Types of dividends!! Yes, there are different types in which a company can give away dividends to its shareholders. Let’s understand a brief definition of dividends first, and then we will take you through different dividend types.

What is Dividend?

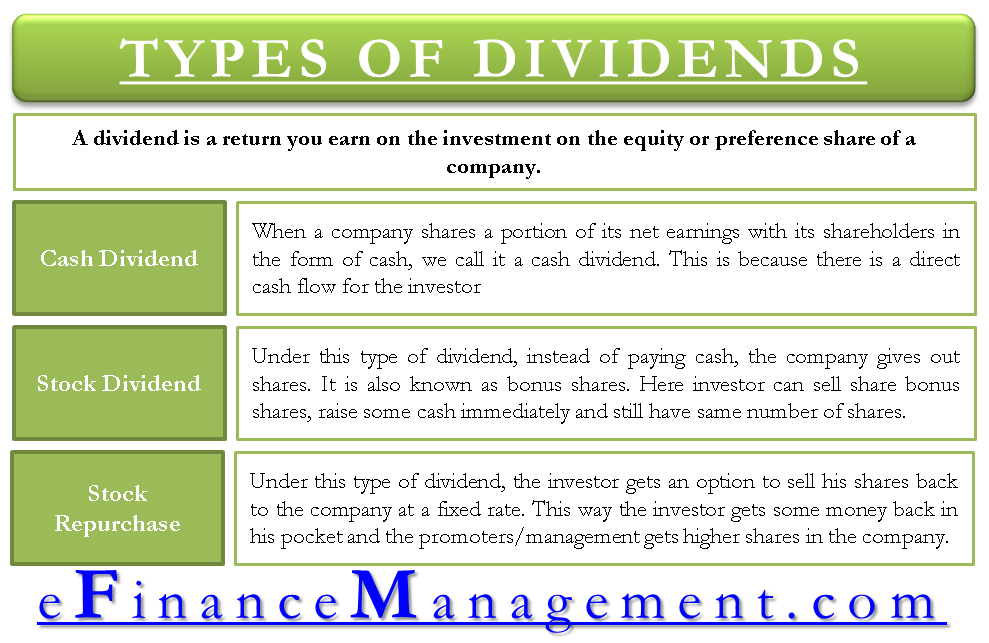

A dividend is a return you earn on the investment on the equity or preference share of a company. The objective of giving dividends is to give the investor some return on their investment apart from capital appreciation. The return does not necessarily have to be in cash. It can be in different types.

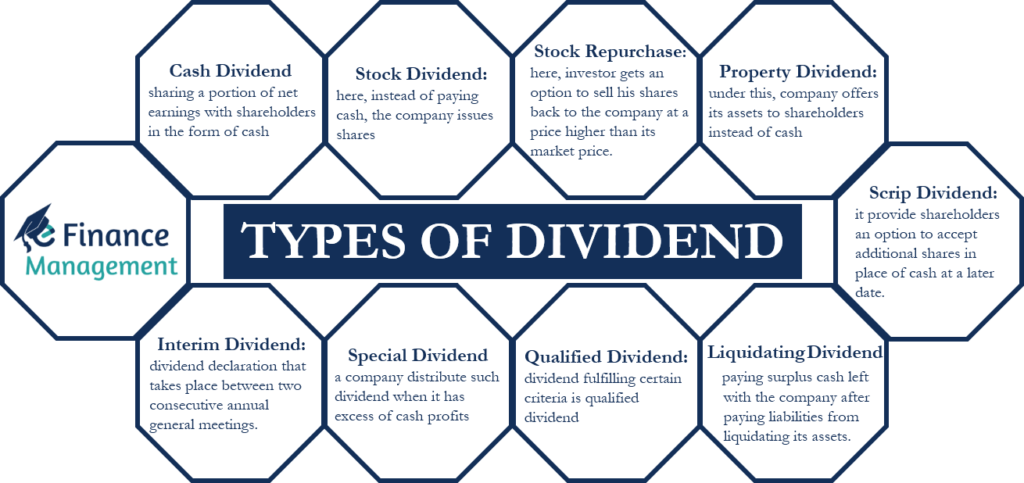

Types of Dividend

A company may pay dividends in different types. Some of the types of dividends are mentioned below:

Cash Dividend

When a company shares a portion of its net earnings with its shareholders in the form of cash, we call it a cash dividend. The date on which the board of directors declares the dividend is called the ‘declaration date.’ A shareholder is eligible to receive the dividend when their name is listed in the shareholder’s register on the ‘record date.’

Benefits to Investors:

Among the various types of dividends, the cash dividend is the most preferred by investors. The reason is that it is a direct cash flow for the investor, which makes the returns more lucrative. Investors looking out for regular income prefer companies that give regular cash dividends. This is because it gives the investor an idea about the regularity of cash flow he can expect over the course of time.

Another reason why investors prefer cash dividends among various types of dividends is that it is easier to predict when the company will be giving out cash dividends. Cash dividends are paid out of the residual profit of the company. An investor can expect a payout when the company is making good profits and has enough cash flows.

While receiving cash dividends has its own benefits, these attract tax too. The tax payout reduces the effective rate of return on the investment.

A company may choose to re-invest the money in the business and may not pay out the cash. This is where the company may prefer another type of dividend over a cash dividend.

Stock Dividend

A stock dividend is a type of dividend under which, instead of paying cash, the company issues shares. A company distribute stock dividend when it wants to reward its shareholders but does not want to pay out cash. Another term for these is bonus shares.

Under the stock dividend issue, the company issues additional shares in a ratio to the investor’s current holding. So if the bonus issue is in the ratio of 1:4, an investor holding 200 shares will get additional 50 shares, that is, 1 new share for every 4 existing shares. While the number of shares with an investor increases, the market value of the shares decreases.

Continuing with the above example, say the share’s current market price is $100. After the issue, the market price of the share will be $80. An investor holding 1000 shares will now have 1250, but the total value of his investment will remain the same at $100,000.

Now, how does an investor benefit from this type of dividend if the total value of the investment remains the same? Here the investor can sell the additional 250 shares, raise some cash immediately, and still have the same number of shares of the company. Or they can wait and enjoy capital appreciation on a higher number of shares.

Another advantage of this type of dividend is that it is tax-exempt. The tax is paid only when there is profit on sales.

To learn about the differences between cash and stock dividend in detail, you can also refer to our article – Cash Dividend vs. Stock Dividend.

Stock Repurchase

Under this type of dividend, the investor gets an option to sell his shares back to the company at a fixed price. Generally, this fixed price is higher than the prevailing market price. This way, the investor gets some money back in his pocket in the form of returns, and the promoters/management gets higher shares in the company.

Stock repurchase is a type of dividend that helps the management show the market that it believes the shares to be undervalued. It also helps in reducing the price-earnings (P/E) ratio of the share. The earnings per share (EPS) of the company will also increase due to the decrease in the number of outstanding shares. Thus, when the management pays out the dividend in cash, each shareholder will get a higher percentage of the payout, thereby increasing dividend yield.

Property Dividend

A company may also opt for property dividends if it does not want to go for cash dividends. Under this, the company offers its assets, such as stock, property, shares of the subsidiary, etc., to its shareholders. A company would favor such a dividend when there is a disagreement between the market price and the book value of the asset under distribution. A shareholder may liquidate such dividend immediately, or it may hold it for price appreciation and liquidate it later on. Another benefit of this type is that it does not attract taxes.

Scrip Dividend

Distributing dividend in the form of scrip dividend provide shareholders an option to accept additional shares in place of cash dividend at a later date. It acts as a promissory note to issue shares to the shareholders and hence, creates a liability for the company. This will help in the increment of the capital of the company. It also offers the advantage of retaining cash for further reinvestment programs, but at the same time, it may seem to the public that the company has limited cash flow.

Liquidating Dividend

A liquidating dividend is paying surplus cash left with the company after paying liabilities from liquidating its assets. Generally, a company distributes such dividends only once in its lifetime, but this may vary in the case of a partial liquidation. Such dividend is not liable for tax.

Qualified Dividend

To classify a dividend as a qualified dividend, certain criteria are required to be fulfilled. These criteria include that it must have been paid by the US or any qualified foreign company, minimum holding period criteria, etc. Such dividends are liable to a capital gain tax rate that is lower than the ordinary tax rate.

Special Dividend

A company distributes a special dividend when it has excess cash profits with it. And, the payment under such type is also higher than the regular dividends. Such excess cash profit may be a result of unusual or extraordinary events. Or, the company may also distribute such dividends in case of some great achievements.

Interim Dividend

A dividend paid before issuing financial statements is termed an interim dividend. Such dividend declaration takes place between two consecutive annual general meetings. While the dividend paid after issuing annual financial statements is the final dividend. A company declares an interim dividend if it earns enough profits every year, allowing such distribution and retention for future purposes too.

Patronage Dividend

Patronage dividend of dividend is distributed by cooperatives to its members.

Conclusion

Classification of dividends can take place on different bases. Such as mode of distribution, that is, cash or asset, or shares. Or, on the basis of the timing of distribution (interim or final), on the basis of tax liability (qualified or unqualified), etc.