A financial instrument could be any document that represents an asset to one party and liability to another. It can be a contract or a document like a bond, share, bill of exchange, futures or options contract, cheque, draft, or more. It carries a monetary value and is legally enforceable. One can also create, modify and trade such instruments, representing a binding agreement between two or more parties.

As per the definition by International Accounting Standards (IAS), financial instruments are any “contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.” Accounting treatment of the financial instruments is governed by IFRS 9.

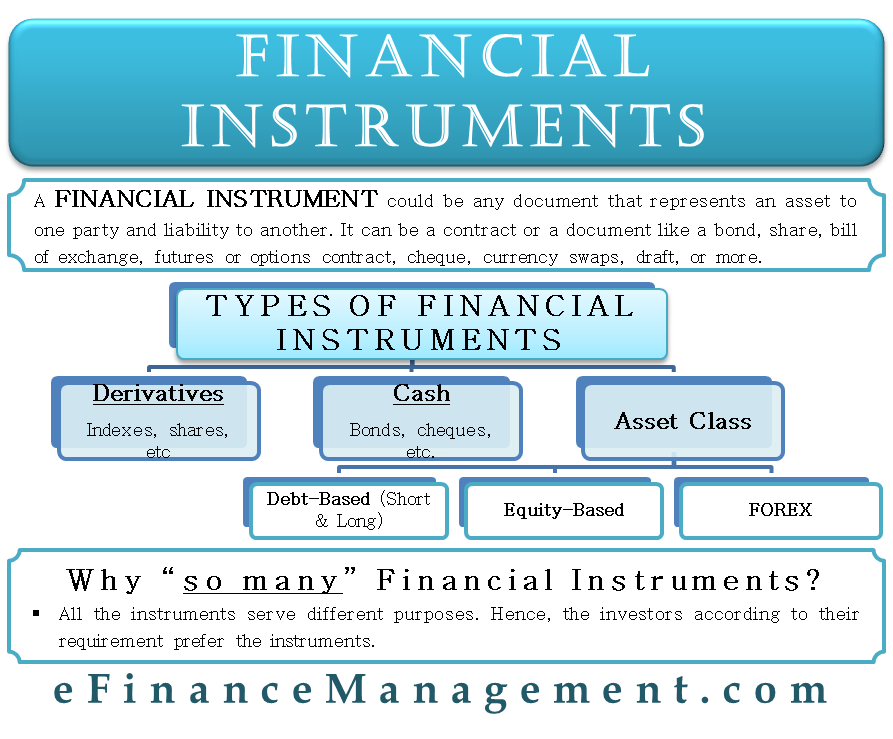

Types of Financial Instruments

There are mainly two types of financial instruments: Derivative Instruments and Cash Instruments.

Derivative Instruments

We derive the value of such instruments from the value and characteristics of the asset they represent. Or in simple words, these instruments are securities that we link to other securities. Such instruments can represent assets like interest rates, indexes, shares, and more. Examples of such instruments are futures and options contracts. Derivative instruments can either be exchange-traded or over-the-counter (OTC) derivatives.

Cash Instruments

Cash instruments are instruments whose market value is available directly. Market forces directly determine and influence the value of such instruments. Such securities are readily transferable as well. Shares, bonds, and cheques are some examples of these instruments. Deposits and loans are also cash instruments if the lender and borrower agree over their transferability.

Also Read: Financial Securities

We can also classify these instruments based on the asset class they represent, i.e., if they are based on equity or debt. Based on the asset class, there are two types of financial instruments – Debt-based and Equity-based financial instruments. The former represents ownership of an asset, while the latter represents a loan by an investor to the owner of the asset.

Debt-based financial instruments can also be of two types based on the tenure – long term and short term. Long-term debt instruments can be bonds, bond futures, options, Interest rate swaps, etc. Short-term debt instruments can be T-bills, Interest rate futures, and forward rate agreements.

There is one more type of financial instrument on the basis of the asset class – Forex instruments. These instruments include forex futures, forex options, currency swaps, etc.

Why So Many Financial Instruments?

As we all know, necessity is the mother of all inventions, and the same is the case with financial instruments. Each financial instrument serves a different purpose and meets a specific need of the investor. For instance, investors who prefer safety over returns can park their funds in bonds. Bonds are less risky and safer, but they offer lower returns than what one would expect from equity.

Likewise, investing in the currency market also depends on the choice and objective of the investor. For instance, from a business point of view, it is better to invest in currencies as it allows investors to hedge currency risk. On the other hand, bonds and stocks might prove better than currencies when the objective is to save funds for retirement.

Quiz on Financial Instrument

This quiz will help you to take a quick test of what you have read here.

RELATED POSTS

- Derivatives Market – Types, Features, Participants and More

- Embedded Derivatives – Meaning, Example, and More

- Marketable Securities – Meaning, Types, Importance And More

- Types of Financial Institutions – All You Need to Know

- Financial Markets – Functions, Importance And Types

- Types of Derivatives Instruments – All You Need to Know

Good information just wish for more information on Equity based financial instruments otherwise it was a good read.