Special Dividend Definition

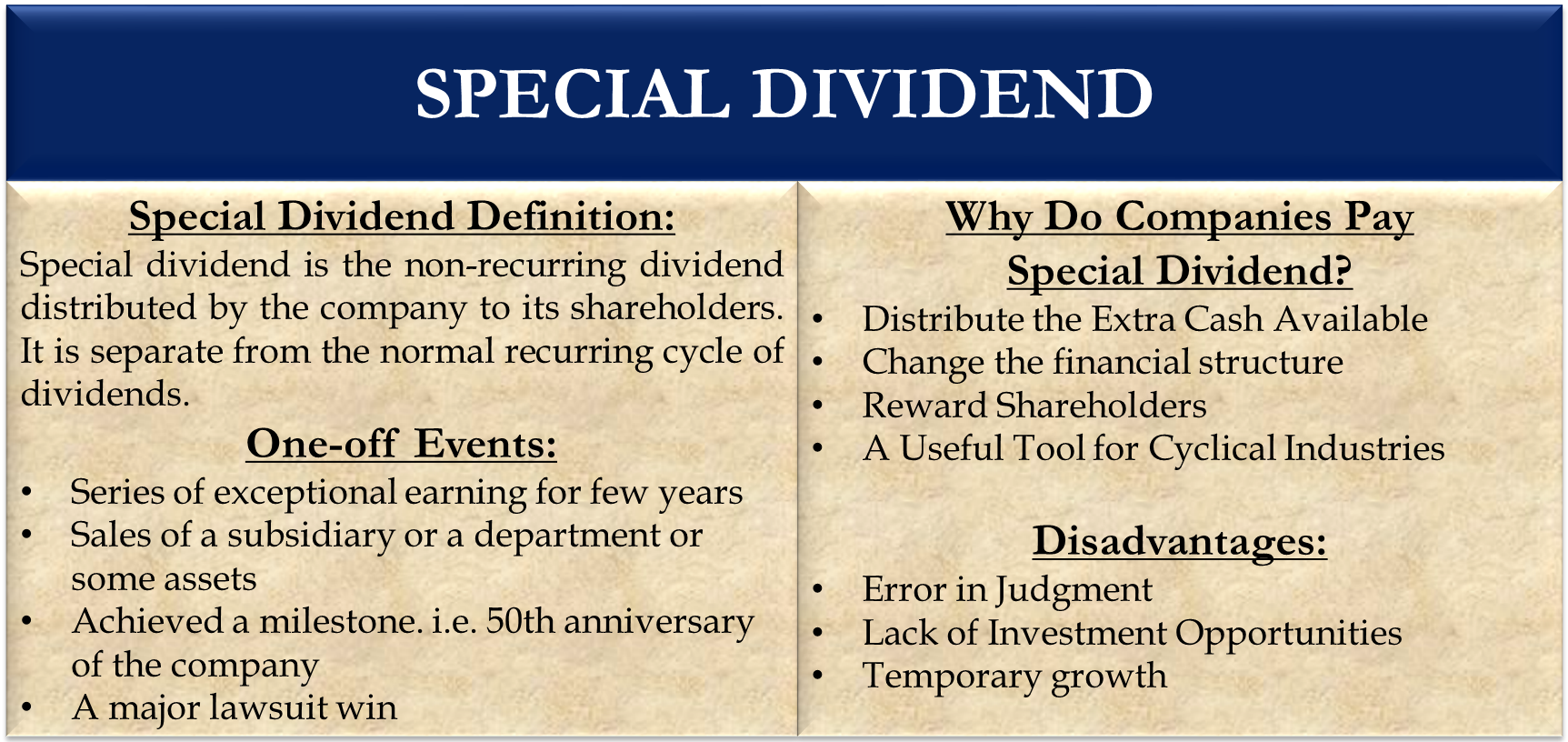

A special dividend is a type of dividend that is non-recurring and distributed by the company to its shareholders. It is separate from the normal recurring cycle of dividends. It is also known as the extra or irregular dividend. The amount distributed through a special dividend is larger than the normal dividend.

It is generally distributed when the company has accumulated a large amount of cash with them. This pile-up of cash is the result of an occasional event. Such special circumstances could be:

- Series of exceptional earnings for a few years.

- The company has sold a subsidiary or a department or some assets

- Achieved a milestone, e.g., the 50th anniversary of the company

- A major lawsuit win

Why do Companies Pay Special Dividends?

Distribution of Excess Cash Available

When the company has a large amount of cash lying on its balance sheet, they choose to distribute it to shareholders through a special dividend. It makes more sense to distribute the cash to shareholders when a company does not have attractive reinvestment opportunities in the near future. The shareholders will be able to invest that money somewhere better than an unappealing project.

Changing the Financial Structure

Sometimes, the intention of the company behind such distribution is to change the capital structure. It will reduce the equity and total assets. So, it will increase the proportion of debt in the capital structure and reduce the cost of capital.

Reward Shareholders

This is a great way to reward shareholders. When shareholders receive some extra and unexpected cash, they are delighted. They are used by the company to show confidence in its long-term position and to increase shareholders’ faith in the company.

A Useful Tool for Cyclical Industries

Cyclical industries are affected significantly by the changes in the economic outlook. Their earnings are unpredictable as they might make a profit in some periods and a loss in some. Hence, cyclical industries use it as a tool to create a hybrid payout policy. They follow the normal dividend cycle, and whenever earnings are good in a particular period, they distribute it through the special dividend.

Special Dividend’s Effect on Stock Price

It will have the same effect as a normal dividend on the price. On the ex-dividend date, the stock price will reduce by the amount of the special dividend declared. For example, if the closing price of a stock one day before the ex-dividend date is $30. The company has announced a special dividend of $5 per Share. Theoretically, the price on such a date should be $25 ($30 -$5). However, the market will reflect all the sentiments related to stock in the price. So, the price might be more or less than 25, depending on how investors interpret the result.

Disadvantages of Special Dividend

Error in Judgment

Companies might announce such dividends, thinking they will have enough cash to fund their future projects even after such distribution. There are chances that the company’s judgment could be wrong. If some attractive opportunity comes up, the company might not be able to take advantage of it because it has disbursed the cash.

Also Read: Stock Dividends

Lack of Investment Opportunities

The market might interpret that the company is making such an announcement because it does not have any project to invest in. Investors looking for growth would not want to be associated with a company with no reinvestment opportunities. This might drag the market price down. Many technology stocks are at their growth peak. They are facing the same issues.

Temporary Growth

The nature of such dividends is very unpredictable. The temporary growth in the cash is not organic growth; it happens because of some special occurrence. So for a long-term investor, this is not of that much importance. It has no effect or a small effect on valuation. Also, it is not considered in the calculation of the dividend yield.

Real-life Examples of Special Dividends

Some examples of companies that have paid special dividends in the past include:

- Red Bull GmbH distributed 500 million euros ($617.3 million) in a special dividend in 2017. This was in addition to 263.4 million euros that the Austrian company paid out in regular dividends in 2016.

- Another example is Costco, which paid a special dividend of $10 per share in December 2020.

- Old Republic International, an insurance underwriter in the US & Canada, declared US$1 per share special dividends in 2021. It was the 3rd special dividend paid since 2018

Conclusion

A special dividend is an occasional event, so investors should not interpret it as a signal for higher future returns. Investing just for this purpose is never a good strategy. Also, companies should be cautious while making such decisions as these can backfire. It has happened with some companies in the past.

Why do you say that special dividends are an excellent way to reward shareholders?

The stock price drops by the amount of the dividend, so there’s no net gain.

Please explain.

Thank you!

Hi Ronald,

Welcome to eFM.

Why did we call it an excellent way to reward?

1. Since the company is sitting on extra cash, that means it does not have good projects to invest in. If the money remains idle with the company, like a watch, the cost of capital does not stop incurring. This will impact badly on the Return on Capital Employed or Return on Equity too. That will reduce the wealth maximization for the shareholders and in turn, will impact the valuation in the stock market too. In this situation, it is ideal to either invest in good projects, and if there are no good projects giving returns more than the Cost of Capital of the company, it should hand over that money back to their investors. So that the investors can invest the money in a better avenue and achieve better returns.

2. Secondly, it works like a profit booking. Those who invest in the stock market, it is also considered a good strategy to regularly book profits.

3. Third, it has a psychological effect on the market. Regular dividend giving companies get good valuation over a company which is not regular in paying the dividend. This special dividend works as a feast.

Thanks and hope it helped.