Cash Dividend Vs Stock Dividend: All you need to Know

Cash dividends and stock dividends are types of dividends released to the shareholders of the company. Although they both are types of dividends, there are few subtle differences between the two, and so comes the question of cash dividend vs stock dividend. Cash dividends and stock dividends are like a share in the profits of the company for the shareholders. The release of dividends to the shareholders is a form of rewarding them for investing and staying with the company. Moreover, whenever the company releases dividends, it reduces the quantum of retained earnings or plows back profits in the company.

Understanding Cash Dividend

Cash dividends are like cash payouts for the shareholders of the company. The company releases cash dividends out of the accumulated earnings and/or current profits of the company. These are like rewards for the company’s shareholders and the long-term capital appreciation in the stock value. Cash dividends motivate the shareholders. However, few shareholders do not appreciate the release of cash dividends. Because they feel that the company should invest the same in the growth of the company, and that may fetch a better return for the shareholders. These shareholders believe that plowing back the earnings would result in the growth of the company in the future. This would enhance the share value in the market.

Sometimes, after the release of cash dividends, the share price may get a bit lower. It may be due to the lower availability of earnings for future growth and investments. Although if the investor wants to reinvest the cash dividend amount back in the company, the same can be done with the dividend reinvestment plan if the company has one such facility.

Understanding Stock Dividend

Stock dividends are like stock payouts for the shareholders of the company. The company rewards the shareholders by releasing additional stocks to them. This reward increases the ownership stake of the shareholders in the company. Although, after the release of a stock dividend, the price per share decreases as the effective quantity of available shares increases in the market. Companies sometimes issue this type of dividend when they are short of liquid cash or when the company wants to conserve the cash for its expansion plan. Most stockholders also prefer stock dividends without the cash option to avoid tax liability.

Also Read: Cash Dividend

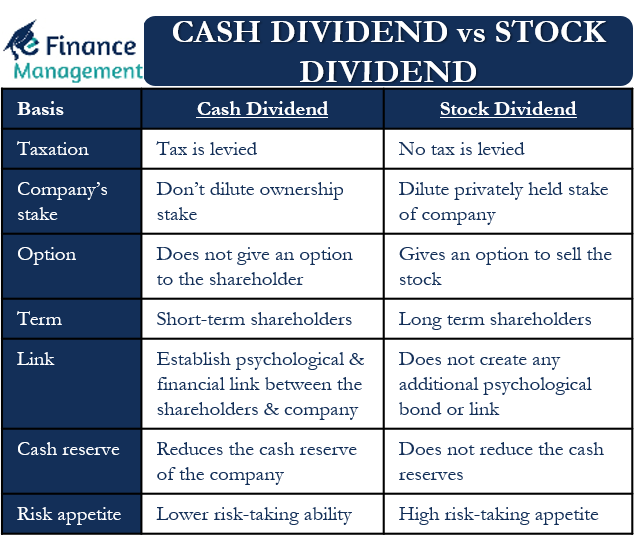

Cash Dividend Vs Stock Dividend: Major Differences

Following are a few major differences between the cash dividend and stock dividend:-

Taxation

Taxation policies are different for cash dividends and stock dividends. When the company releases the dividends in the form of cash, then the dividend amount goes directly to the bank account of the shareholders. For tax purposes, as per the regulations, these are treated as income and are subject to taxability as per the applicable slab of the individuals/entities. Whereas, in the case of stock dividends, no cash release happens. Instead, only additional shares release happens, i.e., the release is in kind are, like giving additional stock to the shareholders of the company. There is no release of any cash or bank transfer in the case of the stock dividends. Thus, there is no taxation on the stock dividends released by the company.

In simple words, shareholders have to pay tax for cash dividends and not for stock dividends.

Company’s Stake

Cash dividends are a release of a portion of the profit for the shareholders of the company. Stock dividends are a release of stock for the shareholders of the company. Cash dividends do not dilute the ownership stake privately held by the major shareholders or promoters of the company. It only reduces the disposal profit and available cash of the company.

On the other hand, stock dividends increase the absolute quantum of publicly traded stocks of the company. However, the overall stake percentage may remain the same. Still, the control and movements of stock prices alter due to increased free float in the market. Increased float is also a cause of concern for the major shareholders and promoters of the company because the accumulation by certain suitors can jeopardy the interest of the company.

Liquidity

When companies are willing to reward their shareholders but are short of cash, then stock dividends are the best option available. Liquid cash is not required for rewarding shareholders in the case of the stock dividends. In contrast, is the situation for cash dividends. While releasing cash dividends, the company requires enough quantum of liquid cash.

Option/Choice with the shareholders

Cash dividend does not give an option to the shareholder, but stock dividend gives an option. Stock dividends with a cash option allow the shareholders to sell the stock and generate money out of it. It is completely at the discretion of the shareholder whether to sell the stock dividend or stay as a shareholder of the company. On the other hand, in the case of cash dividends, there is no such choice or option available. It is compulsory in the case of cash dividends for the shareholder to stick to the amount transferred and cannot wish to have an additional ownership stake in the company.

Also Read: Stock Dividends

Long Term or Short Term

Mostly the shareholders who sought to get cash dividends are short-term shareholders. They mostly have short-term pictures in mind. In contrast to this are shareholders seeking stock dividends. They have a long-term growth view in their mind. They mostly want to stay with the company for a longer period of time and look for share price growth instead of small bouts of dividends.

The Link between the Shareholders and the Company

Stock dividends mostly establish a psychological and financial bond or a link between the shareholders and the company. With the additional stake comes the additional obligation and ownership. A cash dividend does not create any additional psychological bond or link.

Company’s Cash Reserve

The issuance of cash dividends reduces the cash reserve of the company. Cash reserves of the company are for future expansion plans or uncertainty. The opposite is the case when dividend release happens in the form of stock dividends. The stock dividend does not reduce the cash reserves of the company at all.

Risk Appetite

Mostly the shareholders seeking cash dividends are for the short-run and have lower risk-taking ability. On the other hand, shareholders wishing for stock dividend-paying companies have a comparatively high risk-taking appetite.

Common or Not

Cash dividends are more common in comparison to scrip dividends. Most companies prefer releasing a cash dividend instead of a stock dividend. Thus, cash dividend is more common, popular, and widely used in comparison to the stock dividend.

The above-mentioned differences are non-exhaustive in nature; there could be other differences as well.

Cash Dividend Vs Stock Dividend: Conclusion

It is an important decision for the company to select the type of dividend because it directly affects the capital structure of the company. We cannot say that a stock dividend is better than cash dividend or vice versa. It completely depends on the stakeholder’s investment objective and the stage at which the company is or the business requirements. Mostly a stable company would prefer cash dividends and a growing company would prefer stock dividends. Similarly, mostly a short-term investor would prefer cash dividend and the long-term investor would prefer stock dividend. Thus both are types of dividends used to reward shareholders; the suitability varies from case to case.