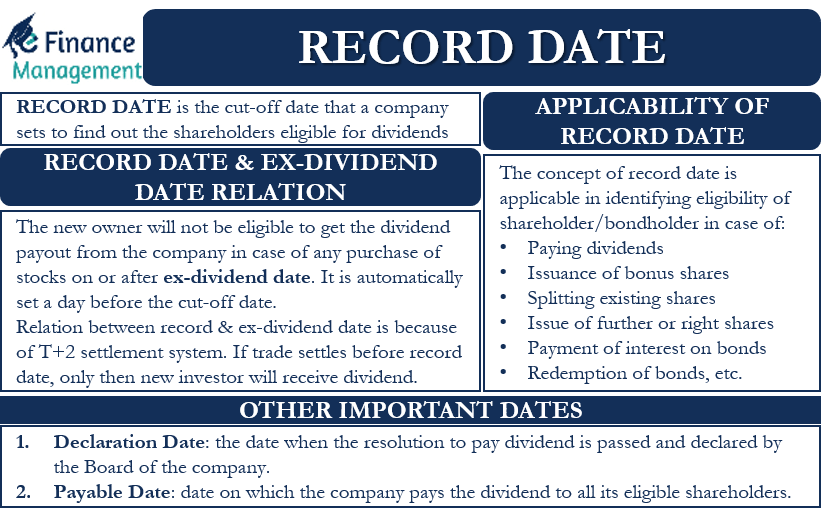

Record Date is a date that one would come across in case of a dividend. Basically, it is the cut-off date that a company sets to find out the shareholders who are eligible for dividends. As shares continuously trade, their ownership also keeps changing. Thus, for a company, it becomes very difficult to decide on the shareholders to whom it will pay dividends.

So, to determine the shareholders who will get dividends, a company sets the record date. This means whoever is the shareholders as of the record date will be eligible and entitled to get the dividend once paid by the company. Another name for this date is the date of record or the cut-off date. In other words, it is the date by which shareholders must officially own shares in order to get the dividend.

It is important to note that the same concept of record date is equally applicable to certain other transactions also, apart from dividends. And these transaction relates to identifying the eligibility of shareholders/bondholders in case of

- issuance of bonus shares,

- splitting the existing shares,

- issue of further shares or right shares,

- payment of interest on bonds,

- redemption of bonds, and other similar announcements from the company.

Thus, for every investor of stocks and securities, it is very important to understand the concept of the cut-off date. Knowing about the record date would allow investors to increase their cash inflow.

Also Read: Ex-Dividend Date

Record Date and Ex-dividend Date Relation

The record date has a very important relationship with the ex-dividend date. And to know the ex-dividend date, one must know the record date. Because any purchase of stocks on or after the ex-dividend date, the new owner will not be eligible to get the dividend payout from the company. The ex-dividend date is automatically set a day before the cut-off date.

Such a relation between the record and ex-dividend date is because of the T+2 system of settlement. In this settlement, a share ‘buy or sell’ trade settles in two business days after a sale or purchase transaction.

So, if an investor buys a share one business day before the cut-off date, the transaction would settle only after the cut-off date because of a T+2 settlement. This means such investors will not be shareholders in the company’s record on the date when it decides about the list of eligible shareholders for the purpose of dividend distribution.

One exception to this is if the dividend amount is 25% or more than the value of the stock. In such a scenario, the FINRA (Financial Industry Regulatory Authority) states that the ex-date is one business day after the payable date.

Other Important Dates

Apart from the date of record and ex-dividend date, there are two more important dates that investors must know about. These are:

Declaration Date

As we know, the power to recommend and approve the dividend rests with the Board of Directors of the Company. Hence, the declaration date is the date when the resolution to pay dividends is passed and declared by the Board of the company. Briefly, it is the date of announcement by the company of its intention to pay the dividend at a particular rate to its shareholders. Usually, the declaration date is a few weeks before the company actually pays the dividend.

Payable Date

It is the date on which the company pays the dividend to all its eligible shareholders based on the record date earlier announced for the purpose.

Of all these four dates, a company does not formally announce the ex-dividend date. A company formally announces all other three dates. Since the ex-dividend date is one business day before the cut-off date, stock exchanges and investors need to determine this date themselves. The same is the situation with regard to ex-interest, ex-bonus, ex-rights dates, etc.

Example of Record Date

Company A declares a dividend of $5. The dividend is payable on May 1 to the shareholders whose names appear on the shareholders’ register on April 10. So, the record date is April 10, and accordingly, the ex-dividend date will be April 9.

If Mr. A wants to get dividends on Company A’s shares, then he would have to buy the shares before the ex-dividend date. So, if Mr. A buys the shares on April 8, the trade will settle (T+2 settlement) on April 10. This would make Mr. A a shareholder of Company A on the record date (April 10), and thus, he will get the dividend.

On the other hand, had Mr. A invested in the Company A shares on April 9, he would not be eligible for the dividend. This is because the trade will settle on April 11, i.e., after the cut-off date.

Final Words

It is very important for shareholders to know and understand the cut-off date and other related dates discussed above. This allows investors to increase their cash inflow via dividends and benefit from the change in share prices. Generally, share prices go up after a company announces a dividend and continues to increase until the ex-dividend date.

Frequently Asked Questions (FAQs)

It is basically the cut-off date that a company sets to identify:

1. the shareholders are eligible for dividends.

2. the eligibility of shareholders/bondholders in case of:

– issuance of bonus shares,

– splitting the existing shares,

– the issue of further shares or right shares,

– payment of interest on bonds,

– the redemption of bonds, etc.

The relation between the record and ex-dividend date is because of the T+2 system of settlement. If trade settles before the record date, only then the new investor will receive the dividend.