Public companies have two ways to reward their shareholders. One is by giving dividends, and the other is by giving extra shares. Giving extra shares has more impact on the market price of shares and increases the total number of stocks available for investing. A company usually gives extra shares by issuing bonus shares or going for a stock split. Both these processes are very different from each other, but many assume the two to be the same. Therefore, as an investor, we know the difference between the Bonus Issue vs Stock Split is extremely crucial. This is because they could have a different but important impact on your overall holdings and return.

Before we detail the differences between bonus issue vs stock splits, it is important to understand the concept of these two terms.

Bonus Issue vs Stock Split – What they Mean?

A bonus share is a free additional share that existing shareholders get as a reward from the company. A company issues bonus shares in proportion to the stock investors already own. For instance, an investor has 100 shares. And the company takes a decision to reward its shareholders by issuing bonus shares in the ratio of 2:5. Hence, the investor will get 40 shares extra for every 100 shares. Therefore, the investor will now be holding 140 shares after the issue of bonus shares. As the overall number of shares increases, the share price will come down accordingly.

These shares get all the rights and protections like any other ordinary share. One point that makes them different from ordinary shares is that bonus shares are issued free of cost to the investors. It is only an accretion to the investor’s holding for which he has to pay or do nothing. A company uses its reserves and surplus to issue bonus shares.

In a stock split, a public company splits its shares into smaller units. This increases the effective number of shares but reduces the face value of the stock. A split helps to attract new investors as the shares are now available for a lesser value than before. Bonus and stock split both are seen by the investors and the market as the entity is performing well financially. But stock split suggests that the company’s shares are also in high demand, and liquidity and investment will increase if the trading value comes down by reducing the face value through the split.

Also Read: Bonus Share

Bonus Issue vs Stock Split – Differences

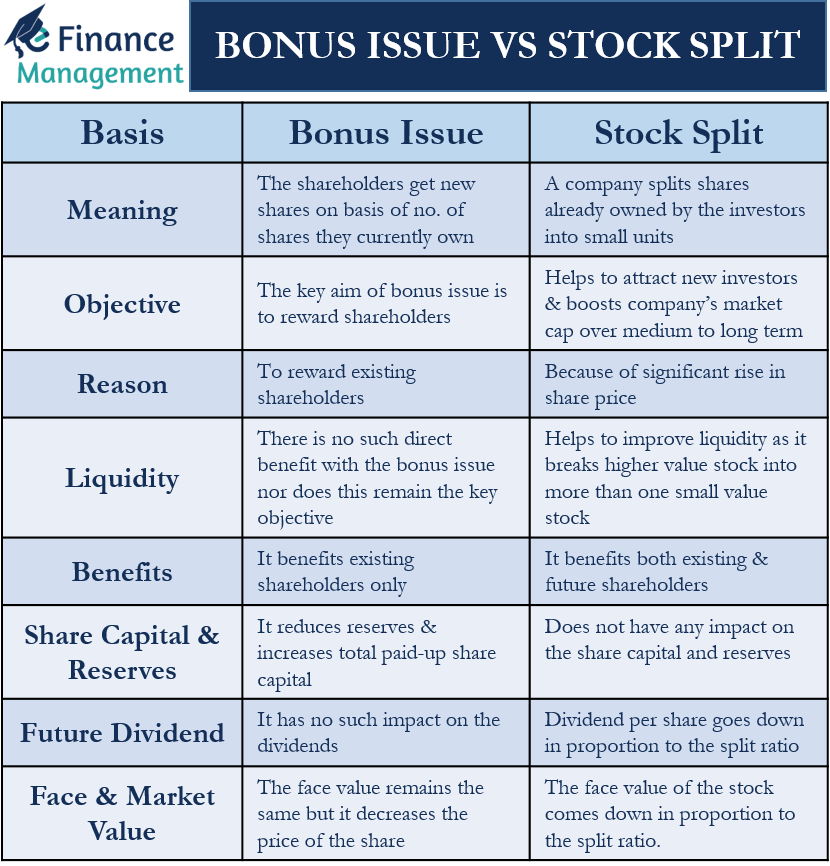

Detailed below are the main differences between the bonus issue vs stock split:

Meaning

In a stock split, a company splits the shares that are already owned by the investors into small units. But, in a bonus issue, the shareholders get new shares on the basis of the number of shares they currently own.

Objective

A stock split helps attract new investors and boost the company’s market cap over the medium to long term. On the other hand, the key aim of a bonus issue is to reward shareholders.

Reason

A company usually goes for a split following a significant rise in the share price. Thus, to lower the share price so as to make it more affordable, a company goes for a split. A bonus issue, on the other hand, helps to reward existing shareholders. The reward could be due to a great profitable year or issuing a bonus share in place of a dividend.

Liquidity

A stock split helps to improve liquidity as it breaks a higher value stock into more than one small value stock. So these shares become more accessible to more and more investors even with smaller capital investments. In fact, improving liquidity is one of the objectives of going for a stock split. There is no such direct benefit with the bonus issue, nor does this remain the key objective. The main aim is to reward the shareholders on account of multiple years of good performance, some key event or milestone in the company’s life. Or to substitute it in place of dividends and thus conserve the cash resources for further growth of the company.

Also Read: Advantages and Disadvantages of Bonus Shares

However, effectively the total number of shares increases even in case of bonus issues like in stock split. This indirectly helps to reduce the current market price. Hence, in this case, also the accessibility of stock increases, of course, not to the extent of a stock split.

Bonus Issue Vs Stock Split – Who it Benefits?

A stock split benefits both existing and future shareholders. But, a bonus issue benefits existing shareholders only.

Example

Suppose Company A announces a split in a ratio of 1:10. The original par value was $100. If an investor had one share previously, but after the split, he would have 10 shares of Company A without paying anything extra. However, because of the split now, the face value of the shares will be $10.

Now suppose Company A announces a bonus issue of 1:1. This suggests that every existing shareholder will get one free share for every share one already owns. In other words, the investor will get the same quantity of extra shares. Suppose an investor has 50 shares before, then after the bonus issue, he would have 100 shares. But all the shares will have the same face value as before. However, the total value of the investment will remain the same. Because normally, the share prices also reduce in line with the increase in the overall number of shares after the bonus issue.

Assume the share price was $90 before the bonus issue. The total investment will be $90. After the bonus issue in 1:1, the share price will drop to $45 per share (proportionate). Still, the total value of an investment will remain the same at $90 ($45*2).

Bonus Issue vs Stock Split – Impacts

A bonus issue and stock split may have different, same, or no impact on different financial metrics. Let us take a look:

Share Capital & Reserves

A stock split does not have any impact on the share capital and reserves. This is because no new shares are issued. It is only the Face Value is reduced, and the number of shares has increased. However, a bonus issue reduces the reserves and increases the total paid-up share capital. This is because a company uses its reserves to issue new shares. And the new shares add to the share capital of the company. However, again like the stock split, the net impact of the bonus issue on the Balance Sheet remains zero. Only the amount changes the heads – from reserves to the share capital.

Future Dividend

After a split, the dividend per share goes down in proportion to the split ratio. So, it may not be good for future investors. Bonus issue has no such impact on the dividends. But, the bonus issue increases the dividend for the current shareholders. The stock split has no such benefit for the current shareholders. The bonus issue also increases the overall quantum of dividend outgo for the company if the same rate of dividend is maintained.

Total Equity and ROE

None of the two have any impact on the total equity, and thus, ROE (Return on Equity) and other valuation metrics remain the same as well. In case of a bonus issue, a company internally transfers funds from reserves to share capital, so the total equity remains the same. And, in a stock split, the face value per share comes down, but the number of shares increases, so the total equity again remains the same.

Fundamentals

Both stock split and bonus issues have no impact on the fundamental of the company. After the split and bonus issue, the share capital, revenue, profits, and other fundamentals remain the same. Due to the increased number of shares, various stock-specific ratios -EPS, Book Value per share, Dividend Per Share, etc. will definitely change.

Face and Market Value

In a stock split, the face value of the stock comes down in proportion to the split ratio. For instance, if the split ratio is 1:10 and the original face value was $100, then after the split, the face value will be $10. The market value will adjust accordingly. The face value remains the same in a bonus issue, but it decreases the price of the share. So, in a way, the bonus issue also helps make a share more affordable.

Final Words

As we discussed stock split and bonus issues, both have different objectives. Both these actions happen in different circumstances too. And both these actions effectively reduce the current market price of the stock. Ideally, the reduction should be proportionate, with reference to the increase in the total number of shares. However, in the market, it can work either way. The effective price may reduce more than proportionate or vice versa.

However, an important point worth keeping in mind is that usually, if all goes well and the company continues to perform well, the effective price should increase and may not reduce proportionately. The reasons could be expectations of continuous good performance and distribution may attract a premium valuation. Secondly, due to the increased number of stocks and reduced pricing, the shares become accessible to a large number of investors, who earlier could not look into them because of the high prices of the stock. Liquidity increase and reduced volatility also play a supportive role in a price increase.