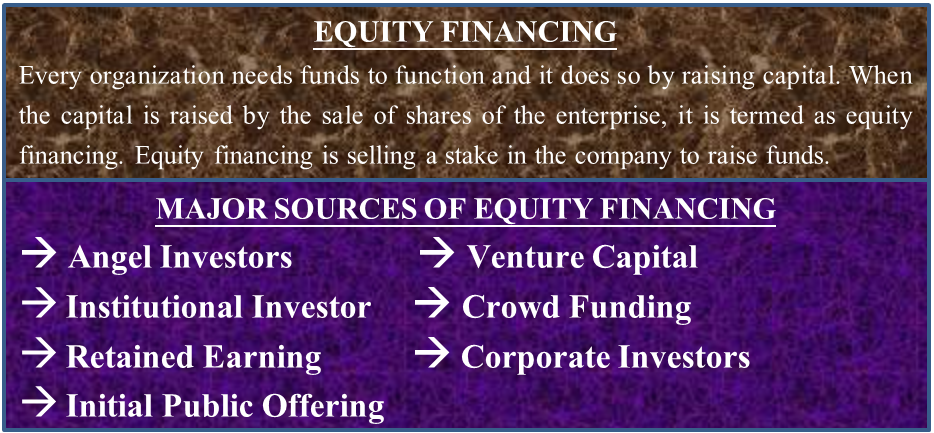

Every organization needs funds to function, and it does so by raising capital. When the capital is raised by the sale of shares of the enterprise, it is termed equity financing. Equity financing is selling a stake in the company to raise funds. Let us have a look at various sources of equity financing.

Equity financing not only involves the sale of equity shares but also includes the sale of other equity instruments like common shares, share warrants, preferred stock, convertible preferred stock, etc.

Once the company determines its fund requirements, it must look for different sources of equity financing.

Major Sources of Equity Financing

Angel Investors

Angel investors are wealthy individuals who put their money into businesses that have the potential to generate higher returns in the future. They bring money to the company by purchasing a stake in it. Apart from money, these investors bring their skills, knowledge, and experience to the business, which helps the company in the long run.

Venture Capital

Venture capitalists are those investors who invest in businesses that are expected to grow rapidly and have the potential to list on the stock exchanges in the future. And venture capital is also termed private equity finance. The venture capitalists purchase a larger stake in the company than angel investors and thereby bring more capital to the business.

Also Read: Debt vs Equity

Institutional Investors

Institutional investors include insurance companies, mutual funds, pension funds, etc. These institutions have large sums of money with them and make an investment in private companies.

Crowd Funding

People invest in companies because they believe in their ideas and expect higher returns in the future. Crowdfunding involves a number of people investing in the company in small amounts. The money collected from the people is summed up to determine whether the targeted funds have been received or not.

Retained Earnings

A company can finance itself by retaining its earnings instead of distributing them to the owners. This is a part of the owner’s equity. This way, the company does not require to look for other sources of equity finance as it has an inherent solution. The business can raise equity by issuing bonus shares to its shareholders.

Corporate Investors

In the form of big organizations, corporate investors invest in private companies to fulfill their financial needs. The investment by big corporates in such companies is mainly to develop a strategic partnership or corporate partnership. These investors create a network of companies by investing in different companies in different spans of time.

Also Read: Private Placement

Initial Public Offering

Well-established companies can obtain equity finance by bringing the company’s Initial Public Offering (IPO). With an IPO, the company can raise funds by offering its shares to the public. Many institutional investors also invest in the company’s IPO. The company utilizes this mode of equity finance when it has already used other sources of equity finance. The reason is that an IPO is a costly and time-consuming source of equity financing.

Conclusion

Equity financing is the most popular mode of financing for a company because the capital can be generated by the business internally. The company saves a lot on the interest cost by not opting for debt financing. By carefully planning the equity financing, the entrepreneur can ensure the growth of its business without diluting its majority stake. Many valuable organizations are able to obtain equity finance easily. Going forward, the organizations with higher growth potential will continue to find the interest of equity source financers.

I needed to put you that very small word so as to say thank you as before for your exceptional thoughts you’ve documented in this article.

I needed to draft you one very little word so as to say thanks over again regarding the incredible techniques you have shared at this time.