Capitalization Rate

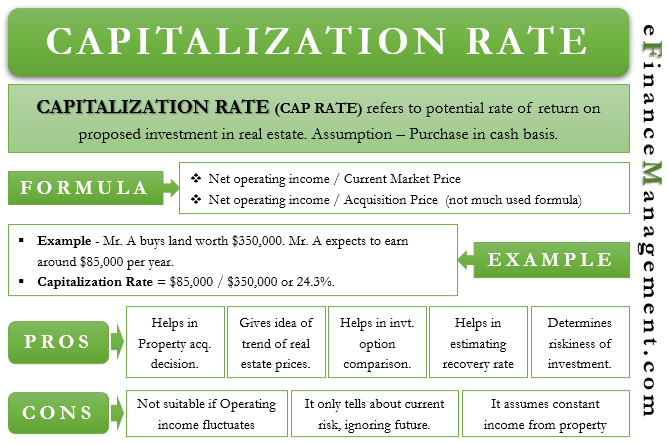

The capitalization rate is a concept relevant to the real estate market. This rate helps to determine the investment in real estate. Or, we can say it tells us the potential rate of return on the proposed investment in real estate. We also call it the Cap Rate. So, the more the cap rate, the better it is for the investors.

In simple words, a cap rate is basically a yield of an asset over a one-year time period. Also, it assumes that the investor buys the property on a cash basis and has no credit.

It is seen as the first-hand measure of whether or not one should invest in a specific real estate asset. We can also see it as a return on investment (ROI) that the property would generate. Or it suggests the intrinsic or un-leveraged rate of return.

Capitalization Rate Formula

Cap rate considers earning the asset could generate in comparison to its value. This rate is based on the net operating income (NOI) and the present market value of the property.

Also Read: Capitalization Rate Calculator

The formula for cap rate = Net operating income / Current Market Price

After reducing property taxes, maintenance costs, and other operating expenses from the gross operating income, we get net operating income. For a rental property, the NOI is rent less maintenance expenses. The calculation does not include depreciation. The current market value is the asset’s value on the market.

There is another approach to calculating the cap rate, and it involves the use of the original purchase price of the property rather than the current market price of the property. So, the current market price is substituted by the acquisition price in the above formula. Hence, the modified formula would be

The formula for cap rate = Net operating income / Acquisition Price

This second approach, however, is not much in use. This is because it gives an inaccurate result when involving old properties, which may have a low purchase rate. Another reason is we can not apply this approach to the inherited property since the purchase price may be nil. Also, the first version is better because the property prices do not stay the same over time.

Capitalization Rate: Examples

Example 1

Suppose Mr. A buys land worth $350,000. Mr. A expects to earn around $85,000 per year from the land. In this case, the cap rate for Mr. A would be $85,000 / $350,000 or 24.3%. This means Mr. A would expect an earning of 24.3% per year from the land.

Also Read: Capital Lease Criteria

When using a cap rate, one must remember that the real estate market is usually volatile. This means the value of land could rise or drop in a short time.

So let us take the above example further and assume that there is a crash in the real estate prices meanwhile. And now, the value of the same piece of land is worth $200,000, and it is likely to generate $50,000 annually. So, the cap rate now would be $50,000/ $200,000 or 25%.

Now suppose the property prices go up, and the land is worth is $400,000 and could generate about $100,000 annually. The cap rate now would be $100,000/$400,000 or 25%.

Let’s take another example of a rental property. Suppose a rental property earns $2,000 rent per month. The owner of the property spends the following annual expenses: insurance $500, $700 property taxes, and $1000 as maintenance fee. The value of the property is $120,000.

To calculate the cap ratio, we first need to work out the NOI. NOI (net operating income) would be ($2000*12) less operating expenses or $24,000 less $500 less $700 less $1,000 or $21,800.

So, the cap ratio would be $21,800/ $120,000 or 18.17%.

Example 2

Assume that the gross income from a property is $80,000 (assuming 100% occupancy) and the operating expenses are $20,000. The market value of the property is $750,000.

Therefore, net operating income = $60,000 (i.e. $80,000 – $20,000)

Capitalization Rate = (60,000/750,000)*100 = 8%

Now, let us review these rates when the basic assumption with regard to various key factors varies. This will give us more clarity with regard to the likely changes and impact of each and every factor and its importance while making the return expectation.

- Scenario I: There is 15% vacancy, i.e., the property occupancy is only 85% instead of 100%

Now, the net operating income will be $48,000 (80,000 – 15% of 80,000 – 20,000).

And, capitalization rate will be 6.4% (48,000/750,000)

- Scenario II: Market value of the property decreases to $600,000

Net operating income: $60,000

Capitalization Rate: 10% (60,000/600,000)

- Scenario III: Market value of the property increases to $800,000

Net operating income will be same, that is, $60,000

Capitalization Rate: 7.5% (60,000/800,000)

- Scenario IV: Operating expenses increased by $25,000

Net operating income: $35,000 (80,000 – 20,000 – 25,000)

Capitalization Rate: 4.67% (35,000/750,000)

All these cases determine the risk in the real estate business. Variation in any one factor can make significant changes in the capitalization rate, which the investor aims to get.

You can also use our calculator to quickly arrive at the answer – Capitalization Rate Calculator.

Benefits of Capitalization Rate

One of the primary benefits of the cap rate is that it helps investors decide whether or not to acquire a property. An asset with a higher cap rate is a usually good buy than the one with a lower rate under a similar set of conditions.

This way, it allows investors to compare the earning potential of different property and then select the property with the highest earning potential. Moreover, the cap ratio also gives an idea of the trend in real estate prices.

Also, the cap rate helps to compare different investment options. For instance, if an investor wants to decide between a 3% treasury bond and a property with a 5% cap rate, then the latter is better. The 2% extra return is for the risk of investing in real estate.

Additionally, the cap rate also hints at the time a property would take to recover its investment. For instance, if the cap rate of an asset is 20%, it could mean the investor would be able to recover the investment in the property in about 5 years.

It also helps to determine the riskiness of an investment. Generally, a lower rate means lower risk, while a higher rate suggests a higher risk. In reality, there is no optimal rate. It all depends on investors’ risk preference.

Though a higher cap rate is good, it does not always indicate a good investment opportunity. So, it is important that an investor must not solely depend on the cap rate and refer to other parameters as well to decide on the investment opportunity.

Drawbacks

Following are the drawbacks of a capitalization rate:

- The cap rate gives accurate results if the net operating income is stable or it does not fluctuate much. In case the NOI is not regular, then it is better to use the DCF (discounted cash flow) method.

- The cap rate does not tell about future risk.

- Calculation of cap rate assumes a constant income from the property. This, however, is not always true. In the case of a rented property, the rent may rise or go down. Also, the value of a property may alter on the basis of the ongoing market environment. Also, the operating expenses may not stay the same.

Final Words

Cap rate is a crucial metric for comparing similar properties, such as in a similar location or similar age. It assists in making investment decisions. However, it is not full proof. Despite the drawbacks, analysts and investors widely use this metric to decide on a profitable investment opportunity. However, an investor or analyst must not solely depend on the cap rate to make their real estate investment decision, instead use other methods as well.