What is Receivable Turnover?

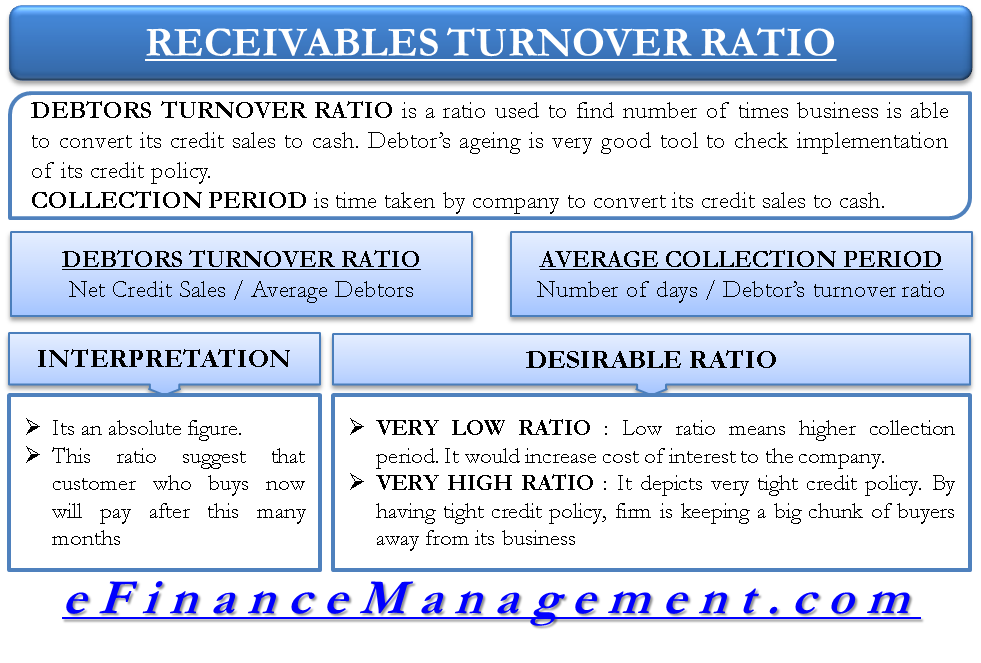

A receivable turnover ratio is one of the key turnover ratios or efficiency ratios used to analyze the performance of a business. This ratio throws light on the effectiveness of the business in utilizing its working capital blocked in debtors. It also indicates the frequency of conversion of receivables into cash in a given financial year. So, fundamentally, it comments on the liquidity of the business’s receivables.

When a company engages in credit sales, the account receivables increase with sales and again reduce on clearing payment. This cycle continues several times a year. For example, if a customer pays money in 3 months, this customer will have 4 such cycles in a year. The receivable turnover ratio is the ratio that suggests, on average, how many times such a cycle is rotated normally in a year. In our example, the receivable turnover ratio is 4, and the collection period is 3 months for that particular customer. When calculating this for a business where there are a number of customers with different credit terms, this ratio represents an average of all those customers and their different terms.

- What is Receivable Turnover?

- 2 Variants – Receivable Turnover and Collection Period

- Calculate Receivables Turnover & Average Collection Period

- Formula for Receivable Turnover

- Formula for Average Collection Period

- Receivable Turnover Ratio Calculator

- Interpretation of the Ratio

- What is Desirable – A Higher or a Lower Receivable Turnover Ratio?

2 Variants – Receivable Turnover and Collection Period

The receivables turnover ratio has another variant, i.e., the average collection period, which gives a time period in which debtors are converted into cash. Both ratios indicate the same thing but in different terms. The former expresses no. of times debtors are converted into cash in a financial year, whereas the latter gives no. of days or months in which the debtors are converted into cash.

Calculate Receivables Turnover & Average Collection Period

In an ordinary course of business, we understand debtors’ turnover ratio as a relation between credit sales and debtors. The formula to calculate this ratio is straightforward.

Formula for Receivable Turnover

Debtor / Receivable Turnover Ratio = Credit Sales / (Average Debtors + Average Bills Receivables)

Formula for Average Collection Period

Average Collection Period = (365 Days or 12 Months) / (Debtor / Receivable Turnover Ratio)

For calculation of the receivable turnover ratio, you can use our

It is also known as Days Sales Outstanding

Against the simplicity of the formula, the calculation and practical usability of this formula have certain questions. We need credit sales and average receivables over the year to calculate the ratio. These figures are not readily available in the financial statements of a business but had to derive from them along with additional information. The credit sales figure is still manageable, but average receivables are complex. The first practical question would be – what average should be taken? Weekly, Monthly, or Yearly? Needless to say, that weekly or monthly average would give better results in terms of the correctness of the ratio because of the preciseness of average receivables increases.

To avoid the situation of non-availability of ratios, one uses the debtors and receivable closing balances, but this practice would have serious questions on the correctness of the ratio. Suppose the debtors decrease at the end of the financial year due to some seasonal business effect; it would directly improve the ratio, which is valid at that point and not the rest of the year.

Receivable Turnover Ratio Calculator

Interpretation of the Ratio

The receivables turnover ratio is an absolute figure normally between 2 to 6. A receivable turnover ratio of 2 would give an average collection period of 6 Months (12 Months / 2), and similarly, 6 would give 2 Months (12 Months / 6). The meaning is quite clear. A ratio of 2 suggests that the debtor who buys goods today pays the money after 2 months. Similarly, in the case of 6, the money realizes after a long 6 months.

It is obviously desirable to realize the money as soon as possible for better trade credit management. It is because the money blocked in the form of the debtors has an attached cost of interest to it, whose driver is ‘Time.’ If the time to realize the money from debtors is more, the cost is also higher, and vice versa. A low debtor turnover ratio directly insists on higher working capital requirements and, therefore, higher interest costs, decreasing the firm’s profits.

Also Read: Types of Activity / Turnover Ratios

Keep reading: How to Analyze and Improve Debtors Turnover Ratio / Collection Period?

What is Desirable – A Higher or a Lower Receivable Turnover Ratio?

The general rule of life, i.e., ‘balance,’ is even applicable here. Neither too high nor too low of this ratio is advisable. Let’s see the implications of both ends.

Very Low Receivable / Debtor’s Turnover Ratio

This is easy to understand. A low receivables turnover ratio means a higher collection period. It gives an impression of the wrong choice of debtors or insufficient efforts to collect the cash. Not only will it increase the cost of interest to the company, but it will also suggest a weak liquidity position of a firm and higher chances of occurring bad debts.

Very High Receivable / Debtor’s Turnover Ratio

It would seem a little contradictory to say that even a very high receivable turnover ratio is not good. A very high ratio hints at the very tight credit policy of the firm. Undoubtedly, a tight credit policy saves a firm from bad debts and interest costs, but it may curb sales down. By adopting a very tight credit policy, the firm is keeping a big chunk of buyers away from its business and thereby restricting its business potential by its policy.

Read more – A High Accounts Receivable Turnover Ratio

Benchmark Ratio

Like our body’s temperature has a benchmark of 96 to 98 degrees Celsius, and that is true for all human beings, there is no such benchmark for this ratio. It depends on the industry practices. A decent way to compare a firm’s trade credit management is to compare its ratios with the industry averages. Ratios of a firm having vicinity to the average industry ratios are considered healthy. Little up and down may result from the quality of debtors and liberal policies.

Debtor’s Ageing

Debtor’s aging is a very good tool to check the implementation of its credit policy. By debtor’s aging, debtors are classified in groups of, say, collection periods between 0-2 months, 2-4 months, and greater than 4 months. Suppose the firm’s credit policy allows a credit of 2 months. More than 80-90% of the debtors should fall into the first category of 0-2 months. If, say, 60% lies outside that, it indicates that the credit collection department cannot collect money from debtors as per the terms and conditions agreed with them. In that case, the management needs a check on them.

Quiz on Debtors / Receivable Turnover Ratio and Collection Period

This quiz will help you to take a quick test of what you have read here.

nice text but could you please give me the source for finding information about debtors analysis of clearing & forwading agent companies