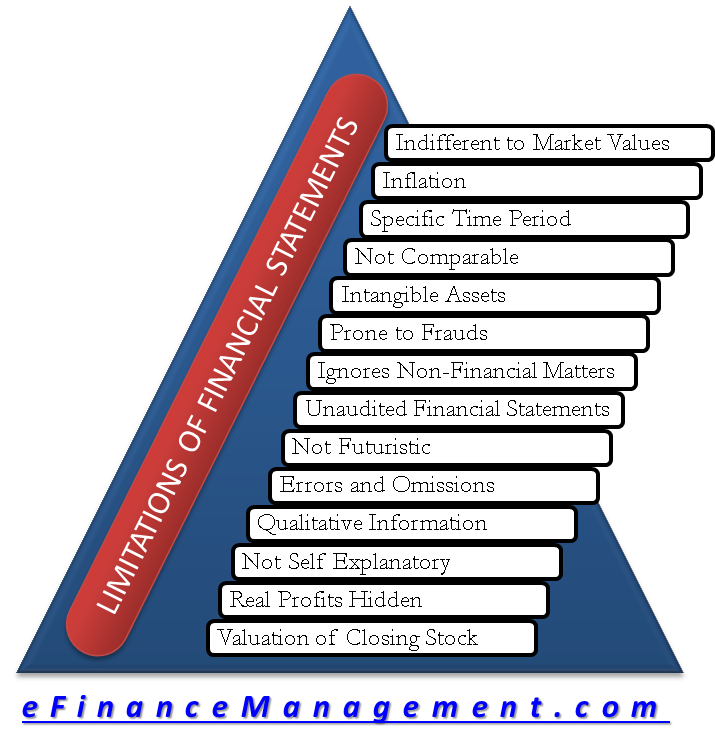

The primary limitations of financial statements are their heavy reliance on historical costs, indifference to inflation, being prone to fraud, being easily manipulated, etc. Financial statement limitations are relatable with current markets looking at the accounting and financial fraud in the news every day. Let us see more in detail the limitations of financial statements.

Limitations / Disadvantages of Financial Statements

Indifferent to Market Values

Financial statements are a derivative of bookkeeping and accounting. While accounting, an accountant records the transaction at cost. For example, assume an asset is purchased at the beginning of a financial year at $10,000 (based on the invoice value). At the end of the year, the real market value of the asset goes down to $5000 due to a new technology introduced in the market. The balance sheet of this company would show this asset’s value @ $10,000. At the max, there would be some depreciation, say @15%. The net value after depreciation also would be $8,500 ( $10,000 less $1500). Still, there is a vast difference between the balance sheet value and the market value of this asset. So, heavy reliance on historical costs makes the financial statement less reliable and more misleading.

Inflation

We all know that inflation is a reality. Sadly, financial statements do not consider the effects of inflation on the assets and liabilities shown on the balance sheet. In a period when the inflation rate is too high, the balance sheet misleads by showing substantially low values.

Specific Time Period

Financial statements are prepared for a specific time period, normally a year. Looking at one such period could be misleading because of the seasonal impact on businesses, economic ups, and downs, etc. It is always advisable to look at 2 to 3 periods or even more. If we wish to have a true analysis of the affairs of a company. Also, these statements show the financial position on a particular date where the financial position changes every day and with every transaction.

Also Read: Presentation of Financial Statements

Not Comparable

For checking the performance of one company, it is a common practice to compare it with other similar companies in the same sector. A financial statement indicates and does not facilitate a true comparison between the two companies. It is simply because these companies follow different accounting practices. Although, good companies mention most of the deviations from accounting policies in their disclosures. Even after a financial statement reader takes the pain of reading the disclosure, and if he finds a difference in policies of two companies, he cannot go and reprepare the financial statements based on one single policy for the sake of his comparison. We must note that it is a good practice to read disclosures and financial statements. Like income statements, balance sheets, and cash flow statements (three statement model).

Intangible Assets

There is seldom any company on this earth that is identifying and recording every intangible asset in their books of accounts. On the one hand, there are missed intangible assets. And on the other hand, the expenses incurred to create those intangible assets (knowingly or unknowingly) are recorded or charged to the income statement as an expense. Such a policy will significantly diminish the valuation of a company. It is a common issue spotted in startup companies. With their hard work, they create intellectual properties, but in the initial phase of their business, they generate minimal sales based on that.

Prone to Frauds

There are many situations when the financial statement becomes a tool to commit fraud. There are a lot of agencies that base their decisions on funding, rating, etc., on financial statements. Another possibility of window dressing financial statements could be by the management team itself. If the shareholders have introduced a remuneration policy linked to the performance shown in the financial statements, the management team has an incentive to show higher incomes deliberately. Another possibility of financial statement manipulation can try when majority shareholders are part of the board of directors and the management team. When these shareholders want to exit from their investment in the company, they have all the incentives to show higher profit and influence the stock market price of the company. So that they can realize the higher value of their investments.

Ignores Non-Financial Matters

Successfully running a business is not limited to sales, expenses, and profits. Many other environmental, sociological, political factors, competitive position, contribution towards local communities, etc., impact the business. These factors are ignored in the financial statements. Although big and good companies have started taking care of these factors in their annual reports, there are many companies for whom writing for reporting about these factors is just a formality.

Unaudited Financial Statements

When somebody uses unaudited financial statements, they can really be misleading without the express opinion of the auditor about the true and fair view of the company’s affairs. The sad part here is that some audited financial statements are also as good as unaudited financial statements due to various reasons. The reasons could be the inefficiency of auditors, when management and auditors have common interests, etc.

Not Futuristic

When a potential investor is looking at the financial statements of a company, what will he be interested in? If I were the investor, I would be interested in the future expected profits of the company. The simple logic behind this is that if I invest today, I will get my return on investment only when the company continues to make profits and raise the profit levels in the coming years. There is no express indication in the financial statements about the future.

Errors and Omissions

The accounting executive carries out the basic recording of transactions which is normally not highly qualified. So there are always chances of errors and omissions—such as misrepresentation in the ultimate financial statements.

Qualitative Information

Financial statements focus highly on quantitative data and thus miss out on qualitative information, which is crucial in running the show. Qualitative information could be the efficiency of management, employees, customer satisfaction, the efficiency of the supply chain, etc.

Not-Self Explanatory

Financial statements are not self-explanatory, which a layperson can understand. Reading, understanding, and interpreting financial statements requires expert knowledge of accounting, finance, etc. Investors from other backgrounds have real difficulty in deciding whether to continue their investment in a particular company or not. They have to rely on other experts. A big investor can still manage, but small investors may find it difficult to afford expert advice for their small investments.

Real Profits Hidden

The financial statements of a company do not significantly distinguish between operating and nonoperating expenses and incomes. This mixes up the things. The true profitability of a business can be hidden if there is a one-time income received from nonoperating activities of the company like profits from Investments, etc.

Valuation of Closing Stock

Valuation of closing stock is a tool for wicked management. It is very easy to manipulate the value of the stock. In a manufacturing concern, it is very difficult at times to determine the exact available quantity of raw material, work in progress, and finished goods. For example, the sand-water mix is stored in the ball mill in ceramic industries. No human can go inside and measure the quantity perfectly. Such situations are used for taking unnatural benefits by tweaking the profits.