What do we Mean by Economic Interactions?

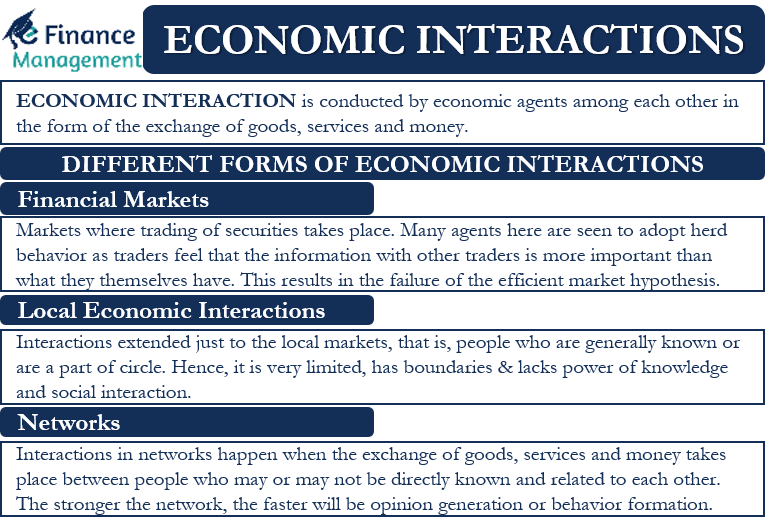

The economic agents in an economy conduct economic interactions among each other in the form of the exchange of goods, services, and money. Interaction simply means reciprocal action, the effect of one’s action and/ or influence of action by the economic agents. The economic agents can be individuals or a group of people. Goods, services, and money move in the economy in a circular flow in complex combinations. There are a number of mediators in the process of economic interaction in the form of local units that help in the transfer of goods, services, and money. These mediators are the key influencers for the intensity of the economic interactions that take place in an economy.

The most important function of money that has evolved over the years is that of means of exchange. It is through money that the agents in society involve in multiple economic interactions. Also, it is a form of means of communication between such agents that gives way to several economic processes. They use the prices of goods and services as an interaction tool. In fact, it will not be incorrect to say that the price system in itself is a storehouse of all information, be it public or private.

Relations Between Individual and Aggregate Interactions

An economy is a very complex structure. The economic interactions of individuals at the micro level define the aggregate behavior in the economy. Individual behavior may not be rational sometimes. But the collective behavior generally moves towards rationality, leading to equilibrium. The concept of division of labor suggests the same phenomenon. Each individual may perform a very simple and minuscule task, but the total outcome of their efforts can be significant and complex. Therefore, individuals may have a limit to their outlook on the economic interactions in a society, but there is automatic coordination between the activities of a group of individuals. Streamlining of all activities occurs accordingly.

What are the Different Forms of Economic Interactions?

There are different ways in which agents engage in economic interactions in a society. Let us take a look at them.

Financial Markets

Financial markets are the markets where the trading of securities takes place. Many agents that participate in financial markets are seen to adopt herd behavior. The behavior of other agents often affects their behavior in the market. This is commonly seen with traders who feel that the information with other traders is more important than what they themselves have. The traders will stop acting on the information they have. They just make inferences from the decisions and actions of others. It will no longer impact the market demand and supply. Herd mentality acts as a barrier to the correct aggregation of information in economic interactions.

This results in the failure of the efficient market hypothesis. Economists call this malfunction an “informational cascade”. Such economic interactions give us satisfactory answers to the phenomenon of the “bursting of economic bubbles”. Others just offer an excuse for the irrational behavior of the market participants. Bubbles form only when there is a prevalence of herd mentality. Notions form on the basis of what the majority of market participants believe or are made to believe. Therefore, such economic interactions result in the bursting of the bubble someday or the other, resulting in huge economic losses for many.

Local Economic Interactions

Agents and mediators sometimes engage in economic interactions that extend just to the local markets. They trade with a few people whom they generally know or are a part of their circle. In such cases, their interactions may not affect the collective market as a whole because their interactions are just with a few local people like their neighbors or their close associates. Therefore, it is very limited, has boundaries, and lacks the power of knowledge and social interaction. It may diffuse down very soon without affecting the broader markets and other agents.

Networks

Economic interactions in networks happen when the exchange of goods, services, and money occurs between people who may or may not be directly known and related to each other. Such interactions involve a number of persons. The speed at which such economic interactions occur is determined by how good the network is between agents and mediators. The stronger the network, the faster opinion generation or behavior formation will be.

Agents sometimes modify their behavior in accordance with the behavior of the people in their known circle or neighbors. Still, they may end up affecting the collective group behavior as a whole. They have two choices- they may either try to organize themselves or else stay disorganized. However, in either case, they may not be able to eliminate the aspect of uncertainty in cases of economic interactions.

Also Read: Types of Market

Summary

The main goal of economics and the activities that take place in it is to achieve an equilibrium point where demand becomes equal to supply at the given price point. The agents in the society interact in the broad economic framework to replicate their respective equilibrium status in the economy as a whole.

The present era is the era of quick information processing and transfers that result in fast economic interactions. The role of mass communication and social and political information amidst growing communication through multiple new mediums and the internet has changed the face of economic interactions in society. It is the age of information technology that has spread its roots in both public as well as private organizations as well as public and private life of individuals/groups/communities. The result is the betterment of economic interactions in the society and economy as a whole, affecting each and every one of us.