What do you Mean by Green Banks?

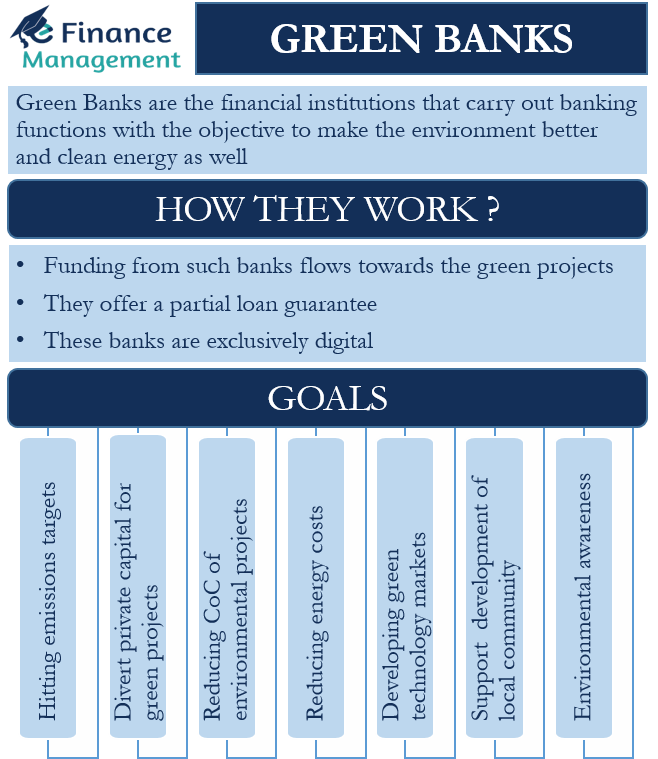

Green Banks are the financial institutions that carry out banking functions with the objective of making the environment better. Such banks facilitate the transition to clean energy and fight climate change. We can say that these banks work to divert private investments into sustainable green projects. Along with focusing on profits, such banks think about people and the planet as well.

Moreover, many of these banks not only invest in environmental projects but are powered by clean energy as well. For instance, such types of banks could be powered by 100% renewable energy. Also, these banks could offer car or home loans to help users transition from fossil fuels.

A Green Bank could either be on a public model, private model, or a hybrid model. Many governments (national and local) have come up with such banks or similar entities in recent years. Countries like Australia, the UK, India, Japan, and more have come up with such banks at a national level. California, Jersey, New York, and more have come up with such banks at the state level. Many of such banks are B Corporation Certified.

Green Banks – How They Work?

This Bank works like any other usual bank. The differentiation is with regard to the usage of those publicly collected funds. The funding from such banks flows toward the green projects. For example, these banks can fund clean, renewable energy projects, community solar projects, sustainable farming, and more.

Another differentiating factor is that they offer a partial loan guarantee. This guarantee works as insurance to cover some portion of the debt if the borrower fails on their green commitments. Such a guarantee gives confidence to private investors to make green investments.

Generally, these banks are exclusively digital, but some of these banks have a brick-and-mortar presence as well. These banks have consumer-friendly online platforms and apps and operate through mobile banking and digital check deposits. Many of these banks offer debit or credit cards that are made of sustainable materials, such as wood or green plastic.

There could also be green banks that do not offer checking or savings accounts. Usually, the state sponsors such banks. These banks use the funds they get from the government to give loans for green projects, as well as encourage private investment into clean and renewable energy.

Goals of Green Banks

These Banks could work towards one or more of the below goals:

- Hitting emissions targets.

- Diverting private capital for environmental projects.

- Reducing the Cost of Capital (CoC) of environmental projects.

- Reducing energy costs.

- Work towards developing green technology markets.

- Using green projects/green finance to support the development of the local community.

- Raising environmental awareness by conducting seminars on green topics.

List of Green Banks

Green Banks are now present in almost every major country. We will list out below some of these popular green banks:

Aspiration – It is a U.S. certified B Corp that donates 10% of its profits. It has 100% fossil-fuel-free investment and retirement funds and is an online-only bank.

Ando money – It is a U.S. certified B Corp, and their debit cards are made with 80% less plastic. They offer their services through mobile banking.

The Charity Bank – It is a UK-based ethical bank that provides loans to charities and social enterprises.

Omista Credit Union – This Canadian bank reinvests its profits locally. They use 100% renewable energy for a part of their operations. Moreover, they offset all their electricity use (non-renewable) with green energy.

Bank Australia – It is a customer-owned B-corp that runs on 100% renewable electricity and is carbon neutral. In their Conservation Reserve, they assist wildlife in adapting to climate change, work towards biodiversity, and more.

Final Words

Green Banking is already a norm in some countries and going ahead, Green Banks will gain even more prominence. To be a part of such banking, the general public does not need to do anything special. These banks offer an alternative way to carry out usual banking functions. So, users just need to associate themselves or shift their banking with green banks to be a part of this green revolution.