What is a Patronage Dividend?

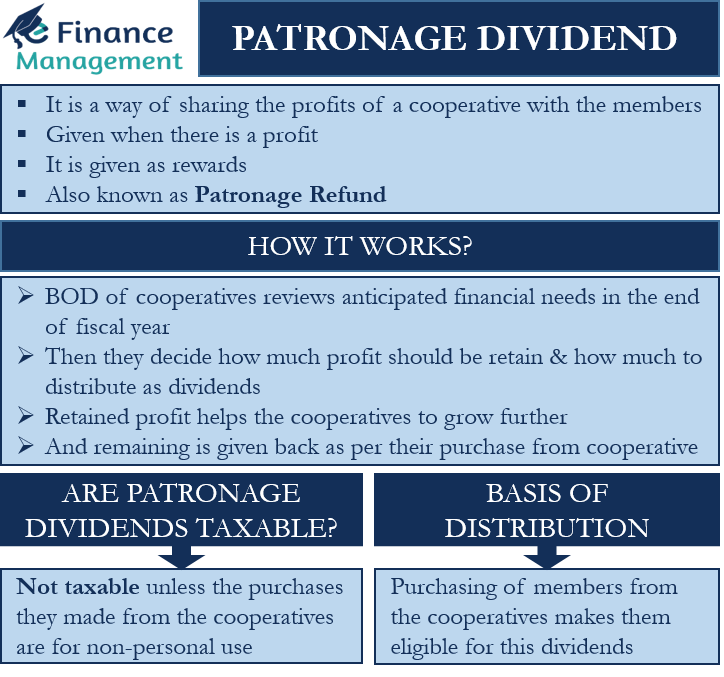

A patronage dividend is a way of sharing the profits of a cooperative with the members. A cooperative organization gives this type of dividend only if it is profitable. Or it is given in the year in which the organization makes a profit. This dividend represents a certain percentage of the total net profit/earning of the cooperative from its business.

A cooperative is different from a usual company. Generally, a cooperative is owned by community stakeholders. And these stakeholders run it for the benefit of the members. Mostly, it is the members who are the customers of a cooperative. So, a cooperative gives such a dividend to reward its members for their contribution to making the cooperative successful.

What is Patronage Refund?

Another name for this type of dividend is the patronage refund. This is because it is a type of refund for the members/stakeholders from the purchases or contributions they have made to the cooperatives during the year in its business.

Basis of Patronage Dividend Distribution

A point to note is that members do not get patronage dividends on the basis of how many shares they own of the cooperatives. Like it happens in the commercial and corporate world. Instead, it happens on the basis of how much the members have purchased from the cooperatives in that financial year. So, this means the more the members shop during a year, the more dividends he or they will likely be eligible for.

Also Read: Types of Dividend

It also means that the amount of dividends could vary from year to year. So, in the year when cooperatives make a big profit, the members get a bigger dividend. And, if the cooperatives do not make a big profit, then they choose to retain more and distribute less in the form of a dividend. And, if the cooperatives do not make any profit in a year, then they will not distribute any dividend.

How it Works?

After the end of every fiscal year, the board of directors of a cooperative reviews the anticipated financial needs of the cooperatives. The management uses this information to decide how much of the profits they should retain in the cooperatives and how much they should give back to the member in the form of dividends.

Part of the profits that management retains helps the cooperatives to grow further. The remaining part of the profits is given back to the members on the basis of their purchases from the cooperatives during a fiscal year.

A point to note is that the distribution of dividends applies to the net profit that the cooperatives make from the sales to the owners or members. We call such a profit as eligible profits. A cooperative can not distribute the dividend from the profits it makes on non-owner sales. So, it implies that the more the members buy from the cooperatives, the more profit it would make, and the more they could get back in the form of dividends.

Also Read: Cash Dividend

The members need to use the dividend checks before the deadline. This deadline is usually mentioned in the notification letter. After the deadline, members will not be able to use the dividend amount. This unused dividend amount usually goes back to the cooperative’s general operating fund.

Are Patronage Dividend Taxable?

Distributing the profits through patronage dividends helps a cooperative reduce its tax obligations. Because as per US Laws, the profitable cooperatives can get a deduction from their income for the patronage dividends. Also, it helps to keep more money in the local economy. The cooperatives usually encourage members to cash their dividend checks and use them locally. Moreover, the benefit for the members is that such dividends are not taxable unless the purchases they made from the cooperatives are for non-personal use.