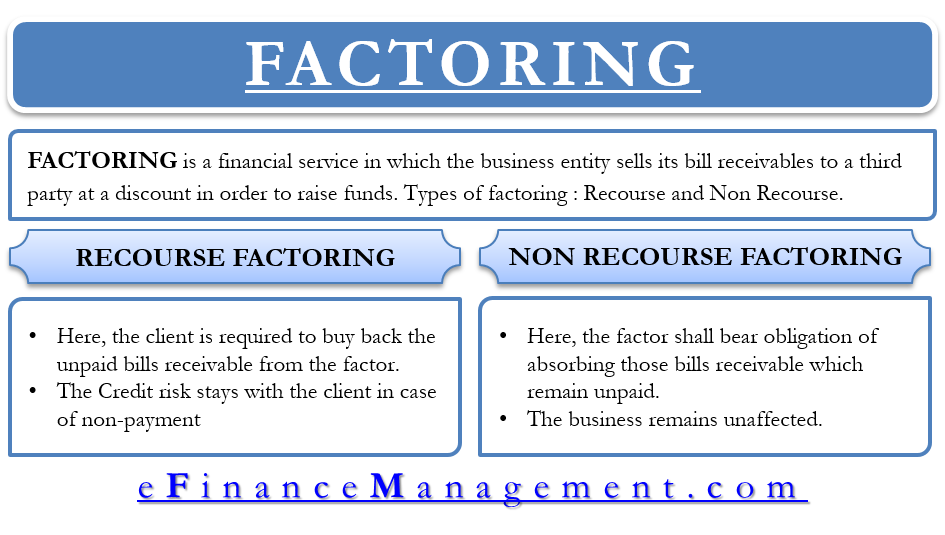

Definition of Factoring

Factoring is a financial service in which the business entity sells its bill receivables to a third party at a discount in order to raise funds. There are many types of factoring services. One among them is Recourse and Non-Recourse Factoring.

Definition of Recourse Factoring

Recourse factoring is an agreement between the client and the factor in which the client is required to buy back the unpaid bills receivable from the factor. Thus, the credit risk stays with the client in case of non-payment by the debtor.

Definition of Non-Recourse Factoring

Under non-recourse factoring, the client and the factor enter into an agreement where the factor shall bear the obligation of absorbing those bills receivable which remain unpaid. Thus, the business remains unaffected by the unpaid invoices.

Difference between Recourse and Non-Recourse Factoring

Recourse and non-recourse factoring are different concepts altogether. The main difference between the two is that in recourse factoring the credit risk of customers stays with the client i.e. in the case of non-payment of any bills receivable by the customer, the obligation to bear the risk stays with the client and not with the factor. So the risk of bad debts always stays in the business. On the other hand, in non-recourse factoring, the credit risk of non-payment of bills receivable stays with the factor and not with the client. Thus, the business can function smoothly without worrying about bad debts.

Also Read: Factoring Accounting

Recourse and Non-Recourse Factoring Accounting

Let us understand the accounting of recourse and non-recourse factoring with the help of an example:

On 1st January 2016, ABC Ltd. factored its account receivables of $ 2,00,000. The fee decided was 8%. As per the agreement, the factor retained security for bad debts that might arise in the future. The total cash received by the company is $ 1,64,000. The factor agreed to return the excess security amount at the end of the accounting period i.e. 31st December 2016. The factor withheld the excess security sum at the end of the period because the bad debts of $ 22,000 exceeded the security amount. ABC Ltd. had provided for the allowance of doubtful debts in the factor’s accounts receivable and bad debt expense was recognized on 31st December 2015 income statement.

Pass the necessary journal entry for both types of factoring:

Solution:

Firstly, we shall pass the journal entry that is common in both recourse and non-recourse factoring as on 1st January 2016.

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Cash | 1,64,000 | |

| Factoring Expense [200000 x 8%] | 16,000 | |

| Due From Factor | 20,000 | |

| To Accounts Receivable | 2,00,000 |

On 31st December 2016, the journal entries in both cases would differ because the bad debts have exceeded the security amount retained by the factor.

- In case of recourse factoring

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Provision for bad debts | 22,000 | |

| To Due From Factor | 20,000 | |

| To Cash | 2,000 |

The excess bad debts of $ 2000 shall be borne by the client in case of recourse factoring.

- In case of non-recourse factoring

| Particulars | Dr. Amt | Cr. Amt |

|---|---|---|

| Provision for bad debts | 20,000 | |

| To Due From Factor | 20,000 |

The accounting in case of recourse and non-recourse factoring is different because in the case of recourse factoring the credit risk of bad debts stays with the client whereas, same is not the case with non-recourse factoring.

Conclusion

Factoring services are an important aspect of big business. It helps them focus on their core business activities rather than indulging in the task of collecting money from the customers/debtors. Before deciding on which type of factoring to opt for, the client should access his customers and the value of the invoices. Recourse factoring is good for those businesses where bad debts are very less. On the other hand, non-recourse factoring is ideal for businesses having high bad debts. Both recourse and non-recourse factoring help the business to run smoothly.

Nicely explained

I am interested to try factoring. This article is very helpful for me. This article feed me all the information that I need to know about factoring. This is article is very useful for me.

I learning to about factoring. I want to use it for my business. This article is a big help for me because this will help me to determine which kind of factoring is good for my business. Thanks for sharing this article.