For understanding the meaning of the capital gearing ratio, we need to first understand the meaning of capital gearing. So, let us see what capital gearing is.

Capital Gearing

Capital gearing also means financial leverage. Every company needs funds to acquire assets or to finance its operations. For this, it has various sources of finance. One of the sources is debt, which can be either long-term or short-term in nature. Hence, Capital Gearing is the level or the degree of such debt that a company uses to acquire assets or fund its operations.

This ratio is the tool that analyzes the capital structure by using the stockholders’ equity and the level of debt in the company. Let us understand it further.

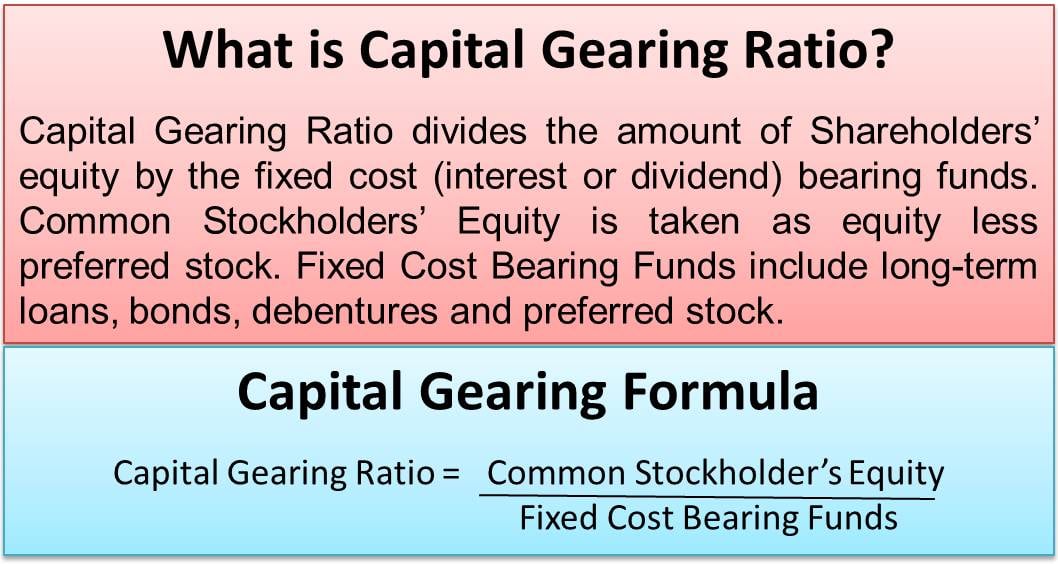

What is Capital Gearing Ratio?

The capital gearing ratio divides the amount of Shareholders’ equity by the fixed cost (interest or dividend) bearing funds. Common Stockholders’ Equity is equity less preferred stock. Fixed Cost Bearing Funds include long-term loans, bonds, debentures, and preferred stock. It is called financial leverage and is typically a measure of the company’s financial strength.

Also Read: Capital Gearing Ratio Calculator

If a company is said to be highly geared, it means that it has more debt than its own funds in its capital structure. It is based on subjective valuation, and thus there is no optimum capital gearing ratio. It varies from industry to industry. The formula is as given below.

Capital Gearing Formula

Capital Gearing Ratio = Common Stockholder’s Equity / Fixed Cost Bearing Funds.

It is a simple ratio that includes the above-given items in order to find out the gearing and capital strength of the company. Let us understand the calculation of Capital Gearing with an example.

Capital Gearing Ratio Example

Company XYZ had the following particulars:

For the year 2015:

Total Equity: $5,000,000

Preferred Stock: $1,500,000

Common Shareholders’ Equity: $3,500,000 (Total Equity less Preferred Stock)

Bonds: $1,500,000

Hence the Capital Gearing ratio for Company XYZ will be:

$3,500,000:$3,000,000 or 7:6, indicating that the company is low geared for the financial year.

For the year 2016:

Total Equity: $5,000,000

Preferred Stock: $1,500,000

Common Shareholders’ Equity: $3,500,000 (Total Equity less Preferred Stock)

Bonds: $4,500,000 (additional bonds of $1,000,000 issued for the financial year)

Hence the Capital Gearing ratio for Company XYZ will be:

$3,500,000:$4,500,000 or 7:9, indicating that the company is highly geared for the financial year.

You can also use our Capital Gearing Calculator.

Significance of Capital Gearing Ratio

Borrowed funds are a cheaper means of financing for the company, but payment of interests, preference dividends, and interest on bonds and debentures directly reduces the amount of divisible profits. This leads to a significant decrease in the dividend paid to the shareholders. A highly geared company usually has a lower dividend payout ratio for this very reason. Thus investors looking to increase their earnings will prefer a low geared company. This ratio will be useful in this analysis.

Conclusion

One must understand that not all debt is bad debt. Subjectively, some companies have to be low geared while others high geared. Others may be able to strike the ideal balance. For a chance of sound investment, an investor must do a complete evaluation. Management must consider many other factors for evaluating a company, and the capital gearing ratio is just one of them.

Visit Leverage Ratios for its other types.

My relatives every time say that I am killing my time here at net, however, I know I am getting experience all the time by reading the fastidious posts.

Howdy! I just would like to offer you a huge thumbs up for your excellent information you have here on this post. I am coming back to your website for more soon.