What are Callable Bonds?

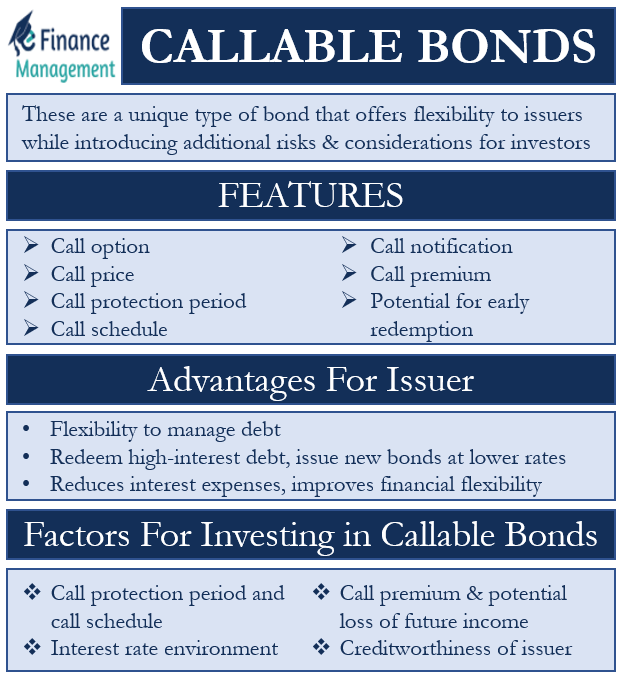

Callable bonds are a unique type of bond that offers flexibility to issuers while introducing additional risks and considerations for investors. These are debt securities issued by corporations, governments, or other entities to raise capital. Unlike traditional bonds, callable bonds grant the issuer the right to redeem or “call” the bond before its maturity date. The issuer has the option to repurchase the bond from the bondholder at a predetermined call price.

Features of Callable Bonds

Callable bonds possess several distinct features that differentiate them from traditional bonds.

Call Option

Callable bonds grant the issuer the right, but not the obligation, to redeem the bond before its scheduled maturity date. This call option provides flexibility to the issuer, allowing them to retire or refinance the debt under favorable conditions.

Call Price

When a callable bond is called, the issuer repurchases it from the bondholder at a predetermined call price. The call price is usually set at a premium to the bond’s face value. It compensates bondholders for the potential loss of future interest payments if the bond is redeemed early.

Call Protection Period

Callable bonds typically have a call protection period during which the bond cannot be called. This period provides stability for bondholders and safeguards against premature redemption. Once the call protection period ends, the issuer gains the right to call the bond.

Call Schedule

Callable bonds often have a predefined call schedule, specifying the dates on which the issuer can exercise their call option. The call schedule outlines the earliest and subsequent call dates, providing transparency regarding the potential timing of redemption.

Call Notification

When an issuer decides to call a bond, they must notify the bondholders in advance. The notification period can vary but is typically several weeks or months, giving investors time to prepare for the redemption and make appropriate investment decisions.

Call Premium

The call premium represents the difference between the call price and the bond’s face value. It compensates bondholders for the loss of potential future interest payments if the bond is redeemed early. The call premium serves as an incentive for investors to hold callable bonds, considering the inherent risk of early redemption.

Potential for Early Redemption

Callable bonds expose bondholders to the risk of early redemption, as issuers tend to call bonds when prevailing interest rates decline. This introduces reinvestment risk for investors who may struggle to find comparable high-yielding investments if their bonds are redeemed.

Also Read: Bonds and their Types

Advantages for Issuers

Callable bonds provide several advantages for issuers. By including a call feature, issuers have the flexibility to manage their debt obligations efficiently. If interest rates decline, they can redeem high-interest debt and issue new bonds at lower interest rates, thereby reducing interest expenses and improving financial flexibility.

Reinvestment Risks for Bondholders

Investors in callable bonds face certain risks due to the possibility of early redemption. When interest rates fall, issuers are more likely to call the bonds, leaving investors with reinvestment risk. Reinvestment risk refers to the challenge of finding similarly high-yielding investments in a lower interest-rate environment. Bondholders may also face the potential loss of future interest income if the bond is called before maturity.

Yield

For investors considering callable bonds, it is crucial to understand the difference between yield-to-call (YTC) and yield-to-maturity (YTM). YTC represents the yield an investor would earn if the bond is called at the earliest call date, while YTM represents the yield if the bond is held until maturity. Comparing YTC and YTM can help investors assess the potential return and risk of callable bonds.

Factors to Consider when Investing in Callable Bonds

When evaluating callable bonds, investors should consider several factors, including:

- Call protection period and call schedule: Understanding the timing of potential call dates.

- Call premium and potential loss of future income: Assessing the compensation for early redemption and the impact on future cash flows.

- Interest rate environment: Analyzing the likelihood of the bond being called based on prevailing interest rates.

- Creditworthiness of the issuer: Evaluating the issuer’s financial health and ability to call the bond.

Conclusion

Callable bonds provide issuers with flexibility in managing their debt, but they introduce additional risks for investors. Understanding the features, risks, and factors to consider when investing in callable bonds is crucial for making informed investment decisions. By carefully assessing call provisions, yield-to-call, and other relevant factors, investors can navigate the complexities of callable bonds and potentially benefit from their investment characteristics.