The difference between absorption costing vs variable costing methods pertains mainly to the allocation of fixed manufacturing costs. As a result, they pose a difference in the value of inventory, consequently affecting the reporting of operating income. Both absorption and variable cost methods are based on the accrual concept of accounting.

Difference between Absorption Costing vs Variable Costing

We are trying to explain the difference between absorption and variable costing under the following different aspects of each type of costing method.

Definition

What is Absorption Costing?

Absorption costing is a type of inventory costing where all the manufacturing costs are treated as inventoriable costs. Therefore, this method focuses on the manufacturing function of the cost. Whether the behavior of cost is fixed or variable, this method will include the cost as part of inventory cost if it is a manufacturing cost.

What is Variable Costing?

Variable costing is a method of inventory costing that treats all variable costs as part of inventoriable costs. It is also known as “Direct Costing” or “Marginal Costing.” Therefore, this method focuses on the ‘variable’ behavior of cost to determine if a particular cost should be part of inventory or not.

Treatment of Types of Costs under Both Methods

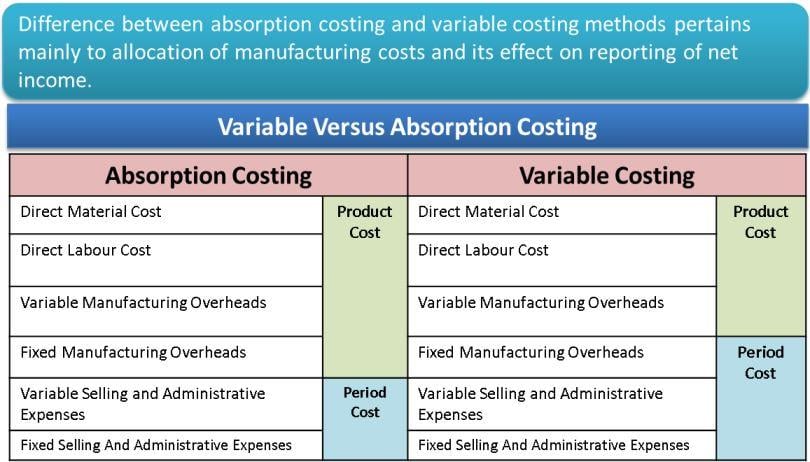

Let’s mix two classifications of costs and try to understand the difference between variable and absorption costing. We are talking about “Manufacturing and Non-manufacturing costs” vis-a-vis “Variable and Fixed Costs.” The confusion occurs because a manufacturing cost could be fixed or variable, or both. Similarly, a fixed cost could be both manufacturing or non-manufacturing cost. Let’s understand the difference with the help of the following table.

Table Showing Types of Costs, whether Inventoriable or Period Costs

| Types of Costs | Absorption Costing | Variable Costing |

| Variable Manufacturing Costs | Inventoriable | Inventoriable |

| Variable Non-manufacturing Costs | Period Cost | Period Cost |

| Fixed Manufacturing Costs | Inventoriable | Period Cost |

| Fixed Non-manufacturing Costs | Not Inventoriable | Not Inventoriable |

We can notice that the principal difference between the two methods is the treatment of fixed manufacturing costs.

Example

Let’s assume Company A is producing and selling pencils.

Following is their inventory data for the year 20XX.

| Beginning Inventory | 0 |

| Production | 900 |

| Sales | 600 |

| Ending Inventory | 300 |

The following is the cost data for the year 20XX.

| Selling Price | 100.00 |

| Variable manufacturing costs | |

| Direct material cost (per unit) | 9.00 |

| Direct manufacturing labor cost (per unit) | 6.00 |

| Manufacturing overhead cost (per unit) | 5.00 |

| Total variable manufacturing cost (per unit) | 20.00 |

| Variable direct marketing cost (per unit) | 16.50 |

| Total Fixed manufacturing costs (all indirect) | 18,000.00 |

| Total Fixed marketing costs (all indirect) | 14,000.00 |

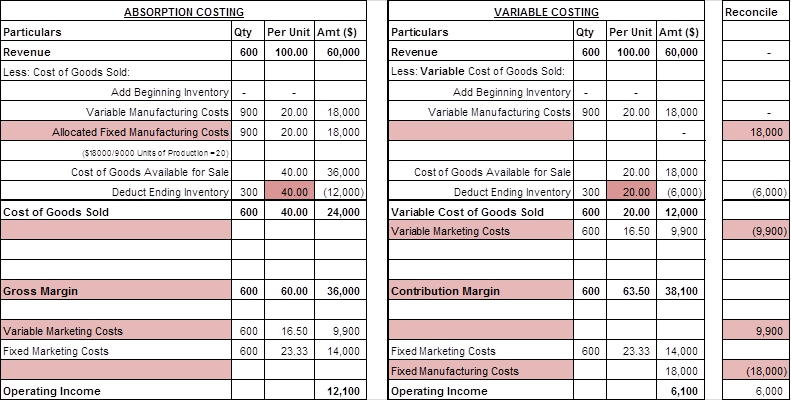

Income statement under both methods of costing, i.e., Absorption and Variable Costing

In the example above, we have highlighted areas where these two methods differ from each other.

Format of Costing

Absorption costing follows the format of gross margin, whereas variable costing follows the format of contribution margin. To maintain their formats, we have their headings in the same fashion. Gross margin and contribution margin are entirely different terms. But for ease of comparison, we can understand them as counterparts. The gross margin in absorption costing is the counterpart of the contribution margin in variable costing.

Fixed Manufacturing Overheads

This is the main difference between these two costing methods. In absorption costing, these costs worth 18000 are part of the cost of goods sold, impacting the inventoriable cost by 20 per unit. In variable costing, they are deducted after the contribution margin to find out operating income. However, this 18000 is part of both the income statements, just that the place of the deduction is different.

Value of Inventory

In the above point, we noted that the inventoriable amount increases by 20 per unit in absorption costing, creating a difference in value in both costing methods. The value of inventory in absorption costing is 12000, whereas it is 6000 in variable costing. The difference is 6000 (12000-6000).

Variable marketing expenses

In variable costing, variable marketing expenses are part of variable costs and hence deducted before the contribution margin. On the other hand, in absorption costing, these costs are deducted after the gross margin.

Also Read: Inventoriable and Period Costs

Reporting of Operating Income

In the income statement, we can clearly see that absorption costing reports an operating income of 12,100, whereas variable costing reports an operating profit of 6,100. This is the same difference that we noticed in the value of inventory.

Interpretation

Thus, income reporting differs under both cost accounting methods. Based on the above example, we can clearly note that the company usually ends up with a lower net income under the variable cost accounting method. The reason behind this is – that all the fixed manufacturing costs are expensed in the same year in which they are incurred. However, absorption cost accounting can also lead to inflated profitability and hence requires careful judgment when analyzing profitability.

We recommend you read our article on the Reconciliation of Profit Under Marginal and Absorption Costing for understanding how profit under these two methods can be reconciled.

Usefulness

Most importantly, variable cost accounting is useful for internal management’s decision-making purposes. On the other hand, absorption cost accounting is helpful for creditors, government agencies, suppliers, and internal control. Absorption cost is also useful when the company doesn’t end up selling all of its manufactured goods and, as a result, creates inventory. This helps some cost base to be shifted to inventory.

thanks