What is a Dividend Bearing Checking Account?

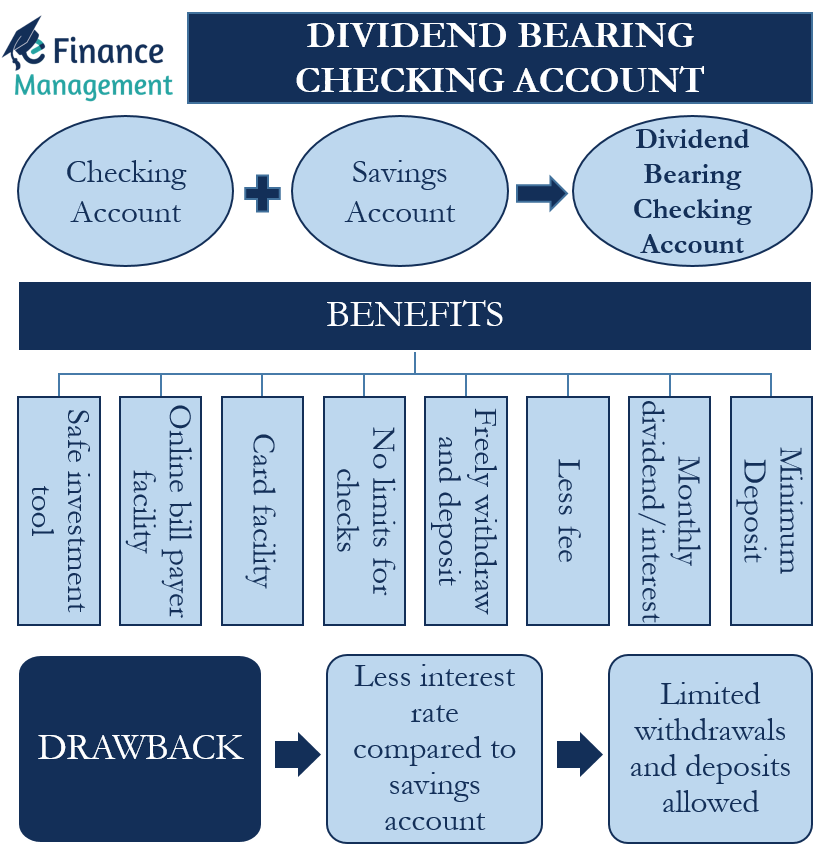

A Dividend-bearing Checking Account is a combo of both types of usual accounts – a checking account and a savings account. This means that it would help you with the day-to-day transactions and offer interest on the account balance. To get the interest, users generally need to maintain a certain specific daily balance.

Even though its name carries the word ‘dividend,’ this account has nothing to do with the dividend that companies pay. Rather, the term dividend here means a bonus or extra money that you get in the form of interest.

Purpose for having a Dividend Bearing Checking Account

A checking account is a type of account that allows one to easily deposit and withdraw money for day-to-day transactions. However, unlike a savings account, a checking account does not pay any interest even if the holder regularly maintains a balance. A Dividend-bearing Checking Account helps to address this shortcoming of a checking account.

Such an account is a safe investment as well. This is because you will continue to get the interest on your account balance and that too without taking any risk.

Benefits

These are the benefits of having such an account:

- Unlike savings accounts that require a larger minimum deposit, one can open these accounts with a little money. This minimum deposit requirement varies from bank to bank.

- A holder usually gets dividends or interest monthly.

- These accounts charge less fees in comparison to a checking account.

- Users can freely withdraw and deposit from the account.

- No limit on the use of checks.

- There is a debit card facility as well. In addition, the institution would offer online and mobile banking services to the account holder for free.

- Access to Online Bill Payer facility.

- Safe investment tool.

Drawback

- In terms of drawbacks, the only thing we can say is that such accounts may not offer the same interest rate that you get with a savings account.

- Additionally, there may also be a limit on the number of times one can deposit or withdraw in a given time period.

Who Offers Dividend Bearing Checking Account?

Many financial institutions offer such a type of account, such as banks, credit unions, and more. Moreover, they may provide additional features with such accounts as well. For instance, to encourage users to maintain higher balances, many financial institutions offer a higher interest rate if the balance is above a specified limit, say $25,000.

Types of Dividend Bearing Checking Accounts

Also, some financial institutions may offer more than one type of Dividend-bearing Checking Account.

Usual Dividend-Bearing Checking Account

As mentioned above, this is the combination of saving and a checking account.

Dividend-Bearing Checking Account with Several Perks

These perks could be discounts on Safe Deposit Boxes, stop payment facilities, and more. Of course, there may be a requirement for a higher minimum balance to enjoy these additional perks in addition to the usual interest on such accounts.

Final Words

A dividend-bearing Checking Account could prove very useful for those who require a checking account to manage their daily transactions but are able to maintain some balance in it. If you plan to go for this type of account, then you must compare the features that different financial institutions are offering. This would help you to select the one that meets your requirements.