What do you Understand by the Term Secured Personal Loan?

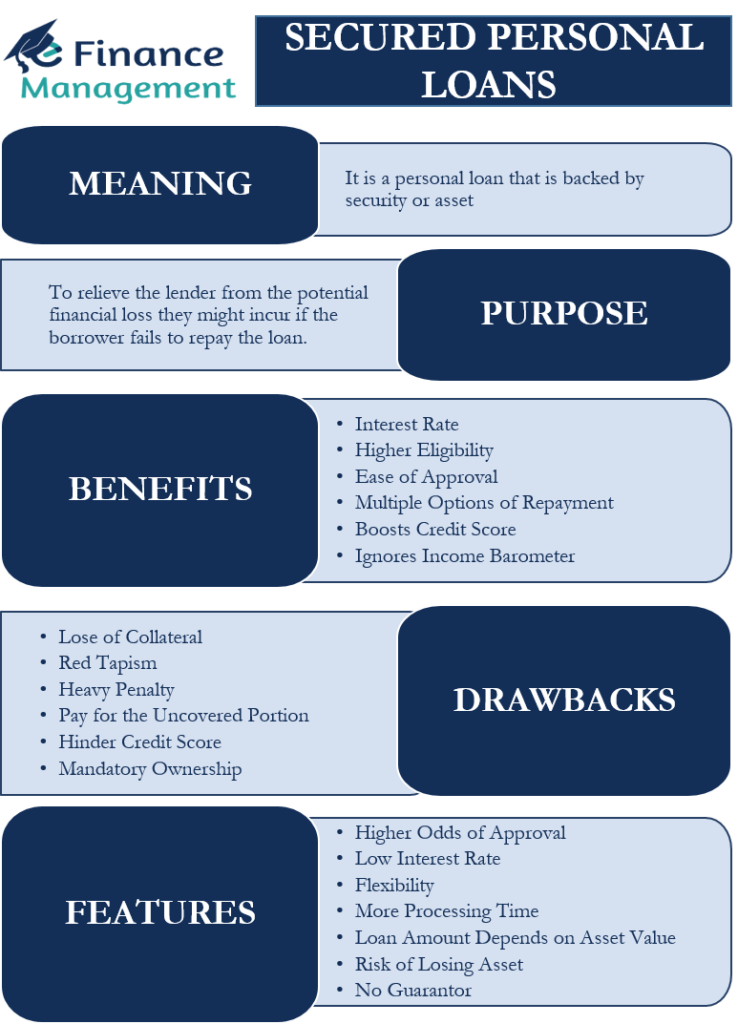

A loan where one needs to pledge an asset or security to receive the loan is known as a Secured Loan. And, if the loan is for a personal purpose where an asset or security is pledged, such loan is called Secured Personal Loan.

In simple words, a secured personal loan is a type of personal loan that is backed by security or asset. That security or asset is usually called collateral. In this loan, the lender would grant the loan only after the pledge of any asset. The asset could be anything like a car, jewelry, land, etc.

Purpose

- The primary purpose of this type of loan is to relieve the lender from the potential financial loss they might incur if the borrower fails to repay the loan timely.

- Also, a secured loan allows the borrower to qualify for a higher loan amount at favorable terms.

Possession of Collateral

The primary factor that works in secured personal loans is the security or the asset pledged. And the basic idea of pledging remains that if the borrower does not honor their commitment of repayment, then the lender has all the rights to the pledged assets. In other words, if the borrower can not pay the personal loan, the lender can access and take over the possession of the security. The lender can also sell the asset of the borrower to recover the loan money. And, if the lender is unable to recover the complete money by selling the asset, the borrower will still remain responsible for paying the difference or shortfall. This is the primary reason why the application for a secured personal loan comes with title deeds and other relevant documents proving the ownership of the asset.

Features of Secured Personal Loans

Below are the features of a secured personal loan:

Low-Interest Rate

Since this loan comes against collateral, there is a lesser risk for the lender. And this encourages the lender to grant the loans to the borrower at low-interest rates.

Also Read: Secured Loans

Higher Chances of Approval

Since the application/request for the personal loan is supported by the security, there remains a high chance of approval of the request.

Flexibility

Such types of loans do not come with any restrictions on how the borrower uses the loan money. Therefore, the borrower is free to use the money borrowed the way it wants to. And he has not to share the details of the uses of the loan money with the lender. That is the case when a loan is taken for a specific purpose.

More Processing Time

Since lenders need to verify the collateral documents of the borrower, the processing of this loan takes more time in comparison to other loans.

Loan Amount Depends on Asset Value

The amount of loan that a borrower gets is proportional to the value of the collateral. This means the more the value of the assets, the more is the loan amount he could get.

Risk of Losing Asset

If the borrower fails to repay the loan in the specified time, the lender can take away the collateral. And thereby, the borrower always carries a risk of losing the asset pledged. Thus, it is very important for the borrower to have a proper plan to pay the loan back.

No Guarantor

For all secured personal loans, usually, there is no need for a guarantor. This is because it involves collateral, which in a way works as a guarantor.

Advantages of Secured Personal Loan

These are the benefits of taking this type of loan:

Interest Rate

As this loan carries a lower risk for the lender, they, in turn, are able to offer lower interest rates to the borrower.

Higher Eligibility

A borrower may be eligible for a higher loan. Usually, the loan amount is 75-85% of the value of the collateral.

Ease of Approval

The approval of a loan becomes easier. Because due to the presence of collateral, the risk of the lender is substantially reduced.

Multiple Options of Repayment

A borrower of this type of loan generally has many options to repay the loan. These options include EMIs or post-dated cheques, or more. Moreover, the borrower has an option to repay the loan earlier if they have more money.

Boosts Credit Score

Even those with an awful credit score can qualify for this loan if they have collateral to offer. Moreover, if they are able to repay this loan on time, it boosts their credit score for the future.

Ignores Income Barometer

Such types of loans usually have no minimum income criteria for the borrower.

Disadvantages of Secured Personal Loan

Below are the drawbacks of taking this type of loan

Loss of Collateral

As we discussed above, the entire loan process of secured personal loans revolves around the collateral. Hence, the biggest risk or worry of the borrower is the loss of asset or collateral in case of non-payment of the loan. But they would lose the asset or collateral only and only if they are unable to repay the loan on time.

Red Tapism

As this loan is tagged with security, hence the process and the formalities need a lot of paperwork. It is because the lender not just requires the regular documents for age, ID, and address verification but also documents for – ownership of the asset. Moreover, the lender also needs to verify the status of the collateral. Further, the borrower needs to sign a lot of documents. And, if the signatures do not match, the whole process needs to be re-start again.

Mandatory Ownership

To be able to use the asset as collateral, it is important that the borrower has full ownership of the asset. Also, one (borrower) needs to ensure that there are no EMIs and partnership agreements related to the asset.

Heavy Penalty

Usually, such loans are for a longer tenure, and this increases your total cost. Moreover, if you are unable to pay any installment, the lender can levy a heavy fine. A longer period also means more chances of things going wrong. If your income drops during the loan period, it could impact the repayment schedule.

Pay for the Unrecovered Amount

In case of default, if the lender is unable to recover the loan amount by selling the collateral, it is the responsibility of the borrower to pay the remaining balance.

Hinder Credit Score

The credit score is very important and critical for any individual. And any default in payment of any loan, including a secured personal loan, will affect the credit score negatively.

Final Words

Experts recommend selecting secured personal loans when one needs to borrow a large amount. Also, one must go for this loan if they are confident enough to pay it back. Failing to pay this loan arises the risk of losing the assets kept as collateral. Irrespective of the loan choices, it is always better to conduct thorough research on the loan options available in the market. Similarly, the interest fees, repayment charges, repayment terms, fees, and other terms should also be considered while choosing a particular loan.