What are Treasury STRIPS?

Treasury Strips, also known as STRIPS (Separate Trading of Registered Interest and Principal of Securities), is a type of zero-coupon bond issued by the U.S. government. They are created by stripping the principal and interest payments of a bond into individual securities, which are then traded and sold separately. Each security represents a specific payment and has its own face value and maturity date. Unlike traditional bonds, Treasury Strips do not pay periodic interest payments but are instead issued at a discount to their face value and mature at their full face value. Because they are backed by the government, they are considered safe investments. Investors can buy and sell treasury strips through financial institutions and brokers, but not directly from the U.S. Treasury.

In treasury strips, the word STRIPS stands for Separate Trading of Registered Interest and Principal of Securities. The literal meaning of stripping applies here, i.e., it strips a bond into several bonds, each having a separate par value. This process of stripping is called coupon stripping.

History of Treasury Strips

The history of treasury strips dates back to the 1980s when the U.S. government began issuing a new type of bond called the Treasury Investment Growth Receipt (TIGR).

TIGRs were a type of zero-coupon bond that separated the principal and interest payments of a bond into separate securities that could be traded separately. These securities were essentially treasury strips, although they were issued by Merrill Lynch rather than the U.S. Treasury.

Also Read: Treasury Bills

Around the same time, the U.S. Treasury began issuing its own version of TIGRs called CATS, or Certificates of Accrual on Treasury Securities. Like TIGRs, CATS were zero-coupon bonds that separated the principal and interest payments of a bond into separate securities.

However, TIGRs and CATS never really caught on with investors due to their complexity and lack of liquidity. In response, the U.S. Treasury began issuing its own version of treasury strips, which were called STRIPS, or Separate Trading of Registered Interest and Principal of Securities.

STRIPS allowed investors to purchase individual payments of a bond, such as the principal or interest payments, which could be bought and sold independently. This provided investors with more flexibility to meet their specific investment needs, while also making the investment process simpler and more transparent.

Today, treasury strips continue to be popular among investors who are looking for safe and predictable investments. They are considered to be one of the safest investments available because they are backed by the U.S. government, and they provide a guaranteed return at maturity.

How do Treasury Strips Work?

To understand how these work, let us take an example.

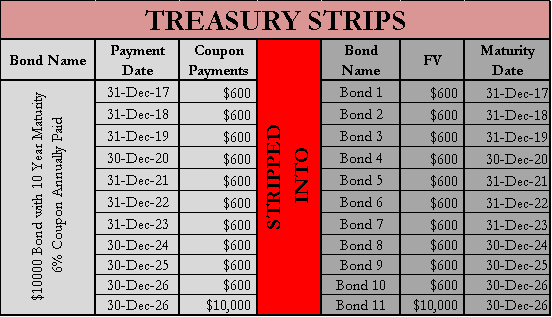

Assume there is a 10-year bond having a face value of $10,000 bond that pays 6% coupons paid annually. There are a total of 11 payments, including 10 interest payments and 1 face value payment. Each of these payments is stripped/converted into 7 zero-coupon bonds.

The table below shows that the bond is stripped into various bonds with different FV and Maturity Dates. The face value is equal to the coupon value, and the maturity date is the same as the coupon payment date.

- Maturity = 5-year from 1st of Jan 2017

- Face Value = $1,000

- Coupon Rate = 6% paid annually

How are Returns Calculated for Treasury Strips?

The calculation of return on TREASURY STRIPS becomes quite simple, like stock trading. The formula for the calculation can be as simple as follows:

If the bond is sold before maturity,

Return = Trading Value – Purchase Price.

If the bond is held till maturity,

Return = Face Value – Purchase Price.

Treasury Strips Characteristics

The following are the characteristics of treasury bonds.

- It is a type of zero-coupon bond categorized under fixed-income securities.

- It matures at face value and is issued at a significant discount.

- There are no interest payments.

- Pay-out was known in advance with a maturity date

- Need to pay federal income tax on bond’s accretion whether received in cash or not.

- It can be purchased from financial institutions, brokers, etc. but not directly from the treasury.

- They are considered safe because the government backs them.

- Easy to invest as there is a smaller chunk of money invested.

- Minimum 10-year bonds are eligible for stripping.

Advantages of Investing in Treasury Strips

The various advantages of investing in treasury strips are as follows:

Low-risk Investment

These are backed by the full faith and credit of the U.S. government, which makes them one of the safest investments available.

Guaranteed Return

Because these have a fixed maturity date and payout at face value, investors know exactly how much they will earn when they invest in these securities.

High Liquidity

Treasury strips can be bought and sold on the open market, which means that investors can easily cash out of their positions if they need to.

Diversification

By investing in treasury strips, investors can diversify their portfolios and reduce their overall risk exposure.

Tax Benefits

While investors must pay taxes on the accretion of the bond (the difference between the purchase price and the face value), they do not have to pay taxes on the interest income.

Risks of Investing in Treasury Strips

The following are the disadvantages of investing in treasury strips:

Low Returns

Because treasury strips are considered a low-risk investment, they typically offer lower returns than other types of securities, such as stocks or corporate bonds.

Inflation Risk

If inflation rises, the real return on treasury strips may be lower than expected, which could erode the purchasing power of an investor’s principal.

Interest Rate Risk

If interest rates rise, the value of treasury strips may decline, which could result in a loss for investors who need to sell their positions before maturity.

Complexity

These can be complex securities to understand.

Not Suitable for Short-term Goals

Treasury strips are designed to be held until maturity, which means that they may not be the best option for investors who have short-term financial goals.

Learn more about various other types of bonds at Bonds and their Types.

Where could I buy these bond’s?

It can be bought through financial institutions, brokers, and dealers only with those who deals in them.