Debenture and bond are often used as interchangeable terms. Bond is used as a broader term which may include the debentures. Let’s categorize bonds into two – ‘with security’ and ‘without security.’ The bonds without security can be technically called debentures. Therefore, debentures are like a subset of bonds. Let us see in detail bond vs debentures.

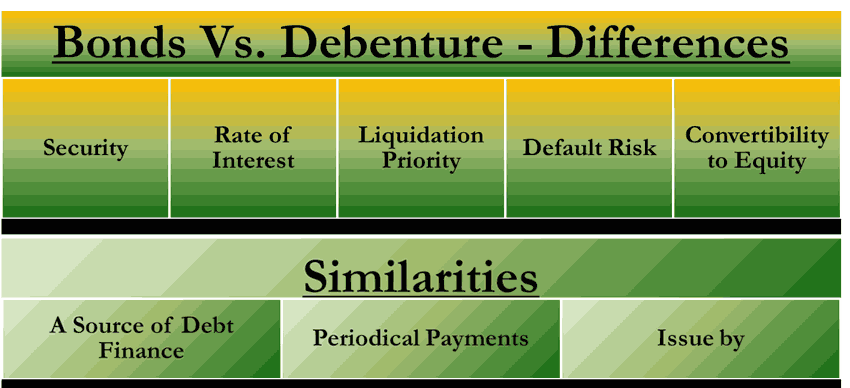

Bond Vs Debenture: Similarities

A Source of Debt Finance

Both debentures and bonds are external sources of debt financing. The companies or Government issue either of the instrument to finance their long-term need for financing.

Periodical Payments

Debenture holders are paid periodical interest on their loan, and the principal is paid back at the completion of the entire term. On the other hand, Bondholders are normally not paid any periodical payments. They receive the accrued interest and the principal upon the term completion at one go. This is not a strict feature of bonds in the new market innovations and can be customized to regular or periodic payment.

Issue by

Corporations, as well as governments, issue both types of instruments.

Difference between Bond Vs Debenture

Debenture and bond are often used as interchangeable terms. However, there are subtle and noteworthy differences between the two instruments:

Security

A bond is a more secure instrument than a debenture. A debenture does not have any collateral backing, whereas a bond will always have collateral attached to it.

Also Read: Characteristics of Debenture

For example, in layman’s terms, if an issuing company fails to pay interest or the principal to the bondholders, the amount can be realized by selling the collateral, i.e., the asset that is kept as a security. Whereas in the case of debentures, selling any asset and realizing money is not an option. This is because any security does not back it. Against the security, the debenture holders only relied upon the company’s credibility while investing money, and the credibility is not saleable in the open market.

It should be noted that these terms are quite loose terms because there are concepts of secured debentures where assets also secure the debentures. It all depends on how the instrument agreement is structured.

Rate of Interest

Debenture holders are entitled to a higher rate of interest in comparison to bondholders. The reason is that debenture is an unsecured loan and, therefore, is riskier than a bond. There is a direct relationship between risk and return. In simplest terms, risk can be defined as the level of assurance of cash flow. The higher the risk, the higher the expected return and vice versa. On that very principle, debentures are perceived as high-risk-bearing instruments compared to bonds, as we already observed that bonds are secured whereas debentures are not.

Liquidation Priority

In a case of a liquidation/bankruptcy, the company is liable to pay bondholders on priority, whereas debenture holders are paid later.

Bankruptcy is a very unfortunate event, and it normally happens when a corporation is not having sufficient funds or assets to pay off its liabilities. Once bankruptcy is filed, the official liquidator sells the assets of the company and honors the liabilities as far as possible. In our case, since an asset secures bonds, the money realized from this asset would be given to bondholders. On the other hand, debenture holders will get the money left over after paying off other secured liabilities. Note that equity shareholders are the last priority, and debenture comes before them.

Default Risk:

All the default risk impacts both debenture and bonds. Debentures are completely exposed to default risk, whereas bonds have an additional cover in the form of security. So, the risk factor is low in bonds and high in debenture when compared to each other.

Convertibility to Equity

Debentures can be converted into equity if the issue debentures are convertible debentures, which is not possible with bonds. If we stick to the concept that bonds are secured, they cannot become part of equity while continuing the security. All equity shareholders will have to have the same rights.