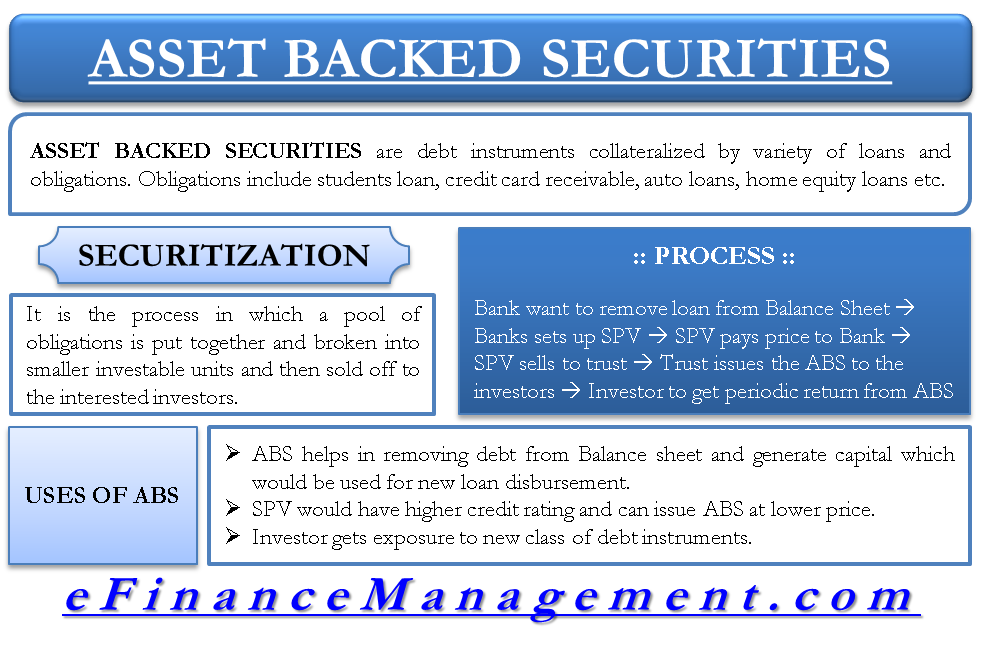

Asset-backed securities (ABS) are debt instruments collateralized by various loans and obligations. These are types of derivative instruments. These obligations usually include student loans, credit card receivables, auto loans, home equity loans, etc. The obligations of different investment ratings are pooled together and then sold off to investors by breaking them up into smaller units through a process known as securitization.

Securitization

Securitization is a process in which a pool of obligations is put together and broken into smaller investable units and then sold off to the interested investors. It usually begins with a bank wanting to move some loans and obligations from its balance sheet. This bank is called a sponsor. The sponsor sets up a special purpose vehicle (SPV) and moves the obligations into it. The SPV pays the price of these obligations to the bank. After the bank sells the loan pools to the SPV, the SPV sells them to a trust. The trust is the party that actually issues the ABS. The trust will convert the loan pool into debt instruments and issue them to the investors. The investors get a periodic return from the ABS as and when the interest and the principal on the underlying loans are paid.

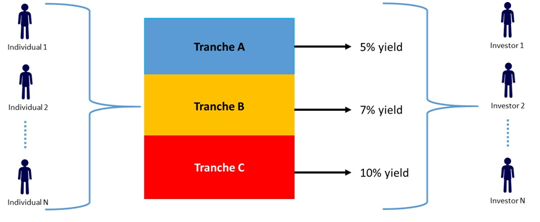

The underlying pool in the ABS usually has loans with different credit ratings. So, the ABS is also divided into various tranches, e.g., A, B, and C. Tranche A is the superior tranche and will be paid first. Trance B has a lower credit rating than A, and C is usually a non-investment grade. Because of this difference in their creditworthiness, the yields at which they are issued are also different. Tranche A has the lowest yield and highest price, while Tranche C has the highest yield and lowest price.

Uses of Asset-Backed Securities (ABS)

Asset-Backed Securities give the banks a way out to move their obligations from their balance sheet and generate capital. The banks can use this capital to disburse new loans. Also, the sponsor bank may have a lower credit rating and hence may not be able to issue ABS at an attractive yield. On the other hand, an SPV with its own assets and liabilities has a higher credit rating and can issue ABS at a lower yield and a higher price. Securitization reduces the risk of non-performance of the debt instrument because of credit-enhancing mechanisms like separating the pool into tranches.

Investors get exposure to a new class of debt instruments that were not available previously. They can choose from various backing assets to diversify their portfolio.

The Structure of ABS

The typical Asset-Backed Securities will have a pool of loans and obligations. Let us assume that the pool is of credit card receivables. These receivables will usually have different credit ratings based on the individuals’ credit score against whom the receivables are actually pending. Once these obligations are pooled together, they are separated into tranches of different investment ratings. Here are usually three tranches: senior secured or Tranche A, a mezzanine of Tranche B, and unsecured or Tranche C. Risk of non-payment increases as we move from Tranche A to Tranche C.

As the risk increases from Tranche A to Tranche C, the yield also increases in the same order. So, Tranche A instruments are issued at the lowest yield, while Tranche C instruments are issued at the highest yield. Tranche A investors have the first right over any payments received in the pool. Once Tranche A investors are paid, Tranche B investors get their payment out of the remaining amount. If any amount is left after paying Tranche B investors, it goes to Tranche C.

A typical credit card receivables ABS structure looks like the below:

The investors can be either individual or institutional.

Credit Enhancement in ABS

To make it more attractive to investors, ABS has various credit-enhancing mechanisms. These are of two types, internal and external.

Internal Credit enhancement mechanisms include tranching, over-collateralization and reserve account, etc. external credit enhancement mechanisms include letters of credit and surety bonds, etc.