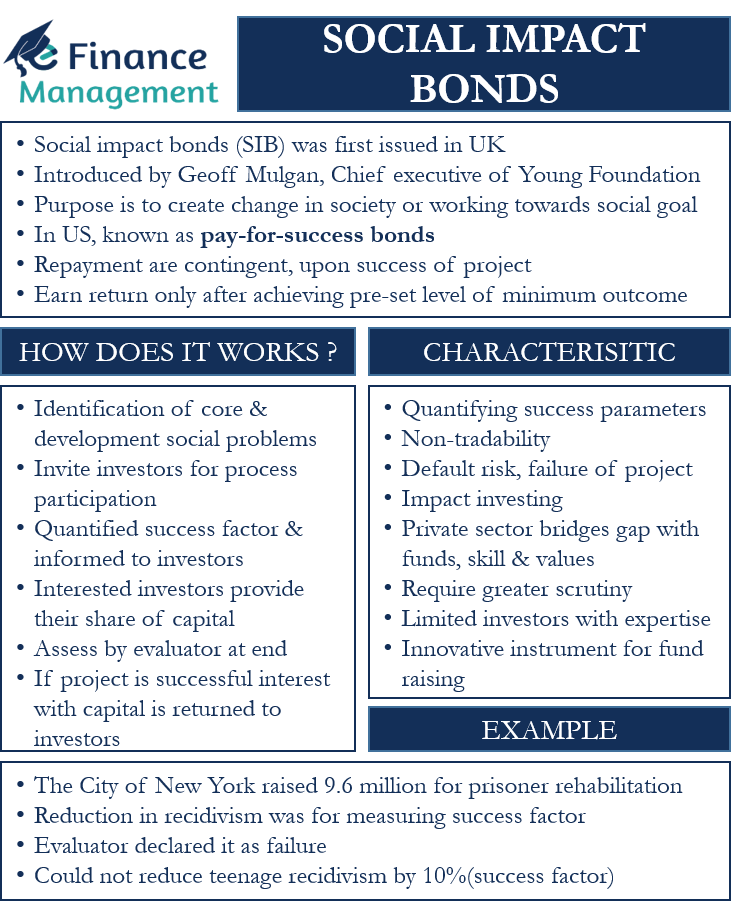

Social impact bonds were first issued in the UK. This term was introduced and coined by Geoff Mulgan, Chief executive of Young Foundation. And the purpose of Social impact bonds is to create a change in society, working toward a social goal. Let us say a bond issued by a governing authority to fight climate change. Moreover, the other name for these SIBs is pay-for-success bonds in the US. Looking at the name gives us an idea about its repayment system. The principal and interest repayment are contingent upon the success of the project. Thus, an investor will earn a return only if the project achieves the pre-set level of minimum outcome.

Hence, an investor does not make investments in such types of bonds purely from an investment angle. Or to generate a return only. In fact, that remains a secondary motive. Rather he is driven by the moot idea of development and change objectives.

The UK has issued many SIBs for various purposes like Youth engagement, training, employment, etc.

How does SIBs work?

The process begins with the government identifying the core social and developmental problem for which it wishes to raise funds via SIBs. After deciding the purpose and the likely outcome, investors are invited to participate in the process. Further, the investors are informed about the nitty-gritty of the SIBs. As the results and parameters of success vary from social problem to problem, success factors also vary and hence are quantified. After quantifying the factors and informing the same to investors, interested investors provide their share of investment capital. One important thing to note here is that no interest payment happens to the investors during the tenure of the project.

Once the SIBs are subscribed, thereby raising enough funds to take up that particular project, then funds are invested. And the implementation of the project kicks off. At the end of the project, an independent evaluator will assess the success of the project against the pre-set parameters. And these parameters will be quantitative, qualitative, and economic as well. If the project achieves the targetted level of success and financial surplus, then the investors receive their share of interest and the capital back.

Until now, the UK has raised 32 social impact bonds, US- 10 Bonds, and 19 bonds from other different countries.

Characteristics of Social Impact bonds

We will discuss here a few main characteristics of such bonds:

- A roadblock in issuing Social impact bonds is quantifying the success parameters. The results are uncertain, and further, the process of realizing them as returns is also a major concern for investors when it comes to SIBs.

- Non-tradability: Social bonds are non-tradable; hence the investors can not shift their ownership or earn returns through price appreciation of the bonds. This limits the scope of bonds and reduces the interest of investors.

- Market, reinvestment, and interest rate risk do not affect the SIBs. But default risk is due to the failure of the project. Or realizing less return due to higher inflation rates do pose a threat to such bonds.

- They are based on Environmental, Social, and Governance (ESG) factors. Modern-day investors have become quite particular with their investments. And will go deep to find out these positive factors in each such investment. Also known as impact investing.

- Public sector reform narrative says that as the NGOs and government or public authorities are coming together to fund the event, they also need the expertise and skill. The private sector bridged the gap with funds, skills, and values.

- The contracts of SIBs are complex and require greater scrutiny as private investors might place their personal motives above the desire goal of social impact. Formative evaluations suggest that SIBs take time to set up and involve higher transaction costs.

- Private investors who are ready to take up the risk and are philanthropic invest in SIBs. Limited investors with expertise in the social cause believe and understand the risky investing of SIBs.

- It promotes both social and financial innovation. A new innovative instrument for raising funds for a social cause makes it an interesting concept. Similarly, to generate returns also they need to devise some innovative ways so that the income flows and continues together with the social benefits.

A Practical Example

In 2012, The City of New York raised 9.6 million for prisoner rehabilitation. Goldman Sachs conducted the bond issue. A reduction in recidivism (relapse of criminal behavior) is the benchmark for measuring success. New York City did not upfront put the issue but was liable for some amount. MDRC (Nonprofit Org) with Goldman Sachs issued the bonds backed by New York City up to a certain amount. However, the independent evaluator declared the failure of the SIBs as it could not reduce teenage recidivism by 10% (the targetted success factor).

Learn more about various other Types of Bonds.