Cash Dividend: Meaning

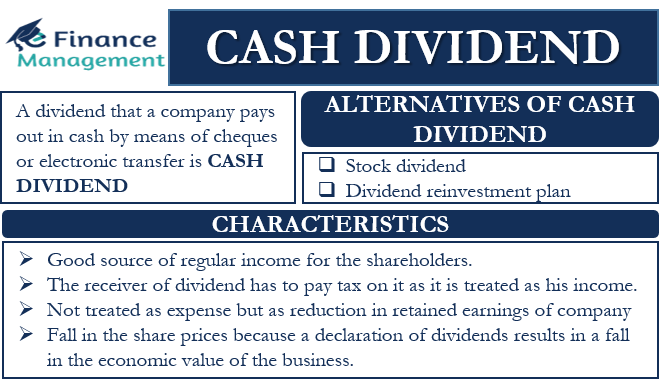

The main thrust and important objective of any commercial organization is to earn profits through its business activities. Any company can either reinvest those profits to grow and generate more business or give a part or all of it as dividends to its shareholders. A dividend is that portion of a business organization’s profit that it gives back to its shareholders. The two types of dividends: cash dividends and stock dividends. A cash dividend is a dividend that a company pays out in cash by means of a cheque or electronic transfer. A company can give away dividends in the form of stock by issuing more of its shares to the shareholders as bonus shares.

A company announces dividends for its shareholders in return for their investment and faith in the company. The board of directors decides how much and when the company should pay the dividends. There is no fixed percentage of profits that a company has to give away as dividends. Also, there is no compulsion to announce the same for any company. It is totally in the will of the board of directors to announce dividends. A company can also use its retained earnings which it has accumulated, to pay dividends to its shareholders.

Record Date and Ex-Dividend Date

When a company decides to pay cash dividends, it does inform and decide on a record date. The record date is the date on which day whoever will be holding shares of the company as shareholders as per the company’s records will be eligible to get the dividends. Thus, only such shareholders appearing in the books on the record date can claim to get and receive the dividend in their bank accounts or by cheque.

At the same time, the company also declares the ex-dividend date, which is usually one business day before the record date. Any purchase transaction by the investor on the ex-dividend date or afterward will not accrue any dividend to him. It will go to the seller whose names appear in the company’s records. One thing to note is that a company can use only its revenue profits to distribute dividends. It cannot make use of its capital profits to give away dividends.

Main Characteristics of a Cash Dividend

Fall in the Share Prices

In actual practice, regular payment of dividends by the company is considered good. However, there is no direct connection between the dividend declaration and the movement in its share price. On declaration of dividend, the share price may fall or may not fall. We have seen several times, in fact, it rises. Secondly, in the case of a fall in prices, there is no correlation between the quantum of dividends and the fall in price.

Yes, in the case of Mutual Funds and ETFs, when they declare dividends, their Net Asset Value (NAV) or the unit price will fall. And further, this fall will usually be in proportion to the quantum of dividends declared.

Taxation

Whenever a company declares a cash dividend, it is subject to taxation. The receiver of the dividend has to pay tax on it as it is treated as his income. Therefore, the actual value of the dividends received gets lower at the end of the investor due to the taxation effect. From a company’s point of view, they do not receive any tax deductions on the dividends that they pay to their shareholders. Instead, they are also required to pay a dividend distribution tax which is a percentage of the gross amount of dividend that a company distributes.

Regular Income

Cash dividends are a good source of regular income for the shareholders. The companies pay out the dividends to the shareholders in proportion to their shareholding in the company or the quantum of shares held by them in the company. While their investment appreciates with every rise in the price of the share over a period of time, cash dividends provide them with additional income and liquidity. This helps to develop a special bond between the investor and the company. Shareholders look to increase their stakes in good dividend-paying companies rather than just booking profits and selling off their shares. Hence, payment of cash dividends regularly to the shareholders creates goodwill for the company in the minds of the investors and the market.

Accounting Treatment

A cash dividend is not treated as an expense for a company. Instead, it is the distribution of the profits to its owner shareholders. Hence, the dividend does not appear in the income and expenditure statement of the company. It is, in a way reduction in the distributable or retained earnings of the company. Thus, we reduce the retained earnings in the balance sheet by the amount of dividends the company pays. Since it is a cash payout, we deduct the amount from the cash or bank balances.

From a shareholder’s point of view, a dividend is a form of income. Hence, it should appear in the income and expenditure statement as an income and be treated accordingly for all purposes.

Cash Dividend Yield

The cash dividend yield is a financial ratio. It measures the dividend a company pays vis-a-vis the market price of the share. The dividend yield is expressed as a percentage. The higher the dividend yield is, the more beneficial it is for the shareholders, as it will mean a higher dividend payout. Investors also tend to stick to companies with a high dividend yield for the long term.

Example of a Cash Dividend

Let us assume that a company, ABC makes good profits in the current year and decides to reward its shareholders. It announces a cash dividend of $1 per share. The current market price of the share is $40.

An investor Mr. S holds 500 shares of the company. Hence, the total cash dividend that he will earn will be $1 x 500 shares= $500.

The dividend yield in this case= Dividend/ market price of the share

= $1/ $40

= 2.5%.

Suppose the market price of the shares falls by $1 to $39 after the dividend declaration.

The value of shares of Mr. S before the dividend declaration –

$40 x 500 shares= $20000.

The current value of Mr. S’s investment in the company-

$39 x 500 shares= $19500.

Therefore, the value of Mr. S’s investment in the company falls by $500, which is equal to the amount of dividend he earned. It may happen so, or it may not happen so in the real world. The price rather may rise even after the declaration of dividends, or the price may fall more than $1.

What are the Alternatives to Cash Dividend?

A good alternative to a cash dividend is a dividend reinvestment plan or DRIP. Such plans reinvest the cash dividends an investor earns in the stock of the company automatically. The investor does not have to wait to accumulate a big sum of money first in order to buy many shares. Instead, his dividends are utilized to invest in the underlying stock. Also, such plans help to save on the brokerage fees that an investor incurs while buying shares. Thus, the dividend goes back to the company in the form of further reinvestment, and the investor’s holding in the company also rises.

A stock dividend is another alternative to a cash dividend in which companies directly allocate new shares to the existing shareholders. Companies adopt this approach when they want to save on their cash holding. Also, there is no additional payout while the shareholders are rewarded too. The shareholders can sell the additional shares if they want some liquid funds. Usually, they do not have to pay taxes too on a stock dividend. Because only upon selling those shares actual income will flow, and then it may turn out to be a long-term capital gain and not the income as such.

Conclusion

Cash dividends are an excellent way of rewarding the shareholders for their trust and faith in the company. Also, it keeps them motivated, interested, and loyal to a company. Cash dividends are effective in maintaining the share prices of companies that have seasonal businesses or follow a cyclical trend. They can announce a cash dividend during the lean season to keep the shareholders interested and remain with the company. Thus, it helps such companies avoid a steep fall in their share prices during slump times. Moreover, companies that declare good dividends regularly stand out from their peers, making them distinct and ahead of the competition.

But cash dividends have their own disadvantages too. They result in a massive outflow of funds that the companies can otherwise use for their own growth or to make new investments. Also, they attract cumbersome taxation as well as payment technicalities. Maintaining a high dividend payout yield consistently can also be a challenge for companies.

Therefore, companies should wisely decide to declare cash dividends by considering all the pros and cons.