Return on Net Worth Definition

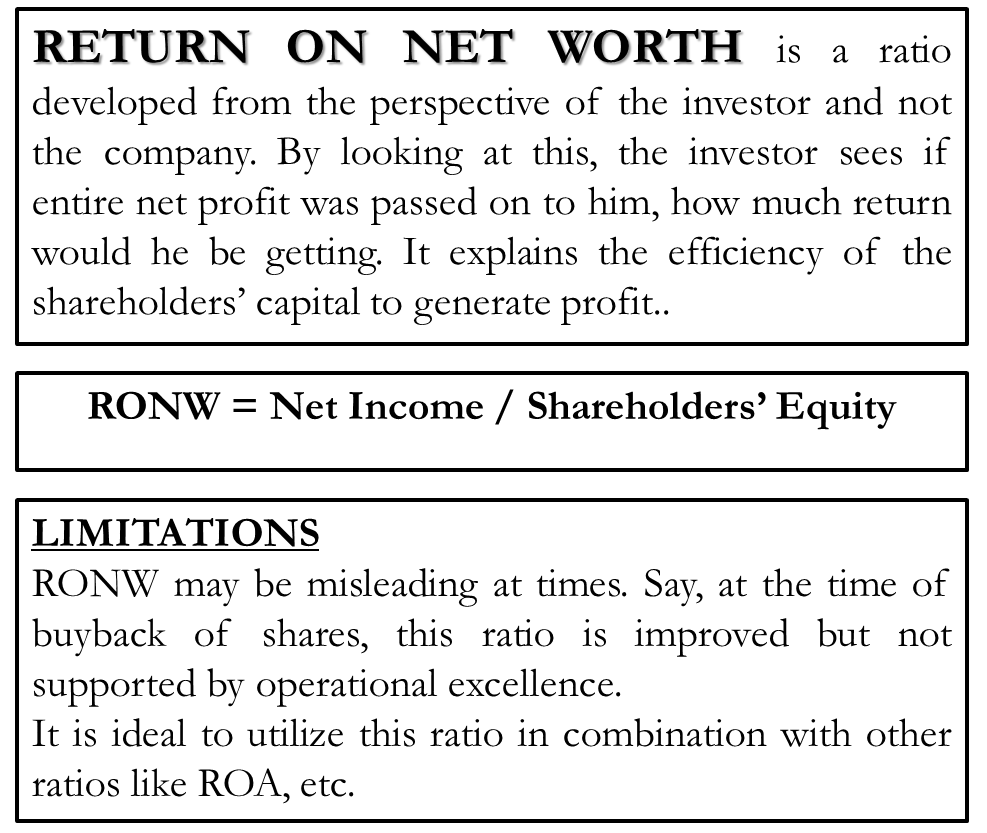

Return on Net Worth is a profitability ratio developed from the perspective of the investor and not the company. By looking at this, the investor sees whether the entire net profit is coming to him or how much return he would get. It explains the efficiency of the shareholders’ capital to generate profit.

Return on Net Worth Formula

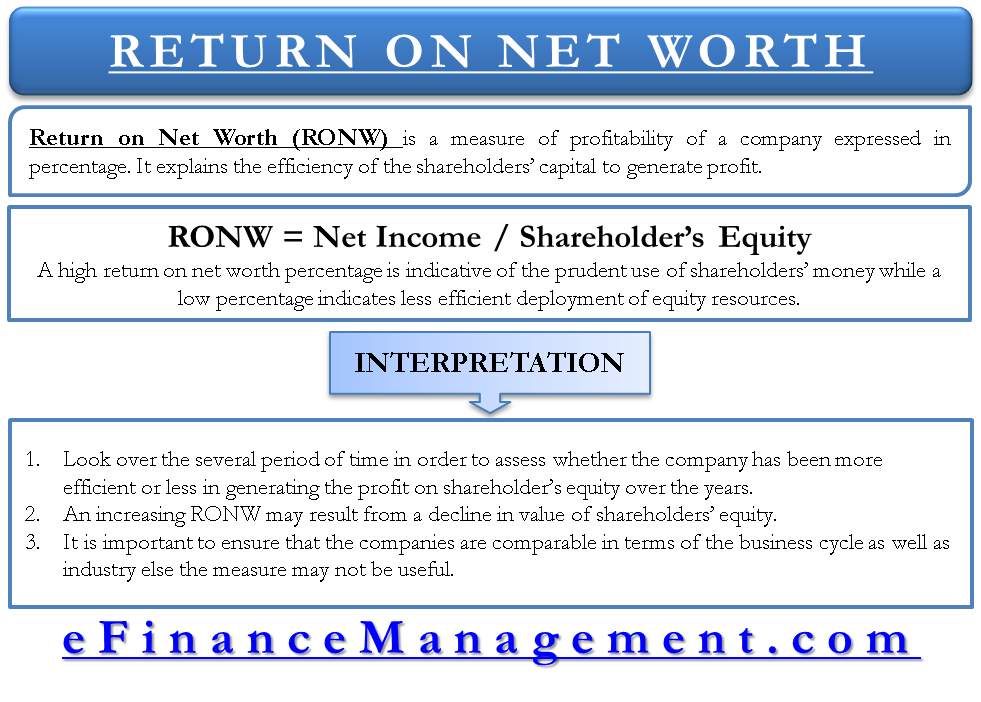

Return on Net Worth (RONW) is a measure of a company’s profitability expressed in percentage. We calculate it by dividing the net income of the firm in question by shareholders’ equity. The net income used is for the past 12 months. Mathematically, it represents as follows:

RONW = Net Income / Shareholders’ Equity

For example, let’s assume that ABC Inc. posted a net income of $100,000 in the past year. At the same time, the value of shareholders’ equity was $500,000; then the RONW would be:

RONW = 100,000 / 500,000 = 0.2 or 20%

The net income should be from the past year. And the equity should be at the end of the period for which we calculate the return on net worth. Also, the equity should have an adjustment for stock splits and should not include preferred shares.

Also Read: Return on Net Worth Calculator

Calculate Return on Net Worth Using Calculator – Return on Net Worth Calculator

How to Calculate Return on Net Worth?

The user has to enter the following figures into the calculator, and it will provide the return on net worth RONW:

Net Income

This is the earnings of the company for the latest Financial Year. To derive this figure, we need to deduct all the expenses, taxes, depreciation, and amortization from the firm’s total revenue.

Shareholder’s Equity

When we talk about the Return on Net Worth, we refer to all the Funds belonging to the Equity Shareholders. And which may include the reserves and surpluses, and balances of the Profit & Loss Account. Somewhere RONW and ROE (Return on Equity) are used interchangeably. Since we are talking about Net Worth, a preferable word could be Shareholder’s Kitty. So in this calculator, we need to use the total Equity Shareholder’s Kitty for arriving at the RONW.

Explanation

In other words, return on net worth indicates how much profit is there for every dollar of equity investment. Even more plainly, it is a measure of how well the company is utilizing the money invested by shareholders. In accounting terms, the example given above shows that for every dollar of equity in ‘books,’ ABC Inc. generated a 20-cent return.

A high RONW percentage is indicative of the prudent use of shareholders’ money, while a low percentage indicates the less efficient deployment of equity resources.

Also Read: Return on Equity (ROE)

RONW is a vote of the efficiency of a company’s management. Here, an increasing percentage indicates higher efficiency in generating profit on every dollar of investment.

Interpretation of RONW

It is important to study this measure over several periods of time to assess whether the company has been more or less efficient in generating profits on shareholders’ equity over the years.

Also, an increasing RONW may result from a decline in the value of shareholders’ equity. Hence, a share buyback can artificially increase return on equity from which investors and analysts may draw an incorrect conclusion of higher profits or increased efficiency. Hence, it is important to look at the ratio before concluding the firm under analysis.

Combined with return on assets (ROA), return on net worth can show whether leverage is being employed by a company. For instance, if ROE is greater than ROA for the same period. It is a sign of using leverage to increase profits because higher debt means fewer requirements for equity, which will boost ROE.

When comparing different companies in terms of their RONW, it is important to ensure that the companies are comparable in terms of the business cycle and industry; otherwise, the measure may not be useful.

For instance, comparing the RONW of a company from the technology and another from the utility sector may not give the right picture as technology companies tend to have lower debt. In contrast, utility companies usually have high levels of debt. Also, technology companies are generally higher growth companies while utilities are usually stable businesses, thus making a comparison between the ROE of these two companies incorrect.

Cautions

To arrive at a conclusion on how the company is managing its fund, one should always take a look at the return on the net worth of a multi-year period. A single year’s return on net worth is not enough to interpret the company’s overall performance. Hence, any decision to invest or otherwise should not be based on a single year’s return. In addition, the status of the industry, in general, should also be taken into consideration before arriving at any decision.

Moreover, a higher return on net worth may be a result of the buyback of shares during the year. This may reduce the overall kitty; thus, there could be a sudden jump in return due to which one can make a wrong interpretation. So proper evaluation and digging are a must.

Read more about other PROFITABILITY RATIOS.

Quiz on the Return on Net worth