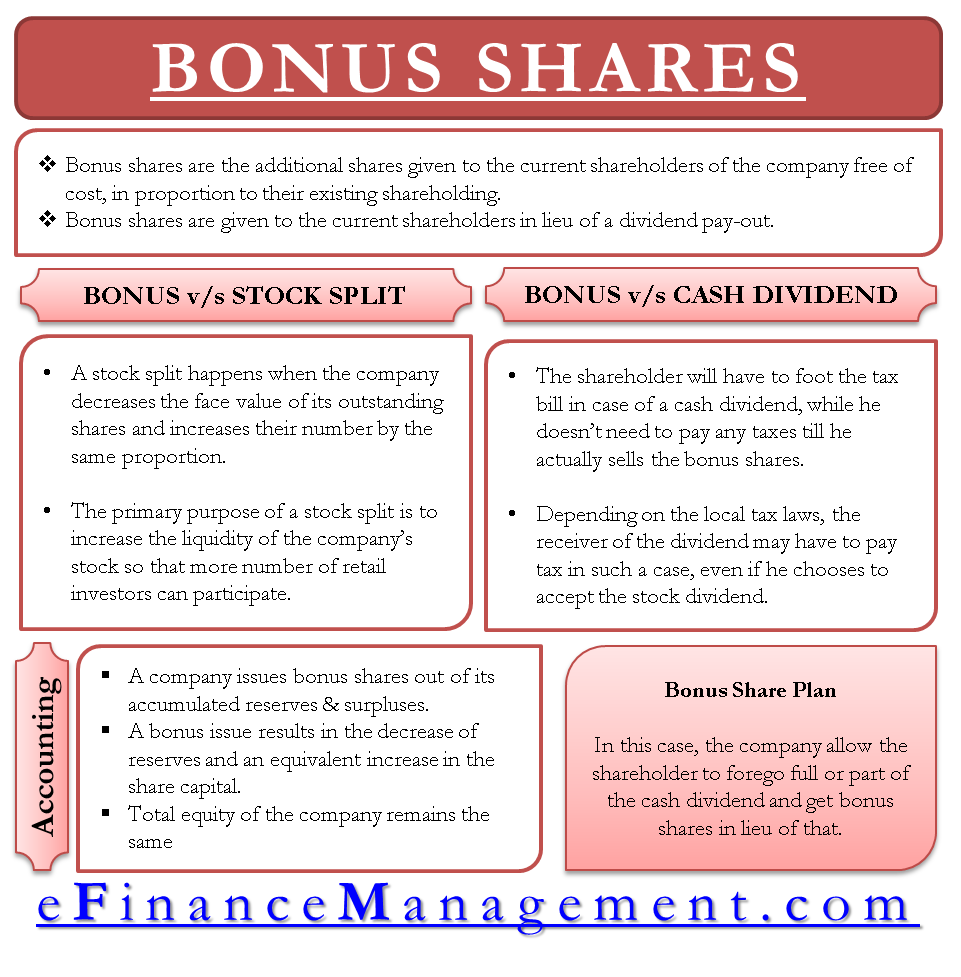

Bonus shares are the additional shares given to the company’s current shareholders free of cost in proportion to their existing shareholding. Such an event is called a Bonus Issue. Bonus shares are given to the current shareholders instead of a dividend pay-out. So, these are also called Stock dividends. Instead of paying out a cash dividend, the company converts a part of its reserves to equity capital and issues additional shares.

The company preserves its cash while still satisfying the shareholders’ desire for a dividend. A bonus issue increases the number of outstanding shares of the company, but the market value remains the same. So, there is a drop in the company’s share price because of the bonus issue. Due to a bonus issue, the existing shareholders don’t face any dilution in their stake. The class of shareholders to which the company issues the bonus shares is decided as per the company incorporation documents.

Bonus Issue Example

Suppose a shareholder holds 100 shares out of a total of 100,000 shares of the stock of a company, and the company announces a 2:1 bonus issue. In that case, the shareholder will get 200 additional shares, and his holding will become 300 shares. The company’s outstanding shares will also increase by 200,000, making the total outstanding shares as 300,000. The shareholder’s stake in the company before the bonus issue was 100 / 100,000 = 0.1%, and after the bonus issue is 300 / 300,000 = 0.1%. So, the percentage holding of the existing shareholders remains the same. The date when the bonus issue becomes effective is called the record date.

Bonus Shares vs. Stock Split

A stock split happens when the company decreases the face value of its outstanding shares and increases their number by the same proportion. So, in a 5:1 split, the outstanding shares will become 5 times the existing. While the face value will become 1/5th of the existing. A bonus issue increases the share capital and decreases a company’s reserves by the same amount, but a stock split changes neither of these. The primary purpose of a stock split is to increase the company’s stock’s liquidity so that more retail investors can participate. On the other hand, the primary purpose of a bonus issue is to reward the existing shareholders with a part of the company’s profit. A bonus issue also serves the secondary purpose of increasing the liquidity of the company’s stock. Read Bonus Share vs Stock Split in detail.

Bonus Shares vs. Cash Dividend

A company can also reward its shareholders by means of a cash dividend. There is a transfer of wealth from the company to the shareholder. And the share price drops by an amount equal to the dividend paid out. The shareholder will have to foot the tax bill in case of a cash dividend. While he doesn’t need to pay any taxes till he actually sells the bonus shares. There is an exception to this when the company gives the option of a cash or share-based dividend. Depending on the local tax laws, the dividend receiver may have to pay tax in such a case, even if he chooses to accept the stock dividend. Read more on Stock Dividend vs Cash Dividend.

Bonus Share Plan

Some companies have a Bonus Share Plan where they allow the shareholder to forego the whole or part of the cash dividend and get bonus shares instead of that. Such bonus shares are usually issued at a discount to the prevailing trading price. This plan may benefit shareholders who want to accumulate the company’s shares instead of getting a cash dividend.

Bonus Shares Accounting Treatment

A company issues bonus shares out of its reserves & surpluses accumulated over its life. A bonus issue results in a decrease in reserves and an equivalent increase in the share capital of the company. The total equity of the company remains the same as a bonus issue is just a reclassification of the equity capital.

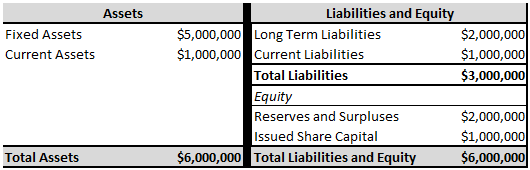

Example: A company XYZ has the balance sheet as below at the end of 2016:

What will the balance sheet look like after the company issues bonus shares in the ratio of 1:1?

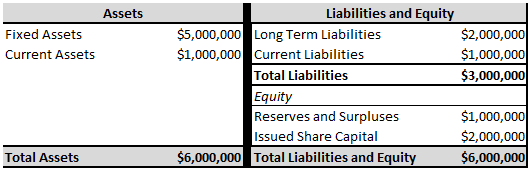

Explanation: Since the company has announced a bonus issue of 1:1, the share capital will increase by an amount equal to the existing share capital. So, the new share capital will be $ 1 mn + $1 mn = $ 2 mn. Reserves and Surpluses will be reduced by an equivalent amount. So, the new Reserves and Surpluses will be $ 2 mn – $ 1 mn = $ 1 mn. The balance sheet will look like the below:

Note that there is no change in the Assets, Liabilities of Total Equity of the Company.

There are various advantages and disadvantages of bonus shares like dividend, capital gain, limited liability, high risk, fluctuation in the market, etc.