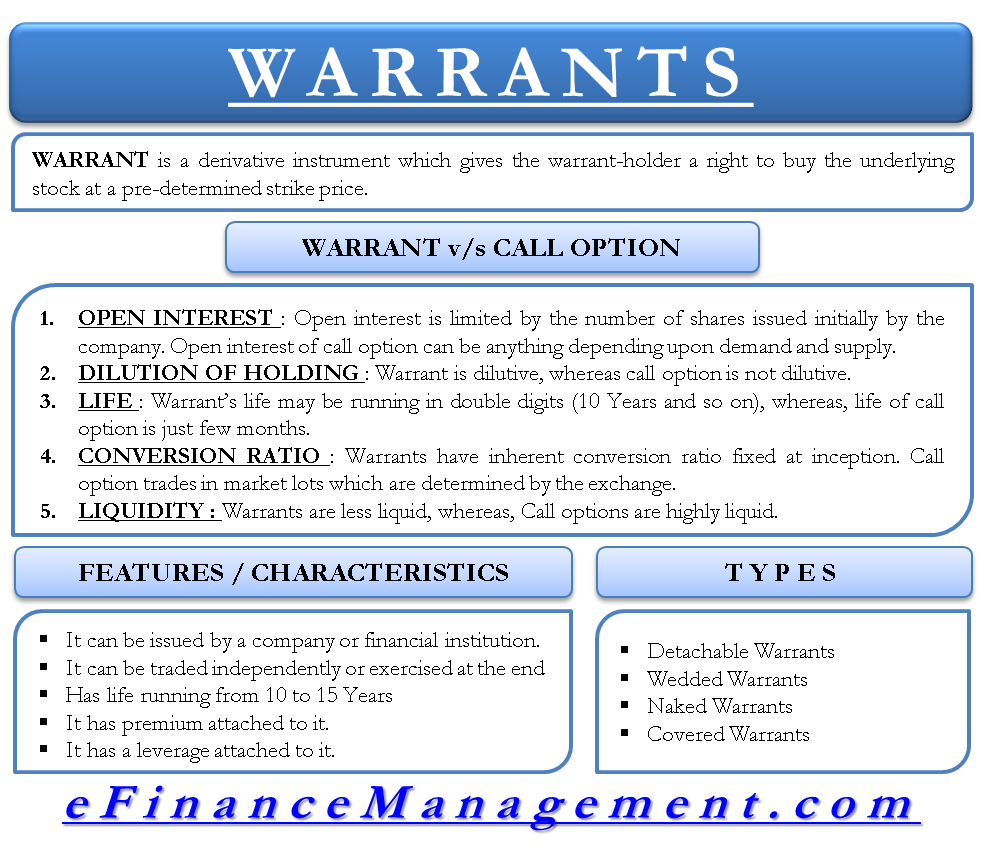

What are Warrants?

A warrant is a derivative instrument that gives the warrant-holder a right to buy the underlying stock at a pre-determined strike price. A warrant-holder can exercise it to buy the stock of the issuing company at an attractive price at a later date. It is basically a discount on the market price of the company’s stock. The companies issue these along with a debt or preferred stock issue. It makes the yield attractive for potential debt investors. Warrants are usually traded OTC. Financial institutions also issue warrants where the underlying assets can be currencies, commodities, interest rates, etc.

Warrant vs. Call Option

A warrant is similar to a call option with some differences as explained below:

Open Interest

A warrant is issued by the company whose stock is the underlying asset for the warrant. A call option can be written by anyone trading on the exchange. This limits the open interest of the warrant to the number issued initially by the company. At the same time, the open interest of a call option can be anything depending on demand and supply.

Dilution of Holdings

A warrant is dilutive. When it is exercised, the company issues new shares to the warrant holder. A call option is not dilutive. A call option is settled with the existing market float or by cash.

Life

A warrant has a life running into a double-digit number of years. It is common to have a life of ten years. On the other hand, call options have a life of a few months with longer maturity LEAPs running to a maximum of two to three years.

Conversion Ratio

A warrant has an inherent conversion ratio fixed at the time of issue. The conversion ratio is basically the number of shares that will be issued to the warrant-holder when he exercises the warrant—a call option trades in market lots, which are determined by the exchange. One market lot can be for hundreds of shares. The size of the market lot can be varied by the exchange based on the price of the underlying and the liquidity of the options.

Liquidity

Warrants are less liquid and are not generally traded by retail traders. Call options are highly liquid and are traded heavily by retail traders.

Characteristics / Features of a Warrant

The following characteristics identify a warrant:

Issuance

A warrant can either be issued by a company or a financial institution. A company can issue these instruments for its own stock while a financial institution issues them for various underlying assets.

Exercise

A warrant can either be exercised at the end of expiry or traded independently of the debt instrument with which it was issued.

Life

A warrant usually has a life running from 10 to 15 years. American type warrant can be exercised anytime during its life, while a European type warrant can only be exercised at the end of its life.

Premium

A warrant is an option like an instrument and hence has a premium attached to it. Premium is the price that the holder pays for the privilege of exercising the warrant at a suitable time.

Leverage

A warrant is a derivative instrument and has leverage attached to it. A holder with $100 worth of warrants will have more exposure to the underlying stock than a holder with $100 worth of shares.

Also, read – Difference Between Warrants and Convertibles.

Types of Warrants

Depending on its characteristics, a warrant can be classified into the following types:

Detachable Warrant

A detachable warrant can be detached from the debt or preferred stock instrument along with which it was issued. It can be traded independently from the debt or preferred stock instrument.

Wedded Warrant

A wedded warrant can’t be detached from the debt or preferred stock instruments. A warrant holder must also surrender the wedded instrument if he has to exercise the warrant.

Naked Warrant

The company issues a naked warrant without issuing debt or a preferred equity instrument in conjunction.

Covered Warrant

The normal warrant instrument is dilutive because new shares are issued upon exercise. A covered warrant is issued by a financial institution that already owns the underlying shares and hence is non-dilutive as no new shares need to be issued upon exercise.

Continue reading – Stock Warrants.