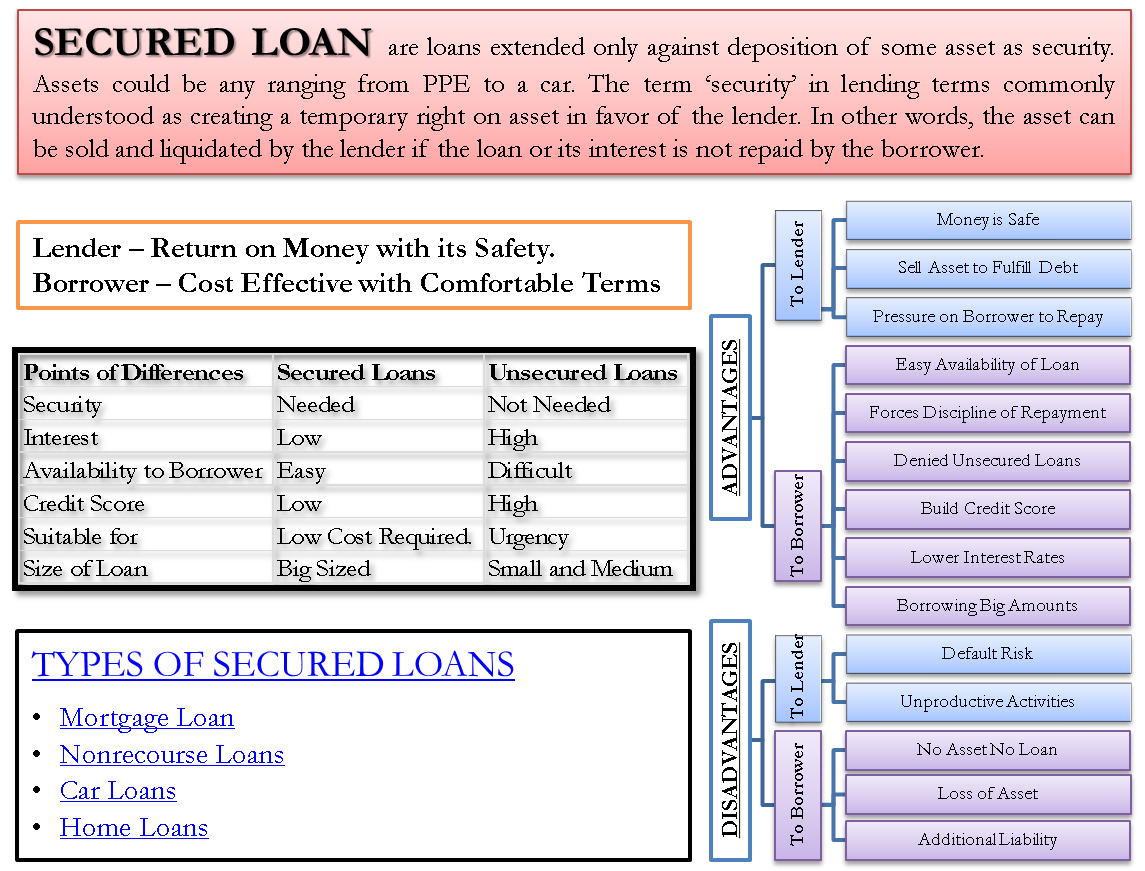

Secured loans are defined as loans where the lender extends loans only against the deposition of some asset as security. Assets could be any asset ranging from plant, property, equipment, or any other business asset to any personal asset like a car, home, etc. In lending terms, the term ‘security’ is commonly understood as creating a temporary right on the asset in favor of the lender.

In other words, the asset can be sold and liquidated by the lender if the borrower does not repay the loan or its interest. All loans come under the meaning of secured loans, which have security in place. The loans which are extended without taking any security are called unsecured loans. The most common example of an unsecured loan is a personal loan.

Securities also are of two common types, i.e., collateral security and additional security. Equipment is collateral security if the loan is taken for buying this equipment. Conservative lenders take additional security like buildings, land, etc., as their additional security.

Why Secured Loans? – The Purpose

By now, we should have got a fair idea of what is a secured loan? Now, let us understand why secured loans are prevalent. Like you love your money (I definitely do), lenders also do and therefore are concerned about losing their money. The borrower may reach a situation where he is not able to pay the loan due to an unfortunate situation or even by will at times. What will the lender do at that time? So, to secure his money, he extends a loan against security. A big chunk of money is always given against securities.

When a borrower has given his hard-earned property for getting a loan, there are all the chances that he will do everything on this earth to pay the money back. This is the simple logic behind securities. Even if, after everything, the borrower is not able to pay, the lender has the security available with him to liquidate and assure his money.

From the borrower angle, secured loans are meaningful because they help them achieve loans at favorable terms and conditions. Most importantly, the cost of funds is lower compared to unsecured loans. Secondly, the repayment terms can also be tweaked to some extent with mutual consent between the borrower and the lender.

Types of Secured Loans

Secured loans are categorized into different types as follows.

Mortgage Loan

A mortgage loan is a secured loan where the asset under the pledge is a property. It is a legal agreement where a person gets a loan in exchange for collateral. The collateral can be an asset or any property of the borrower. Various types of mortgages available in the market are:

- Fixed-rate mortgage

- Adjustable rate mortgage

- Interest only mortgage

- Graduated payment mortgage

- Ballon mortgage

- Reverse mortgage

- Offset mortgage

- First mortgage

- 2 step mortgage

- FHA mortgage

- VA mortgage

- USDA mortgage

- Chattel mortgage

Also read – Mortgagee vs Mortgagor

Non-recourse Loans

Nonrecourse loans are loans where the liability of the borrower to pay the debt is limited to the seizure of assets under collateral. This means that the lender can seize the asset and sell it. There are two possibilities here. One, the lender gets sufficient money by selling to fulfill the balance of the unpaid debt. Second, the lender does not fetch sufficient money by selling the asset. Under non-recourse loans, the borrower is not liable to pay more in the second condition mentioned here.

Car Loans

Car loans are the most common loans availed by individuals and businesses. In these loans, the collateral is the car for the loan that has been taken.

Home Loans

Fortunately, in all individuals’ life, there comes a situation when he plans to buy a home. We will all agree that it is a costly affair and shelling out that amount of money in one go is very difficult for normal individuals. A home loan is a very good option under the secured loans category for getting a loan at lower interest rates. Here, the home is the collateral. This is considered most secured by the lenders, especially when the home is bought for living in it and not for investment purposes. It is because any individual would not like not to pay and become homeless when the home is seized.

Example of Secured Loans

All loans, whether corporate or personal, are secured loans as far as it is backed by an asset. Following are some common examples of secured loans.

- Mortgage

- Home Loans

- Auto Loan

- Boat Loan

- Recreational Vehicle Loan

- Secured Credit Cards

- Secured Personal Loans

Advantages of Secured Loans

To Lender

Money is Safe

A money lender has only two purposes that he wishes to serve – the safety of his money and earn a return. With secured loans, the first purpose of safety is fairly catered. It is very difficult to identify borrowers from their faces. The world is a mix of good and wicked people. Wicked borrowers may have a bad intention of taking a loan and not repaying it. So, the job of a lender is to identify the intentions and make sure that the money is safe. By the process of taking securities, a lot of these problems are solved. Still, there are bad secured loans. It is difficult to eradicate but definitely is controlled.

Sell Asset to Fulfill Debt

Fortunately or unfortunately, if a borrower is not able to pay, the lender has an option to seize the asset, sell it, and fulfill its debt. Although it is not a desirable situation, the process is not so easy also. It isn’t easy to sell a second-hand asset and get its due price in the market. At times, it is possible that even after selling the asset full amount of debt is not recovered, but it can at least reduce the loss.

Pressure on Borrower to Repay

When the borrower offers security, there is psychological pressure to repay. The consequences of non-payment are known to the borrower. Consequences include the loss of assets that he acquired with the help of a loan and the loss of credit that will substantially reduce his capacity to take any further loans.

To Borrower

Easy Availability of Loan

Secured loans are easily available in comparison to their counterpart, that is, unsecured loans. The process of secured loans is seamless because the lender has a reasonable assurance of his money.

Forces Discipline of Repayment

Priorities in an individual’s life are more than his capacity to handle. In this crowded list of priorities, it is natural that some priorities lapse. The secured nature of this loan helps an individual keep the loan repayment in his top priorities and thereby enables him to remain in the discipline of repayment. It is good for both the borrower as well as the lender.

Denied Unsecured Loans

One of the most important benefits of secured loans is to a category of borrowers who have been denied unsecured loans. They have no choice but to go for secured loans if the need for money is crucial.

Build Credit Score

Loans are a reality of the current world. There is seldom anybody who has not taken a loan or has felt a need for a loan. It is difficult to forecast that unforeseen situation when you would need money. money is given to those who have good credit scores. It is very important to build and maintain credit scores. Secured loans are a great way of building a credit score. The information about taking this loan goes to the credit bureau, and if the loan is successfully paid, the credit score is strengthened.

Lower Interest Rates

Compared to unsecured loans, secured loans have a quiet and lower interest rate. The reason behind it is quite simple; the lender assumes less risk when there is security. We know that risk and returns are directly related. Lower the risk – lower the return expectations, and higher the risk – higher the return expectation of the lender. Although there are more angles, do it like the ability to repay, the viability of a project, the income of an individual, etc.

Borrowing Big Amounts

Secured loans are the only choice when you want to borrow big amounts. No lender would risk millions of dollars for an unknown borrower. Collateral and additional security are in easy language both lender and borrower can understand.

Disadvantages of Secured Loans

To Lender

Default Risk

There is always a risk of default, however good the borrower’s credentials may be. The reason for default could be anything but this situation is always a disaster for a lender. The primary job of a lender is not to seize assets and sell them. Due to inefficient selling, the lender may not be able to get the right price for the asset. The difference has to be booked as a loss.

Unproductive Activities

In the event of default, the lender is bound to invest his time in productive activities of following up with the borrower for payment, seizing assets, auctioning, selling assets, etc.

To Borrower

No Asset No Loan

When a borrower needs money and has no assets to offer security, he cannot get a secured loan. He will have to try for unsecured loans, which are costly and require a good credit score.

Loss of Asset

If the borrower is not able to pay the loan on time, there is a risk of losing the asset he owned by borrowing money. At times, there are genuine life hardships that force non-payment, be it business or an individual.

Additional Liability

We discuss the situation when the selling asset also does not have sufficient money to repay the loan. Depending on the terms and conditions of a secured loan or if the loan is not a non-recourse loan, the borrower may also be liable to repay with his personal assets.

Secured Vs. Unsecured Loans

They are practically opposite to each other. Let us check the differences between the two.

| Points of Differences | Secured Loans | Unsecured Loans |

| Security | There is an asset placed as collateral security. At times there are other additional assets also as additional securities. | In unsecured loans, there is security given by the borrower. The loan extended here is completely based on the borrower’s credit. |

| Interest | Since the lender’s money risk is low, the interest cost is also lower here. | Similarly, the risk perception in unsecured loans is high. Therefore the interest cost is also higher. |

| Availability to Borrower | The secured loans are easy to borrow. There is no need to convince the lender too much on parameters when security is available. | Unsecured loans are not easily available to everyone. The borrowers conduct a tough credit check before extending the loan. |

| Processing | The decision to process the loan is relatively easy but processing the papers may take some time. Rest depends on the amount of loan that is looked out for. | The processing time increases in making a decision whether to extend the loan or not. |

| Credit Score | A lower credit score also suffices when you have security to offer for a secured loan. | You should have a very good track record and reasonable credit score for an unsecured loan. |

| Suitable for | A secured loan is suitable for all the purposes where the borrower wants the cost of funds to be on the lower side. Like a business loan for buying a machinery, the businessman would expect a low cost of funds. A higher cost of funds may snatch away the whole viability of the project and increase overall risk. | This type of loan is suitable for a temporary unavoidable need for money because long-term loans are very costly. They are mostly personal loans extended based on the credit score, salaries, etc. |

| Size of Loan | All sizes of loans are available as secured loans. | Only small and medium-sized loans are extended as unsecured loans. Big size loans are not lent as unsecured loans. |