Secured and Unsecured Bonds are two primary types of debt instruments that allow issuers, usually the corporate and government, to raise funds. It is very crucial for investors to know as well as understand the difference between secured vs unsecured bonds.

Secured vs Unsecured Bonds – Meaning

The primary difference between secured and unsecured bonds is that the former involves collateral and the latter does not. Let us understand what this collateral thing means in detail:

Secured Bonds

A bond that is backed by an asset class or collateral is a secured bond. The asset or collateral backing the bond could be a property, machinery, stock, revenue, or any other asset. In case of default, bondholders will be able to realize the payment from the asset or collateral backing the bond.

For example, the government issues a bond to construct a new highway. These bonds are secured from the income that the government would generate by way of the toll charges. This way, the bond offers the security of payment to the shareholders. Such bonds that offer protection through revenue streams are revenue bonds.

Also Read: Secured Loans

Unsecured Bonds

These are the bonds that are not backed by any asset or collateral. Another name for such bonds is debentures. If the issuer of such bonds goes bankrupt or defaults on the payment, then the bondholders may not be able to get any money (interest and principal) back. This is because these bonds do not have any backup of any collateral assets that can be used in case of default, like secured bonds.

Generally, any bond that is not backed by any asset or collateral is an unsecured bond. Despite such risk, investors go for these bonds on the basis of the creditworthiness of the issuer. This is because an issuer with a good reputation is unlikely to default on the payment. For instance, the U.S. Treasuries, which are supposed to be zero-risk investments, are a type of unsecured bond.

Secured vs Unsecured Bonds – More Differences

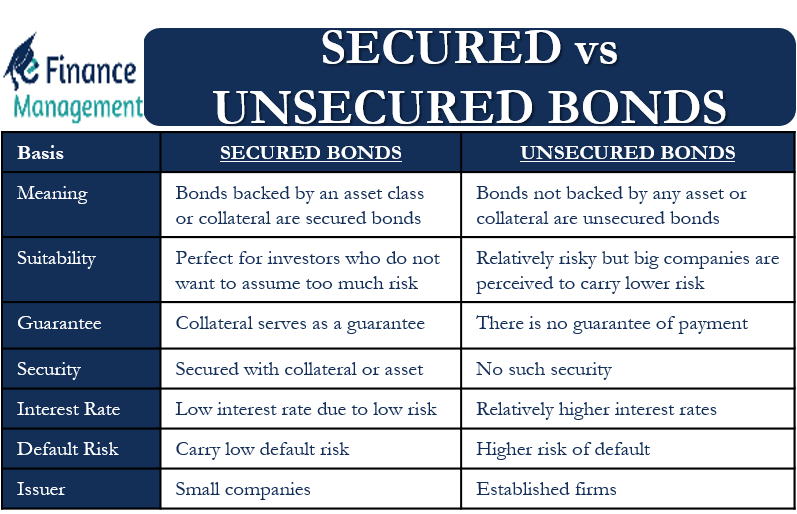

Now you know the primary difference between secured vs unsecured bonds. But, there are a few more differences between the two that stem from the primary difference itself. Let us take a look at those differences between secured vs unsecured bonds:

Suitable For

Secured bonds are perfect for investors who do not want to assume too much risk. On the other hand, unsecured bonds carry relatively more risk. However, unsecured bonds from big companies are perceived to carry lower risk.

Also Read: Bond Vs. Debenture

Guarantee

In a secured bond, the issuer secures the payment with collateral or asset, and this serves as a guarantee of payment. In contrast, there is no guarantee of payment in the case of unsecured bonds.

Even in the case of secured bonds, the guarantee of payment may not cover all the investments from the bondholders. If the issuer defaults, the collateral may fail to generate enough money to pay back all the bondholders.

Security

There is a security of payment in the case of a secured bond because of the collateral. In an unsecured bond, there is no such security.

Interest Rate

Generally, secured bonds carry a lower interest rate because they also offer lower risk. In contrast, most unsecured bonds offer relatively higher interest rates because they are also at higher risk.

Default Risk

Secured bonds usually carry low default risk, while unsecured bonds have a comparatively higher risk of default. However, unsecured bonds from big corporates and governments have a good credit rating and thus, carry lower default risk.

Claim on Assets

In the case of secured loans, the bondholders have a claim on the assets or collateral. The unsecured bondholders also have a claim on the assets of the issuer, but only after the assets have been used to pay off the higher debt.

Issuer

Generally, the issuers of secured bonds are small companies whom many would not know. In contrast, established firms generally issue unsecured bonds. This is because investors would only trust established companies with their money.

Final Words

Even though unsecured bonds are relatively riskier, both types of bonds are equally popular among investors. One must decide whether to invest in secured or unsecured bonds on the basis of their financial goals, including investment horizon, risk tolerance, and expected return.