Meaning of Debt Financing

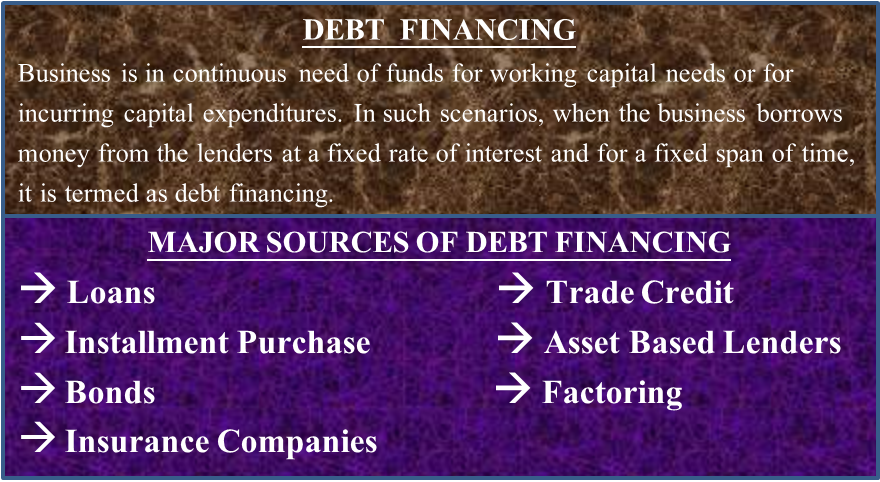

Business is in continuous need of funds for working capital needs or for incurring capital expenditures. In such scenarios, when the business borrows money from the lenders at a fixed or floating rate of interest and for a fixed span of time, it is termed debt financing. The sources of debt financing for a company include banks, credit unions, etc.

Let us learn further about the sources of debt financing.

Sources / Types of Debt Financing

Loans

Loans are the most common and popular mode of debt finance for a company. Businesses borrow money from commercial lenders like banks by keeping some collateral security against the loan; it can be recourse or non-recourse debt. Loans from banks and other commercial lenders are for a fixed period, and business needs to pay regular interest for it. The loans can be for short, intermediate, or long-term, depending upon the financial requirements of the business.

Trade Credit

Trade credit is an arrangement in which the business can purchase the goods now and pay for them later. This way, the business can avail of debt financing for the short term. Trade credit is a good mode of finance for startups as they cannot afford to obtain loans of a higher amount by placing a collateral society.

Installment Purchase

Purchasing capital goods on installment is another type of debt financing. Installment purchase comprises buying an asset and making payment in pre-determined installments. The buyer has to mortgage its asset until makes full payment of an installment. A business with a higher credit rating may not have to mortgage any asset. Banks and finance companies provide the facility of installment purchases to the business.

Also Read: Debt Financing

Asset-Based Lenders

Asset-based lenders are those finance companies that lend money to the business for purchasing the assets. The business, in return, has to pledge its assets like inventory, accounts receivables, etc. This type of debt financing is very useful for businesses with higher inventory, account receivables, real estate, or any other asset that can be pledged.

Bonds

Bonds are a source of debt capital for businesses that are well established and need funds for the business’s long-term growth. The company can raise funds by selling bonds to different buyers and sharing profits on the projects for which bonds are issued.

Factoring

Factor purchases the accounts receivables of the companies. In factoring agreement, the business gets a timely flow of money and does not have to wait for the customers to pay them. In return, the business has to pay the factor a certain fee or commission. Factoring is of two types, i.e., recourse factoring and non-recourse factoring. Based on the need and requirement, the business can opt for any of the suitable financing facilities.

Insurance Companies

Insurance companies act as a major source of finance for small companies. They provide two types of loans to businesses: mortgage loans and policy loans. A mortgage loan can be avail by mortgaging any asset of the company. On the other hand, a policy loan is based on the amount of money that is paid in the form of a premium on the insurance policy.

These are a few debt financing sources. Many more debt-financing instruments are available in the market. The business can select and avail these services after looking at their prospects and determining which source suits them the best.

Peer-to-Peer Lending

A peer to peer lending is a new form of debt financing in which the needs of both the lender and the borrower are addressed without the help of any official financial institution. And hence the elimination of the middle makes the cost of the debt lower.

Conclusion

Debt financing is the second most popular source of financing for businesses, the first being equity financing. Debt financing enables the business to meet its working capital requirements and expand its business. The business needs funds at regular intervals, and the entire monetary requirement cannot be met with equity financing after a certain point in time. In such scenarios, debt financing acts as a helping hand to fulfill the monetary needs of the business. Going forward, the sources and need for debt financing will increase rapidly because the new startups are growing, and the current players will need additional funds to fight competition.

I intended to post you a very little word in order to say thank you the moment again for these magnificent views you have documented here.

Yes,I totally agree with what you said.I also think that business definitely need working capital to process.I think that business owner must know how to get working capital for their business. Thanks for sharing this article.

Thanks for sharing this. This help me to understand debt financing. Thanks for sharing this article. This is very easy to understand.

Debt financing is an important source of financing for the corporates. All the point are covered Very well and a beautiful brief explanation of all the aspects.