What are Leverage Ratios?

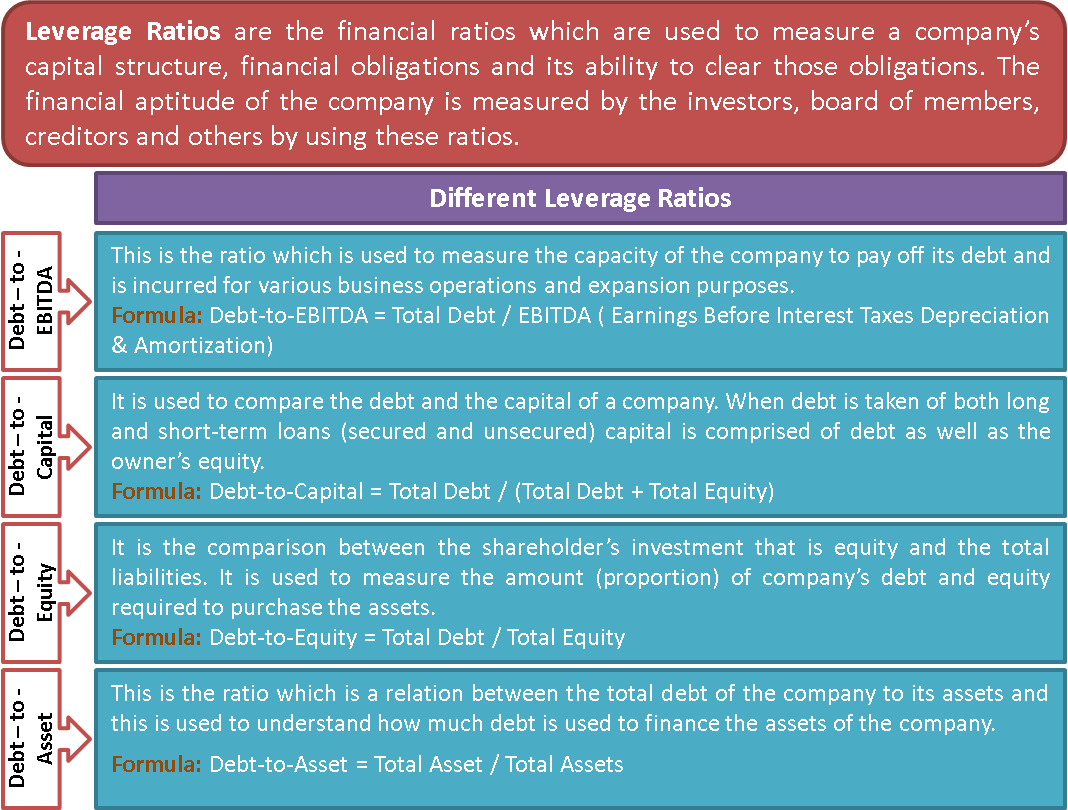

Leverage ratios are financial ratios that measure a company’s financial stability using its capital structure, financial obligations, and its ability to clear those obligations. The investors, board of directors, creditors, and others measure the financial aptitude of the company using these ratios.

A leverage ratio is a financial metric to measure the capability of the company to pay off its dues. Or to determine how much asset is put to use with the loan taken and is a good indicator of capital structure.

Before moving ahead, let us first answer 2 very important questions. These are: what is leverage and what effect does it have on a company’s returns.

As we know, the basic meaning of leverage is to use a tool (lever) to lift or open something. But how is it useful in the financial world? So, here debt acts as this tool to increase (lift up) the earnings per share (EPS), ultimately increasing returns on equity (ROE). Therefore, leverage in business means having debt in its capital structure.

After answering our first question, let us move to the second one. “How does leverage affect the EPS of a company?”

Effects of Leverage

Let’s take a simple example to make your concept crystal clear.

Assume a company, ABC, needs $200,000 for one of its upcoming projects. It has two options for financing its project. One is by raising 100% funds by way of equity. And another one is to go with debt and equity in a ratio of 50:50. The interest rate for debt is 10%, while the cost of equity is 20%. Have a look at the table to understand how the existence of the debt in the capital structure increases the ROE.

| Particulars | Only Equity | Both Debt & Equity | Remarks |

| Requirement | $ 200,000 | ||

| No. of Shares (1) | 20,000 @ 10 | 10,000 @ 10 | |

| Equity | 200,000 | 100,000 | |

| Debt | – | 100,000 | |

| EBIT (2) | 300,000 | 300,000 | |

| Interest (3) | – | 10,000 | 100,000*10% |

| EBT (4) | 300,000 | 290,000 | (2) – (3) |

| Tax @ 10% (5) | 30,000 | 29,000 | (4)*10% |

| EAT (6) | 270,000 | 269,000 | (5) – (6) |

| EPS (7) | 1.35 | 2.69 | (6) / (1) |

| ROE | 13.5 | 26.9 | (7) * price per share ($10) |

As it is very clear from the table, the introduction of debt in the capital structure has magnified the EPS and ROE. It is almost twice what it is in the case of only equity financing. This could differ too on the basis of the proportion of debt and equity.

At a certain point in time, every business needs finance from investors and financial institutions to expand. But control over these loans and debts is a must to generate earnings. The return earned on capital has to be greater than the interest rate paid on these loans and debt; if ROI > Interest, shareholders’ wealth will increase & vice versa.

Types of Leverage Ratios

Leverage ratios comprise ratios that measure the amount of debt and ability of the business entity to fulfill its financial obligations. Since business needs financing in the form of equity and debt, the ratios help balance the two for a perfect mix of capital structure to balance out capital costs.

Also Read: Debt Ratio

The different ratios under leverage ratios are as follows:

Debt-to-EBITDA

This is the ratio that the company uses to measure its capacity to pay off its debt. It is mainly used by the credit rating agencies and financial institutions to check whether the company will be able to clear its debt or not and how efficiently it can do it.

Formula

| Debt to EBITDA = Total Debt or Net Debt / EBITDA |

Where EBITDA = Earnings Before Interest Taxes Depreciation & Amortization

Debt-to-Capital

A company uses it to compare its debt and capital. This is the ratio used to analyze the company’s financial structure, and it also checks how the business operations are getting financed.

Formula

| Debt to Capital = Debt / (Debt + Equity) |

Debt-to-Equity

It is the comparison between the shareholder’s investment, equity, and total liabilities (most of the time, only long-term debts are taken into consideration). It is used to measure the proportion of a company’s debt and equity. The banking industry frequently uses this ratio in its credit appraisal of businesses applying for a loan. It compares the investment made by the owners vs. the investment by the bank. Banks normally keep a provision of margin money to maintain this ratio and check the seriousness of the owners towards the business.

Formula

| Debt-to-Equity = Total Debt / Total Equity |

For a detailed understanding, visit Debt to Equity Ratio.

Debt-to-Asset

This is the ratio which is a relation between the total debt of the company to its assets, and this is used to understand how much debt is used to finance the assets of the company.

Formula

| Debt-to-Asset = Total Debt or Total Liabilities / Total Assets |

Visit Debt to Total Asset Ratio.

Financial Leverage or Equity Multiplier

The financial leverage ratio is more commonly known as the equity multiplier. This ratio measures the amount of value of total assets supported for each money unit of equity. The higher the financial leverage ratio, the more leveraged a company is. For example, a financial leverage ratio of 4 means that each USD 1 of equity supports USD 4 worth of assets.

| Financial Leverage Ratio = Average Total Assets / Average Total Equity |

Keep reading: Equity Multiplier.

Capital Gearing Ratio

A company, to acquire assets, requires funds. It may look for sources of finance with fixed costs or common stockholder’s equity. The capital gearing ratio defines the proportion of these fixed cost-bearing funds with common stockholder’s equity. Fixed cost-bearing funds include debentures, bonds, preferred stock, etc.

| Capital Gearing Ratio = Common Stockholder’s Equity / Fixed Cost Bearing Funds |

Visit Capital Gearing Ratio for more.

Cash Flow Adequacy Ratio

This ratio determines a company’s solvency position by analyzing if its operating cash flows are enough to finance its investing and financing activities.

| Cash Flow Adequacy Ratio = Cash Flow from Operations / (Long-term Debt + Purchase of Fixed Assets + Cash Dividends) |

Refer to Cash Flow Adequacy Ratio for more.

Loan to Value Ratio

This ratio calculates the cost of taking a loan. It compares the value of assets with the amount given as a loan for them.

| Loan to Value Ratio = Loan Amount / Appraised Value of Property |

Loan to value ratio + Haircut in finance = 100%

Examples of Leverage Ratio

Let’s understand this concept of leverage ratios with the help of an example. Company XYZ ltd. has a capital of $2,000,000 comprised of 40% debt and 60% equity. The EBIT of the company is $200,000. The amount of depreciation and amortization in the financial statements is $30,000. The assets of the company totaled to $1,500,000.

| Total Equity | $1,200,000 | 2,000,000*60% |

| Total Debt | $800,000 | 2,000,000*40% |

| EBITDA | $230,000 | 200,000+30,000 |

| Total Assets | $1,500,000 | – |

| Total Capital | $2,000,000 | – |

Debt to EBITDA = $800,000/$230,000 = 3.48

and, Debt to Capital = $800,000/$2,000,000 = 0.4

Debt to Equity = $800,000/$1,200,000 = 0.67

and, Debt to Assets = $800,000/$1,500,000 = 0.53

Interpretation of Leverage Ratio

Leverage Ratios tell about the financial health of the company and its capabilities to meet its financial liability and obligation.

Debt to EBITDA (earnings before interest, tax and depreciation, and amortization) suggest how much a company earns before paying interest. And how many times that earnings can cover its debt obligations. In fact, the higher ratio means that the debt is higher than earnings, and a similarly lower ratio implies that debt is lower than earnings, which is good.

The debt to Capital ratio shows the proportion of debt in the capital structure. The higher the ratio, the more the risk.

Debt to Equity defines the proportion of debt and equity in the capital structure.

Debt to Assets shows how much portion of the assets is sourced from the debt. In other words, how much of the debt is used to create physical and productive assets.

Cautions

Leverage ratios measure the solvency of the company and how they utilize the available funds. The company should try to keep its Debt to EBITDA, Debt to Capital, and Debt to Equity lower instead of at a reasonable level so that meeting obligations in time should not pose any problem.

You can also use our Leverage Ratio Calculator for calculating all these ratios.

Uses of Leverage Ratios

Leverage ratios analysis is important to both internal and external parties involved in a business, whether it is the management, the creditors, or the investors. Even the third parties like the credit rating agencies require these to get the company’s operational efficiency.

- These ratios are important as they give an insight into the company’s financial health and its capability to meet its financial liabilities and obligations.

- It is used to measure the potential and the efficiency of the company with which it is using the debt to run the business and earn revenue and expand as well.

- Leverage ratios use can be many as it is also used to understand the company’s capital structure and whether it is solvent or not. The creditor can rely on these ratios to extend credit to the company even if the company is highly levered but earning good returns on their investment, surpassing the interest cost of capital.

Visit Solvency Ratios for more.

Conclusion

Leverage ratios are used to measure the solvency of a company, its financial structure, and how it operates with the given fund (equity and debt). Creditors use it, investors, and internal management to evaluate the company’s growth and ability to clear all dues/debts/interests.

Refer to Ratio Analysis for various other types of ratios.