What are Equity Investments?

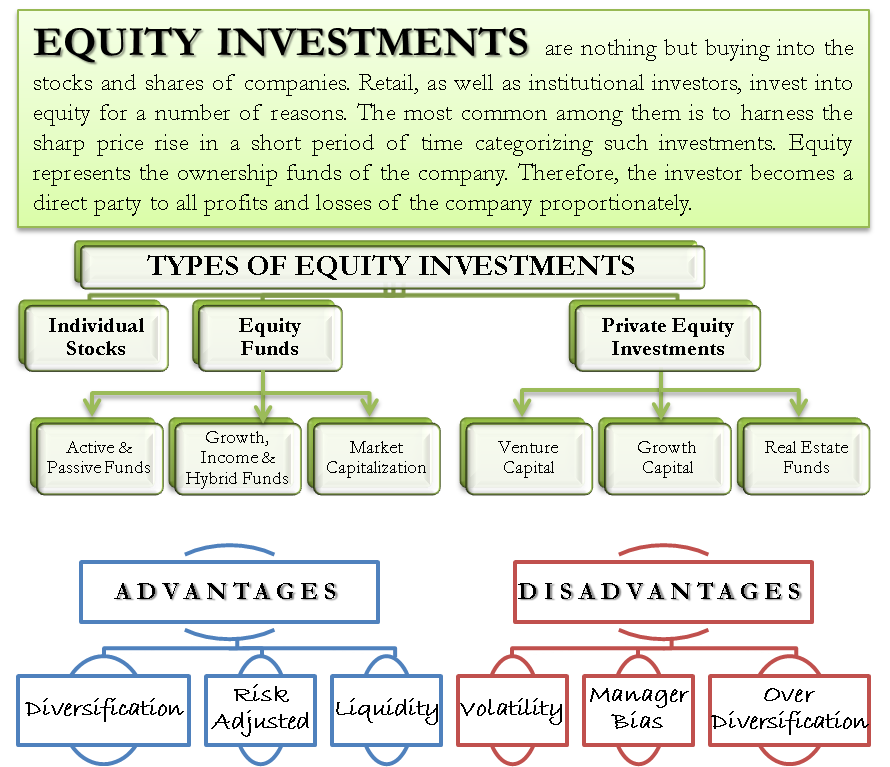

Equity investments are nothing but buying the shares of companies. It refers to sharing ownership stakes in a company or business. When an investor makes an equity investment, they acquire ownership in the company in exchange for funding or other resources.

One popular example of equity investment can be seen in the most talked about television show nowadays “Shark Tank”. Here, aspiring entrepreneurs pitch their business ideas to a panel of investors. The entrepreneurs ask the sharks for funding in exchange for a percentage of ownership in their company.

For instance, an entrepreneur might ask the sharks for $100,000 in exchange for a 20% ownership stake in their business. This means that if the business is successful and grows in value, the sharks will receive 20% of the profits.

Investing in equity shares refers to getting ownership in the company. Let’s learn about various types of equity investments through which one can acquire an ownership stake.

Types of Equity Investments

The following are the types of equity investments:

Common Stock

Common stock, also known as equity shares, is a type of equity investment that represents ownership in a company. When an investor buys common stock, they become a shareholder in the company, which gives them the right to vote on important company decisions and receive a portion of the company’s profits in the form of dividends. Common stockholders also have the potential to benefit from capital appreciation if the company’s stock price increases.

Equity Funds

Equity funds are a variation of mutual funds whereby the majority of the fund’s investment is in stocks and shares of companies. These funds are basically a pool of several equity stocks. They are aggregated, and units of the fund are then sold to the investors. Consequently, an investor is able to enjoy the benefits of diversification and cover a wider base of equity investments. This would not be possible in an individual capacity by the investor. An equity fund can further be classified into numerous branches. Some of them are as below.

Active & Passive Funds

Passive funds seek to replicate the index, while active funds are very aggressive. The fund manager has to actively keep on altering the portfolio contents to ensure a return higher than the benchmark.

Growth, Income & Hybrid Funds

Growth funds invest in stocks with high capital appreciation potential. Income funds generally invest in large-cap companies that are relatively stable and pay dividends regularly. However, investors who prefer the best of both worlds can also opt for a hybrid fund. The fund managers here strive to provide reasonable appreciation while maintaining a constant stream of income.

Also Read: Equity Share and its Types

Market Capitalization

These equity funds segregate their holdings on the basis of sectors. However, the market cap is carefully accounted for. They generally hold a couple of large-cap stocks as their core holding. This provides a firm footing to the fund. The balance investment is into small to mid-cap stocks promising attractive prospects. Therefore the volatility of the latter is offset by the former’s stability.

Private Equity Investments

They represent investing in stocks of companies not listed on the exchange. They are generally not liquid and involve a huge ticket size. For this reason, only high-net-worth individuals and institutional investors can afford to invest in them. Private equity investments resort to a venture’s inception or expansionary phase and entail a high return on investment. A snapshot of popular private equity investment means is below:

Venture Capital

The investors step in at the cradle stage of the company. These private equity investors charge a hefty premium and take away a considerable portion of ownership. They expect handsome compensation for their risk with such baby companies. The risk involved is so huge that the company may skyrocket or even never take off.

Growth Capital

Growth capital is similar to venture capital funds except that they invest in mature companies. They provide funds to established companies seeking expansion, diversification, and exploring new avenues. They come to the rescue when the company is not in a position to raise more debt.

Real Estate Funds

These are private equity funds with real estate and properties as the main underlying. They involve themselves in acquiring, developing, and maintaining real assets. Rental income constitutes the mainstream of cash flow. The property is also sold away at opportune times to take advantage of a bullish property market. The main advantage of this fund is that it enables small investors to reap the benefits of changes in property prices without actually buying one.

Now, that we are aware of the types of equity investments, let’s move further to understand why investors prefer to invest in equity.

Why do People Invest in Equities?

Retail as well as institutional investors invest in equity for a number of reasons.

- Equity represents the own funds of the company. Therefore, the investor becomes a direct party to all profits and losses of the company proportionately.

- Another reason why equity investments are so popular is because of the magnitude of returns it provides. Along with the dividend income, an investor can also earn by trading his investment on the stock exchange.

- The icing on the cake is also the fact that equity investments can also be designed to suit investors’ risk appetites individually.

- A company raises funds through equity shares as its long-term source of funds. And, therefore, equity investments also help investors (who invest in growth stock) in long-term wealth creation.

- The next best alternative an investor has is to count on the interest generated by the savings account or invest in bonds and similar instruments. These are highly passive forms of investments. It is almost impossible to accumulate wealth with other options. In such a scenario, equity investments provide the necessary aggression required to fast-track the process of income generation.

Other than these, equity investments offer various other advantages that make them more lucrative to investors.

Why Equity Investments are Considered Risky?

Equity investments are considered riskier because they are subject to a wide range of factors that can cause the value of the investment to fluctuate significantly over time. While equity investments have the potential for high returns, investors must carefully consider all the drawbacks involved in investing in equity shares and make informed investment decisions based on their individual risk tolerance and investment objectives. These disadvantages include dividend uncertainty, high risk, fluctuation in market price, limited control, residual claim, etc.

Hi Sanjay! Well written blog, congratulations !!!

Do you reside in the USA or in India?

Can you raise funding for a private firm?

Are you also a commercial broker or an institutional broker?

I have many other questions. Would you please, contact me for us to learn if we could conduct business. Thank you very much.

Best regards, Manny De Angelo