Meaning of Green Finance

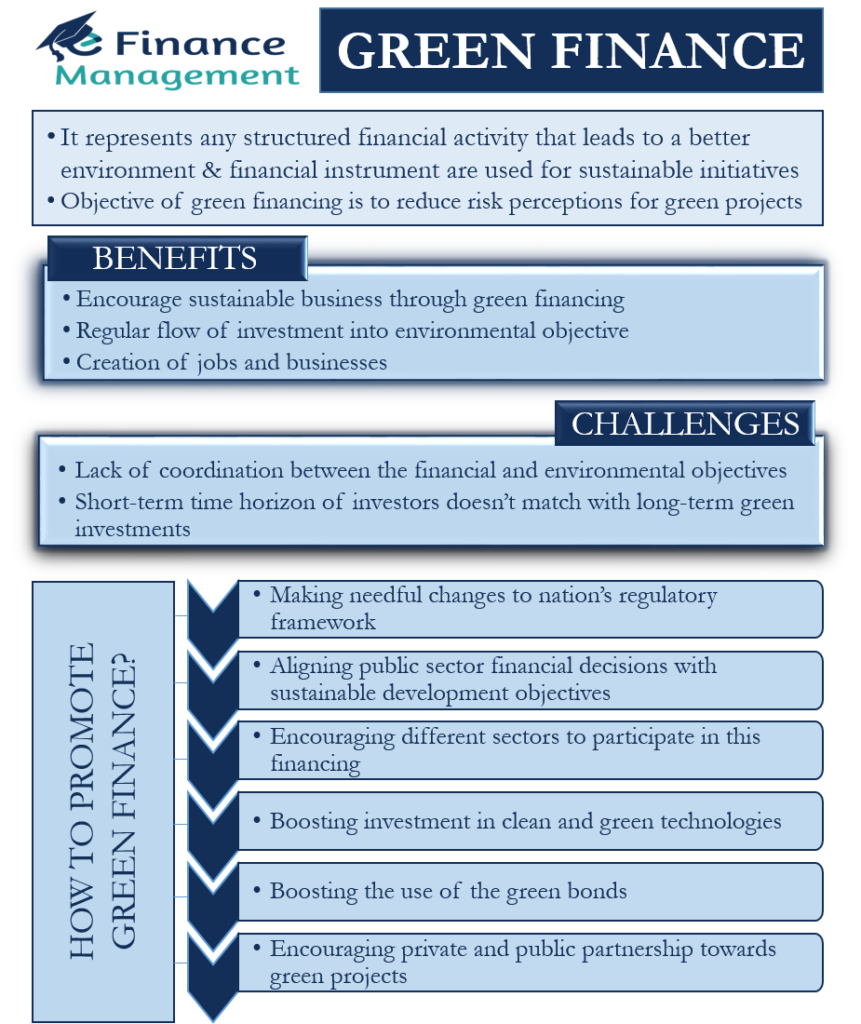

As the word implies, Green Finance relates to the investments that help improve the environment/climate. This includes the actions by the private and public entities, including banks, governments, companies, non-profit organizations, and others. This finance includes all types of actions and initiatives, such as developing, implementing, and promoting projects that can have sustainable impacts or sustainable business models. Along with making funds available for green projects, another objective of green financing is to reduce risk perceptions for green projects.

In simple words, we can say it represents any structured financial activity that leads to a better environment. These activities could be loans or investments, or any other financial instrument. We can also say that this type of financing comes into play if the proceeds of any financial instrument are used for sustainable initiatives.

Understanding the Term: Green Finance

We can also say that any loan or investment that helps in supporting green activities, such as buying green products or services or developing an eco-friendly infrastructure, is green financing.

For example, funds to promote renewable energies, carrying out environmental audits, and more. Also, investments that help in lowering pollution, carbon footprint, and deforestation would also come under this type of finance.

Presently, switching to a green product could be expensive. Because of the lower volumes and developing technologies, the cost of production is high as compared to other products for similar use. We can have the example of an electric bike or car where the cost of bike or vehicle is more compared to gasoline or petrol vehicle. However, green financing will prompt and incentivize people to make a switch to greener products. This way, such financing offers incentives to both businesses and consumers to take the environment into consideration while making decisions.

Climate Finance

Many people use the term Climate Finance and Green Finance interchangeably. The two terms sound similar but have a few differences between them. In fact, Climate Finance is a part of green financing. Climate Finance mainly includes public finance. And it also includes efforts from developed countries to make financing available to tackle climate change. In contrast, green finance is a wider term and includes all types of financial flows for environmental objectives.

Green Finance: Benefits

The benefits are listed below:

- Encouraging green financing on a massive scale implies that green or environmental initiatives get priority over usual business investments that may or may not be sustainable.

- Focusing on such finance leads to transparency and a regular flow of investments into environmental objectives.

- The growth of this type of financing will help in the creation of more jobs and business opportunities.

- All this will ultimately lead to better human life and facilities as well as sustainable developments without spoiling or destroying nature.

Green Finance: Challenges

Following are the challenges faced in this Financing:

- Often short-term time horizon of the investors does not match with the long-term green investments.

- There always remains an issue with regard to proper coordination, cooperation, and alignment of financial and environmental objectives. Each would like to pull the trigger to prioritize its own objectives.

How to Promote Green Finance?

To promote such type of finance, the following things need to be done (or are being done):

- Making required changes for green financing to a nation’s regulatory framework.

- Aligning public sector financial decisions with sustainable development objectives.

- Encouraging different sectors to participate in this financing.

- Boosting investment in clean and green technologies.

- Boosting the use of the green bonds.

- Encouraging private and public partnerships toward green projects.

Current Trends in Green Finance

Green Bonds are a very good example of such a financing activity and instruments. The U.S., China, and France are among the biggest issuers of these bonds, while ECB (European Central Bank) also plays a crucial role in such types of activities. It is estimated that the green bond market could go up to $2.30 trillion in the coming years.

Along with Green Bonds, carbon market instruments are also a popular tool of green financing. In addition to green tools, we also see a surge of green financial institutions, such as green funds and green banks.

Initiatives by UN to Promote Green Finance

The United Nation’s Environment team is also actively working with public and private entities to align global financial systems and environmental objectives. For instance, the UN is assisting nations in re-engineering their regulations to boost green initiatives in both the public and private sectors. Subsidies for adopting solar energy are a good example of such initiatives.

UN also has a resource efficiency program that helps towards this financing. Such a program assists nations in evaluating their policies and regulatory framework to develop sustainable financial plans. Also, the program helps central banks and regulators to come up with a multi-country policy at the national and international levels.

Final Words

Green Finance, especially Green Bonds, could very well be the future of the financial sector. It will play a leading role in the march towards net-zero (minimum greenhouse gas emissions). These bonds are one of the best ways to meet the needs of environmentalism, as well as capitalism. There is, however, a need for minimum standards for this type of finance to ensure its long-term effectiveness and benchmarking of risk. Having standards and rules would help in the creation of more green finance tools.

The concept is rapidly gaining ground. More and more investments are driven with the objective of socially responsible investing. The need of the hour is to create a regulatory framework and credit rating agencies. This will help proper utilization of funds with the given objectives rather than the diversion of funds in the name of green investments (greenwashing).