What are Blue Bonds?

Water accounts for around 70% of Earth’s surface. But, in the last few decades after the advent of plastics, we have keenly observed that water bodies have been flooded with pollutants globally. In fact, marine resources are also being handled irresponsibly and have become dump yards for various types of pollutants and non-bio-degradable articles. Growing awareness and efforts, both nationally and globally, are underway to save our ecosystem, including water bodies. One such initiative is the blue bonds.

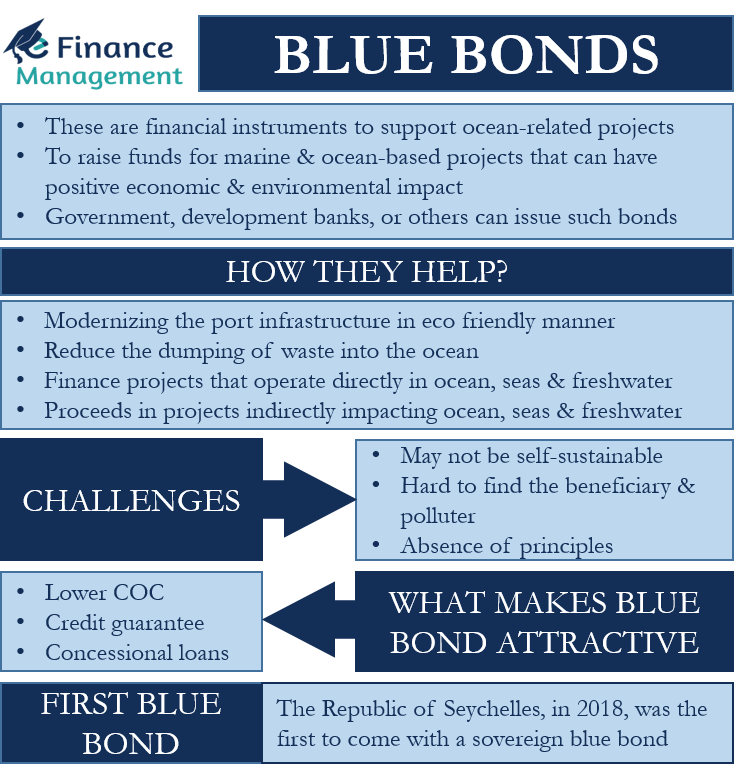

Blue Bonds, as the word suggests, are nothing but financial instruments like green bonds to support ocean-related projects. It is basically a debt instrument to raise funds for marine and ocean-based projects that could have a positive economic and environmental impact.

Government, development banks, or others can issue such bonds. It will not be wrong to say that such bonds are a part of green bonds, which support all types of green projects. And of course, like green and ESG investments, blue bonds also give an opportunity to all, including the private sector, to support the blue economy.

First Blue Bond

The development of blue bonds is very important for our planet. But, these bonds hold more importance for economies that depend more on ocean or water economically. The Republic of Seychelles is a good example of this. Its economy depends heavily on the ocean, especially on fisheries. Tourism and fisheries are the most important sector for Seychelles.

The Republic of Seychelles, in 2018, was the first to come with a sovereign blue bond. The objective of the bond was to save Seychelles’ 115 islands, which are flanked by coral. Seychelles’ issue got the support of the World Bank, as well as its Global Environment Facility.

Going ahead, such bonds can also prove very beneficial for Africa’s blue economy. The continent has a more than 47,000 km coastline, as well as 38 coastal and island states. The fisheries industry in the continent employs over 12 million people and generates revenue of over $24 billion. Rising temperature and growing pollution may endanger the livelihood of communities dependent on fisheries and the ocean in Africa.

Blue Bonds – How They Help?

It is hard to pinpoint a single industry that is responsible for polluting the water bodies. This makes it important to use the proceeds from these bonds on varying types of green (water) projects. These uses can be:

- Spending the proceeds on modernizing the port infrastructure in an ocean-friendly way.

- Supporting projects that reduce the dumping of waste in water and solid waste into the ocean.

- Finance projects that operate directly in the ocean, seas, and freshwater. For example, such projects could be in the fields of tourism, fisheries, aquaculture, shipping, and more.

- Proceeds can also go to projects that indirectly impact the ocean, seas, and freshwater. Such projects can be the production of packaging products that reduce waste, developing sustainable textiles, lowering agrochemical runoff, and more.

What Makes Blue Bonds Attractive?

Along with supporting oceans, another purpose of issuing these bonds is to lower the cost of capital (CoC) for the investors. The participation of international organizations helps a great deal in achieving this purpose. For instance, the World Bank offers a free credit guarantee to the investors in these bonds. This guarantee means that if the issuer is unable to pay back the funds, then the World Bank will make good the losses.

Such a guarantee gives investors confidence to invest in these relatively newer types of bonds. Moreover, the guarantee makes these bonds attractive even if they offer less return. Governments around the globe use such guarantees and concessional loans to make these bonds more attractive, as well as magnify the return and reduce the risk for the investors.

Challenges

Self-Sustainable

The biggest challenge with blue bonds is that the projects they fund may not be self-sustainable. And this often results in investors not getting their due money.

Determine Beneficiary and Polluter

Generally, a project generates revenue by levying charges on the beneficiary or fining the polluter. But, in projects concerning the ocean, it usually gets hard to determine the beneficiary and the polluter. The massive size of the ocean and the remote locations of polluters make it hard to find the beneficiary and the polluter. So, many times, it is the aid money that comes into use for paying back to the investors.

Revenue Model

Thus, for the development of the blue bonds market, it is very important that they fund projects with a revenue model. This would help to lower their dependence on government aid. A solid revenue model would also give investors more confidence in the safety of their money.

Absence of Principles

Another challenge or drawback of these bonds is the absence of principles that issuers can use. Such principles ensure that issuers reveal all the details of the bonds. These bonds may not have such principles now, being at the early stage. But they will have them as such bonds gain more popularity in the future. Until such bonds have their own principles, issuers can use the green bond principles. Also, the UN Global Compact Sustainable Ocean Principles can serve as a guide to set the principles for these bonds.

Final Words

Blue Bonds are a relatively newer credit asset class. So far, there are only four or five issues of such bonds. The first was in 2017 from Seychelles, and then in 2019 from the Nordic Investment Bank and the World Bank. In 2020, the Bank of China was also an issuer of this type of bond, making it the first blue bond issue from a commercial bank.

However, considering the rising sea levels, growing population, and increasing environmental awareness, it will not be a surprise if blue bonds go mainstream and stand at par with any other bonds in the coming time.

Also, read – Bonds and their Types.