What are Green Bonds?

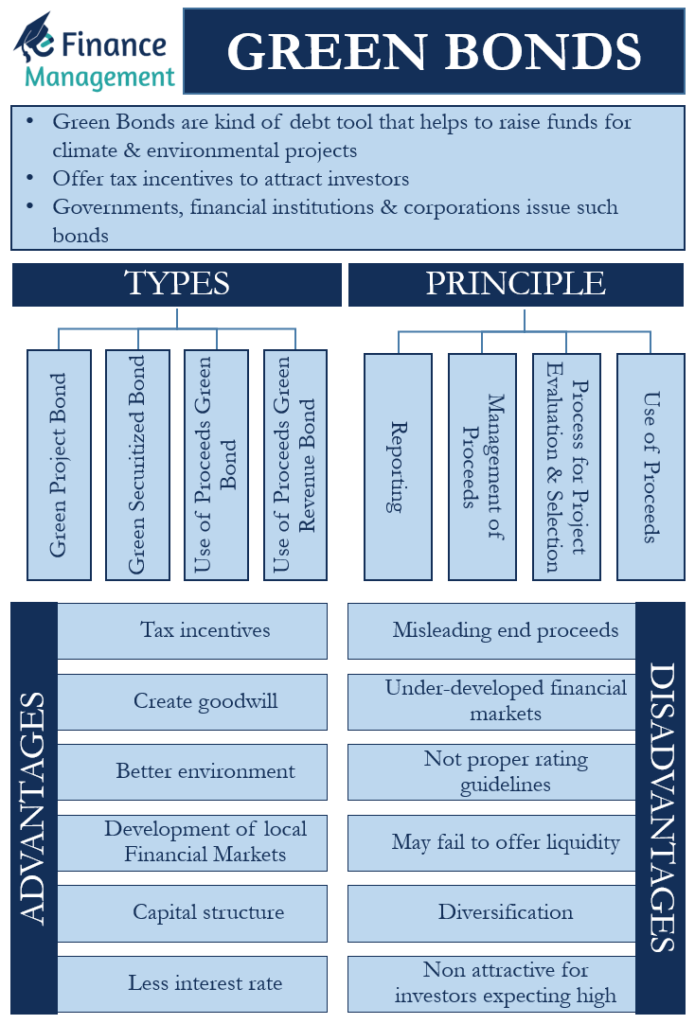

Green Bonds are a kind of green finance debt tool that helps raise funds for climate and environmental projects. Generally, these financial instruments offer tax incentives to attract investors. Governments, financial institutions, and corporations can issue such types of bonds.

Such bonds are very similar to any ordinary bond with one distinguishing point. And, it is that the proceeds from the bonds go for the funding of projects with positive environmental impact. These projects could be developing renewable energy, green buildings, clean transportation, wastewater and water management projects, pollution prevention, and more.

History of Green Bonds

The World Bank issued the first official green bond in 2008. However, the history of these bonds links to the City of San Francisco, where a ‘solar bond’ was approved to fund renewable energy. Also, in 2007, some development banks, such as the European Investment Bank, issued an Equity index-linked bond of such a type.

The World Bank has issued more than $14 billion of such bonds since 2008 to fund 111 projects globally. More than half of these projects are for renewable energy, efficiency, and clean transportation.

Also Read: Blue Bonds – Meaning, Challenges, and Uses

In terms of market size, the green bond issuance in 2012 was only at $2.6 billion, compared to $161 billion in 2017 and almost $270 billion in 2020.

Presently, most of these bonds come from Europe. And regulatory and policy factors are the primary drivers of such bonds, such as the Paris Agreement and The European Green Deal. In the U.S., such bonds mainly come from corporations.

Types of Green Bonds

There are primarily four types of such bonds on the basis of the kind of security available. These are:

Use of Proceeds Green Revenue Bond

The proceeds of these bonds are used for the earmarked projects. And their security is the income generated from those financed projects.

Use of Proceeds Green Bond

Such bonds are secured by the assets. And the proceeds go for green projects.

Green Securitized Bond

The security for such bonds is the large pooled assets.

Green Project Bond

The security for such bonds is the project assets as well as the balance sheet items.

Green Bond Principles (GBP)

ICMA (International Capital Market Association) came up with these principles. These principles help to ensure transparency and disclosure in the development of the market for such bonds. Moreover, these principles provide investors with information on the sustainability of their investments. We can say that these principles help the issuer to develop a framework. Primarily these principles cover the following four components:

Use of Proceeds

GBP states how the issuer can use the proceeds. In this way, it outlines the eligibility of the green projects. GBP clearly states that these projects must contribute to the environmental objectives, including pollution prevention, climate change, and more.

Process for Project Evaluation and Selection

GBP specifies all points that an issuer needs to consider when evaluating and selecting projects. Also, the issuer should clearly communicate all the details of the project. Moreover, GBP encourages a high level of transparency in the project as well, including eligibility, associated risks, managing any potential material, and more.

Management of Proceeds

GBP specifies that the issuer needs to manage proceeds in a sub-account or in a sub-portfolio. Moreover, such a process of managing the proceeds should be aligned properly with the investment objectives of the project. Also, it states that the issuer should do their best to manage this process as transparent as they can.

Reporting

GBP covers how the progress and impact of the bond need to be reported. It states what all details should be shared, such as the use of proceeds, a brief description of the project, allocations, and more. The issuer could also report on the estimated impact of the bonds.

How to Identify a Green Bond?

The following points should be in mind to identify a bond as a green bond:

- The issuer must have labels the bond as ‘green’ in the public documents.

- Suppose the revenue from the project funded by these bonds should be applied to the environmental projects. Please keep in mind that if over 5% of the revenue from such bonds is used for other purposes, then it is not a green bond.

- The bonds should fall in the climate bond taxonomy. If they do not, then they should not be included in the green bond list.

Real-Life Examples

Let’s take a look at some of the best examples of these bonds:

- Tesla Motors in 2013 issued $600 million of convertible green bonds.

- The LSE (London Stock Exchange) has a green bond segment to give investors more information on green projects.

- Nigeria issued more than $60 million in bonds to local investors to fund its green projects, including solar power, deforestation, and more.

- India’s Export-Import Bank (EXIM) issued $500 million of such bonds for a five-year term.

In 2010, green bond funds came up as well to allow retail investors to take part in these financial instruments. These funds are sponsored by Blackrock, Allianz SE, AXA World Funds, Axa SA, and more investment and asset management firms.

Advantages

Following are the advantages of these bonds:

- These bonds offer tax incentives, such as tax credits and tax exemption, to investors.

- These bonds help to create goodwill for the companies issuing, as well as investing in these bonds.

- Such bonds are the best choice for investors looking to invest only in environmental projects.

- Such bonds eventually lead to a better environment. This is because the proceeds of these bonds help to fund green projects.

- Issuing and investing in these bonds assist in meeting green mandates, such as the UN’s PRI (Principle for Responsible Investment).

- Such bonds help in the development of local Financial Markets, even for non-environmental projects.

- These bonds help issuers with their capital structure. Issuers of such bonds are usually allowed to use some part of the proceeds to pay back their other debt and use it for working capital. Moreover, the issuer can also use the proceeds to replace high-cost debt in existing green projects. However, replacing old debt is only allowed if the issuer has a good credit rating and a robust performance record.

- The interest rate of such bonds is less than the loans from commercial banks. This helps to lower the cost for the issuer.

Disadvantages

These are the disadvantages or drawbacks of such bonds:

- These bonds have criticism with regard to their end-use of proceeds by the issuer because of several reasons. There were instances when the end-use did not fall under the green category. And the public has been misled.

- Under-developed financial markets may not be conducive to the development of such bonds.

- There are no proper rating guidelines for such types of bonds.

- Such bonds may fail to offer liquidity that some investors, mainly institutional investors, may want at times.

- Such bonds have received criticism for not being diversified enough in terms of issuers or the countries where the projects are based.

- Non-green investors may not view it as an attractive investment if they expect to earn more returns from other investments.

Final Words

Green bonds are extremely useful for environmental projects. They are an attractive option not just for the investors but for issuers as well. The demand for such bonds is continuously growing. According to the Climate & Development Knowledge Network, the demand for these bonds is at least $12 trillion.

Over time, drawbacks of these bonds, such as less liquidity, would also go away as they grow more popular. This would help to attract institutional investors. But, for this to happen, the regulators and credit rating agencies need to come up with a conducive environment, such as benchmarking, guidelines, and standards, for these bonds.

Also, read – Bonds and their Types.