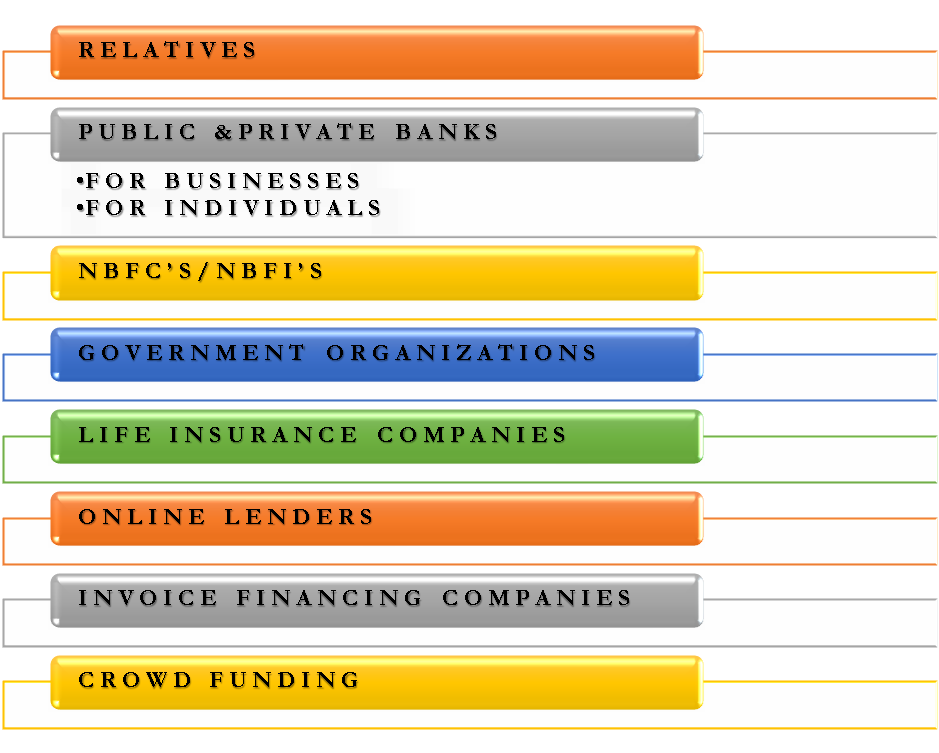

Various sources of loan are bank loans for businesses & individuals, loans from NBFC’s/NBFI’s, government organizations, insurance companies, online lenders, invoice financing, crowdfunding, etc.

A loan is a debt provided by one entity to another. The entity that lends is a lender, and the loan receiver is a borrower. There are predetermined terms between the lender and the borrower with respect to repayment structure, interest rates & collateral securities. Following are some of the sources of loans available to businesses & individuals. These sources of loan fit different needs, and it is ideal for assessing the requirement properly and choosing an appropriate loan.

Relatives

Taking a loan from family & friends or other relatives is a very good source of finance, especially when the loan required is of a small amount. Solely depending on your relationship with the lender, you can negotiate security requirements, repayment terms, and interest rates. In fact, sometimes such loans are even interest-free & security free, just because the lender has a close association with the borrower.

Public & Private Banks

Whenever someone thinks about loans, the first place that comes to mind is the bank. That is because the banks are in the business of lending & they have so many loan products for the borrowers that it becomes easy for the borrower to find a loan that perfectly suits his requirement. Following are the broad type of loans that banks offer:

For Businesses

Term loan

A term loan is a lump sum loan for any business purpose, whether to buy real estate, equipment, or working capital.

Working capital/cash credit

A working capital loan is for the purpose of financing the everyday operations of a business. The borrower can’t use this money to buy assets or investments.

Also Read: Sources of Credit

Equipment financing

When a company wants to buy new equipment or machine but doesn’t have the required cash, this loan creates the road ahead. The loan is extended to buy the equipment & the equipment itself acts as the collateral.

For Individuals

Personal loans

Personal loans are useful for funding anything like a holiday, home renovation, weddings, etc. One can avail of a loan without any collateral or security, but proof of income is a must.

Home loans

Banks offer home loans to buy a house where the house works as the collateral.

Auto loans

An auto loan allows a borrower to buy an automobile where the automobile work as the collateral.

Education loans

A bank sanctions an education loan specifically to pay fees for higher education, also known as student loans. The bank usually has a guarantor for such loans. In case of default, the guarantor has to repay the loans.

NBFC’s / NBFI’s

NBFC/NBFI stands for non-bank financial companies/non-bank financial institutions. These are institutions that are in the business of lending to individuals and businesses, but they are not recognized banks. The benefit of borrowing from an NBFI is that they have more relaxed policies towards customers. Especially when you have a low credit score, it is easier to get a loan from NBFI than from a bank. The disadvantage is that for the loan, NBFI usually charges a higher interest rate than bank charges.

Also Read: Sources of Debt Financing

Government Organizations

The government sets up special organizations to extend loans to help the lower or growing sectors of society. For example, in India, an institution called NABARD (National bank for agriculture & rural development) gives loans exclusively to the rural population. Similarly, there is SBA (Small Business Loans) in the USA, which lends exclusively to small businesses. As the goal of these institutions is to give thrust to growing sectors, their policies towards borrowers are relaxed & interest rates are also low.

Life Insurance Companies

Originally the main function of a life insurance policy was to provide protective cover. Still, nowadays, they give policyholders the benefit of availing of a loan against the life insurance policy. One needs to check the amount of loan they are eligible for with the insurance company. The loan amount is a percentage of its surrender value. Loans can usually be up to 85-90% of the surrender value. The interest rate in case of a loan against an insurance policy is based on the premium already paid and the number of premiums that have been paid. The more the premium amount and number of premiums paid, the lower the rate of interest charged.

Online Lenders

After the recession of 2009, bank lending tightened. This gave a perfect opportunity to technology companies to get into the business of lending & make money. It works the same as borrowing from a bank or NBFI’s, but the entire process is online. These online loans are usually more expensive than bank loans. Some of the biggest names in online lending are Prosper Marketplace Inc., LendingClub Corp., and many more.

Invoice Financing Companies

It is a common financing option for businesses. The businesses get money as soon as the invoice is generated. Invoice financing companies lend against business invoices. In a way, a company’s invoices are collateral to the lender & as the payment starts to come from outstanding invoices, the payment goes to the lender. Companies pay a percentage of the invoice amount to the invoice financing companies as a fee for borrowing the money. There are many exclusive invoice financing companies such as Universal Funding Corporation, Rivera Finance, etc.

Crowd Funding

The concept of crowdfunding is borrowing a small amount of money from a large number of people. Crowdfunding allows borrowing equity capital or loans. The best part of conducting a crowdfunding project to raise loan money is that it gives a lot of flexibility to the borrower in terms of interest rates, repayment structure & collateral security. The risk is that a crowdfunding project may or may not succeed as one has to convince a large number of people to lend. This type of loan gained prominence after the rise of social media.

Read Sources of Finance for Small Businesses to learn more.