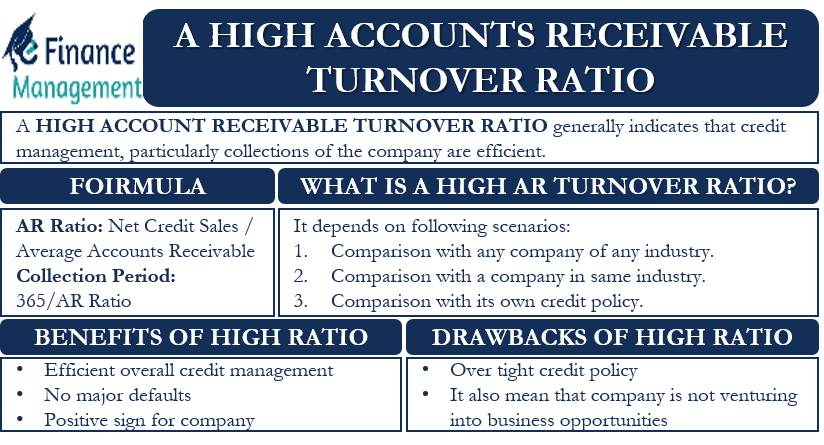

A high accounts receivable turnover ratio generally indicates that credit management, particularly collections of the company, is efficient. However, inferring just that much from this ratio would be too shallow an approach. Let us do a deep dive into the concept to have a better and right interpretation of this very important metric. Before that, let us just first recapitulate the concept in brief.

Accounts Receivable Turnover Ratio (AR Ratio)

The AR ratio is calculated by dividing net credit sales by average accounts receivable. This will give “credit sales is ‘x’s times of accounts receivable.” To make it more meaningful, we divide 365 days by the ratio (x) to express the ratio in a number of days called the “collection period.”

Formula

AR Ratio = Net Credit Sales / Average Accounts Receivable

Collection Period = 365 / AR Ratio

Example

Assume A Corp has net credit sales of $300 million and average accounts receivables of $50, whereas B Corp has $300 million and $75, respectively.

Let’s calculate the ratios as under:

| Particulars | A Corp. | B Corp. |

| AR Ratio | 300 / 50 = 6 | 300 / 75 = 4 |

| Collection Period | 365 / 6 = 61 days | 365 / 4 = 91 days |

You can also use our calculator on accounts receivable.

Just hold on; let us not jump on to the conclusion about which company’s ratio or performance is better.

What is a High Accounts Receivables Turnover Ratio?

We call something as ‘higher’ or ‘lower’ only when we compare it with something of a similar nature. That is the catch with respect to our current subject. Therefore let us pose a question here for us. Before calling the AR Ratio or Collection Period of A Corp. as higher or lower, what shall we compare it with? We have the following choices:

- Compare A Corp metrics with B Corp.

- Compare A Corp metrics with a similar company in the same industry, say C Corp.

- Or compare A Corp. collection period with its credit policy.

How to Interpret?

If A corp. deals in textile and B Corp in machinery, then the comparison and any comment on the positive or negative side of AR Ratio will be of little relevance or significance.

If, however, we compare Corp A with its peer, we gain insights on how good is the credit management of the company with respect to its industry peers and draw conclusions. Those conclusions will have far more relevance and can be a reference point as both the entities are operating in a similar environment and industry. By such a comparison, any corrective action is possible to improve the overall performance. Also, if a company’s credit policy for a customer is 60 days of credit, then that becomes the baseline, and expecting a collection period below that would not be normal.

Benefits of a High Accounts Receivable Turnover Ratio

- A higher ratio signifies the company has efficient overall credit management.

- Most customers are paying on time, and there are no major defaults.

- It is a positive sign, as it substantially reduces the time, effort, and chances of bad debts.

Disadvantages of a High Accounts Receivable Turnover Ratio

Yes, you have read the heading right. Nothing in this world is free from cons. Let us check the following points where this could be of a disadvantage.

- It can also mean that the company is losing into business opportunities by not giving a higher credit period along with marginally higher profit margins. This could improve the volume, revenue, and profits. This increased volume will reduce the operating cost, thereby further increasing the profits. Availability at a lower cost may eventually open a bigger market, and the company may become a dominant player.

- However, the company may be losing heavily by not looking into this aspect apart from focussing on the higher AR Ration.

- Businesses do face cycles. A very tight and non-accommodative credit policy opens the doors for customers to try out with the competition. And if the competition takes the game seriously, the company may lose a good customer forever. That would be an eventual loss of the business.