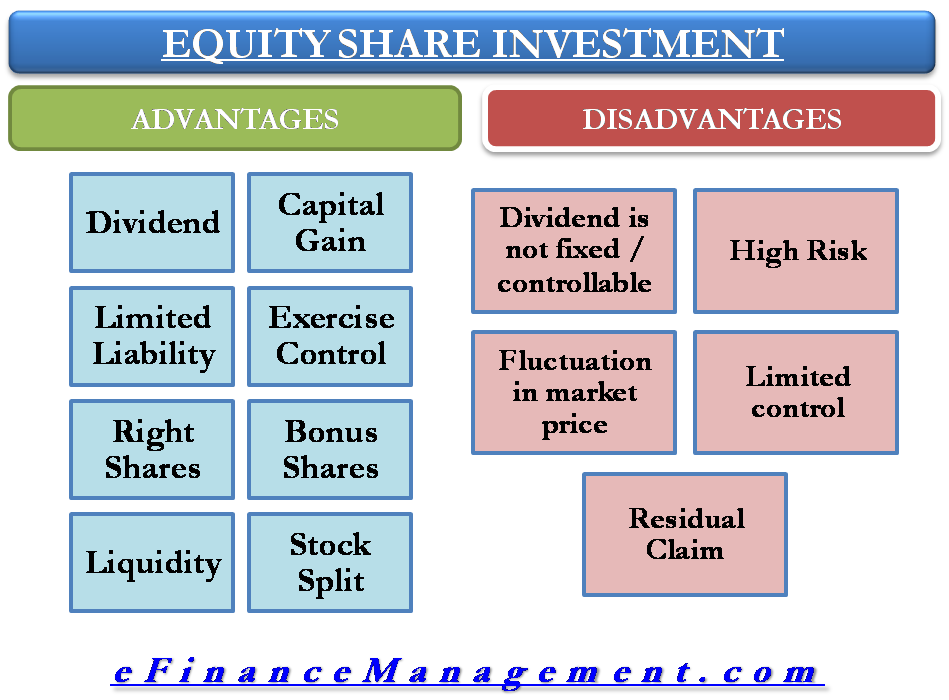

Different stakeholders look at equity shares from different perspectives. There are two major angles of looking at it – the company angle and the investor angle. So, any statement about equity capital would have a different meaning for a company and an investor. In this article, we will look at the advantages and disadvantages of equity share investment from an investor angle.

Advantages of Investing in Equity Share Capital

The following are the various advantages of investing in equity shares:

Dividend Income

An investor is entitled to receive some share in the profits of the company in the form of dividends. It is one of the two primary sources of return on his investment.

Capital Gain

The other source of return on investment apart from dividends is capital gains. This means gains arising due to a rise in the market price of the share.

Limited Liability

Equity shareholders are not personally liable for the company’s debts or obligations beyond the amount they have invested in the company.

Ownership & Voting Rights

Equity is just another word for ownership. Making an investment in equity shares of the company provides voting rights to the investors. This ensures that their interests as a shareholder are being represented. Voting rights also provide a level of control over the company’s operations that is not available to other types of investors, such as bondholders or preferred stockholders.

Claim over Assets and Income

An investor of an equity share is the owner of the company, and so is the owner of the assets of that company. He also enjoys a share of the income of the company.

Rights Shares

Whenever companies require additional capital for expansion, they tend to issue ‘rights shares‘. Issuing such shares preserves the ownership and control of existing shareholders, and the investor receives investment priority over other general investors. Right Shares are issued at a price lower than the current market price of the equity share. So, an existing investor can take that advantage or renounce the right in someone’s favor to get the value of the right.

Bonus Shares

A bonus share is an additional share given to existing shareholders at no cost, based on the number of shares they already hold. It increases the number of shares held by the investor, which increases the value of the investment if the share price increases.

Liquidity

Though not always true for private equity investments, liquidity is a sure-shot benefit for listed and public stocks. There is a ready market available for shares of listed companies. The volume and number of transactions are always large enough to assure the investor of a ready sell whenever he intends to. Cashing out and squaring position at any time is possible. Therefore, equity investments serve as a lucrative means of investment for investors with a not-so-long horizon.

Also Read: Types of Equity Investments

Diversification

Equity investments can be diversified across various sectors, caps, geographies, and even the phase of business cycles. The investor is thus protected against the consequences of “putting all eggs in one basket.” Turbulence in any specific stocks or sectors is unable to adversely impact the value of the portfolio as a whole.

Long-term Investment

Equity shares are typically viewed as a long-term investment because the company does not redeem its equity capital until liquidation. And, as per the going concern concept, no business is made with the intention of winding up. Therefore, this provides investors with the potential for steady returns over time.

Stock Split

Stock split means splitting one share into many. It is a process where a company increases the number of shares outstanding while reducing the value of each share. But, how should an investor benefit from this? It increases the liquidity of the shares by making them more affordable to a wider range of investors. This increases the demand for the shares and potentially drives up the share price.

Disadvantages of Investing in Equity Share Capital

While equity shares offer several advantages to investors, there are various disadvantages of equity share investments to consider.

No Guaranteed Returns

The dividend which a shareholder receives is neither fixed nor controllable by the investor. The management of the company decides how much dividend should be given. If there is a loss, there is no question of dividend. If there is a profit, investors will not receive the dividend unless the Board of Directors proposes a dividend.

High Risk

Equity share investment is a risky investment compared to any other investment like debts, etc. The money is invested based on an investor’s faith in the company. The companies operate in an ecosystem and are subject to business cycles, adverse government policies, and sector-specific disturbances. Equity investments display more movement than their counterpart index or bonds. Therefore, risk-averse investors may be uncomfortable parking their funds into such investments.

Fluctuation in Market Price

The market price of any equity share has a wide variation. It is always very difficult to book profits from the market. On the contrary, there are equal chances of losses. The market forces of demand and supply determine the prices of equity investments. A highly random variable that can’t be in control is investment perception. The perception of investors plays a key role. A negative sentiment or false information about a stock can spread like wildfire. This inadvertently impacts its prices.

Limited Control

An equity investor is a small investor in the company, therefore, it is hardly possible to impact the decision of the company using the voting rights.

Residual Claim

An equity shareholder has a residual claim over both the assets and the income. Income that is available to equity shareholders is after the payment of all other stakeholders’ viz., debenture holders, etc.

Over Diversification

While diversification helps eliminate unsystematic risks, there is also the possibility of over-diversification. While, on the one hand, diversification helps in capping the downside, over-diversification may also limit one’s upside. A fund that may be diversified to the extent that it no longer reaps additional returns but only averages out the results. In such cases, the investor ends up merely replicating the index. An efficient diversification strategy is one in which stocks are carefully handpicked to harness their growth potential. Blindly adding stocks to the basket defeats the purpose.

Also, read the Advantages and Disadvantages of Equity Finance from a financing angle.

My company wants to give me some shares and this article cleared a lot of my doubts.

If your company wants to give you shares of the company, first research on the company’s equity history then only agree. Companies are always looking for investors. But as an investor you must think wise where to invest.

thanks Rahul, love you

I have shares with equity but, I left the postal address I was using to receive my dividend check. I don’t have postal address for now how can I receive my check?