What is Equity Multiplier (EM)?

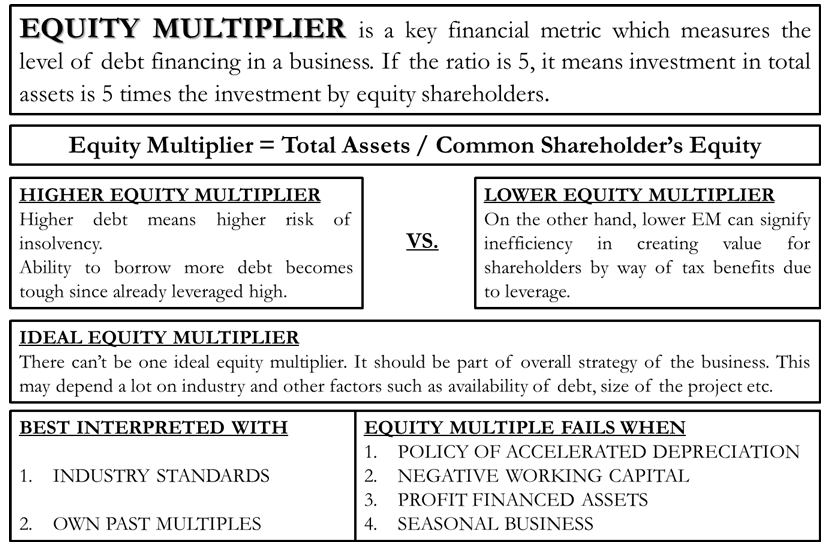

Equity Multiplier is a key financial metric that measures the level of debt financing in a business. In other words, it is defined as a ratio of total assets to total equity. If the ratio is 10, the equity multiplier means investment in total assets is 10 times the investment by equity shareholders. Conversely, it means 1 part is equity, and 9 parts are debt in overall asset financing.

Formula

The formula for equity multiplier is as follows:

Equity Multiplier = Total Assets / Total Shareholder’s Equity

Here,

Total Assets: Total assets would mean all the company’s assets, or one can take the total asset side of a company’s balance sheet. This was the understanding from the asset side. A total of all the liabilities and equity capital are covered for arriving at the figure of total assets from the liability side.

Total Shareholder’s Equity: It is determined by the total amount of equity that shareholders hold in a company, which includes the sum of common stock, preferred stock, additional paid-in capital, retained earnings, and accumulated other comprehensive income (net of treasury stock, if any).

It is a reciprocal of the equity ratio.

Calculation (Example)

Let us understand the calculation using the following example:

Suppose,

Total Assets of a Company = $200 Million

Total Shareholder’s Equity = $ 50 Millions

Using the equity multiplier equation as follows

Equity Multiplier = Total Assets / Total Shareholder’s Equity = 200 / 50 = 4.

We get a multiplier of 4. This simply means that total assets are 4 times the total equity.

You can also use our calculator – Equity Multiplier Calculator

Interpretation and Analysis

Running a business needs investment in assets. You do it in two ways, i.e., debt or equity. A ratio of 4 times states that total assets are 4 times that of its equity. In other words, 1 out of 4 parts of assets are financed by equity and the remaining, i.e., 3 parts, are financed by debt. In percentage terms, 25% (1/4) is equity, and 75% (3/4) is debt.

Also Read: Equity Multiplier Calculator

Our mind is always inquisitive about categorizing everything between good and bad. So, before jumping on to whether the multiple of 4 is good or bad, let us understand that the comparison is possible with 2 things – Industry Standards and Own Past Multiple.

Industry Standard

If the multiple is higher than its peers in the industry, you can safely say that the company has higher leverage.

Own Past Multiples

Comparing our multiple with our own past multiples can help us gain only the trend of it. If the trend is rising, it can be an alarming situation for finance managers because further debt borrowing becomes difficult with the rise in debt proportion. If the rise is not accompanied by sufficient profitability and efficient use of assets, it can lead the company toward financial distress.

Relation with DuPont & Impact on ROE:

The DuPont Analysis attempts to break down ROE into 3 components, viz. Operating Profit Margin Ratio, Asset Turnover Ration, and Equity Multiplier. The product of all 3 components will arrive at the ROE. DuPont formula clearly states a direct relation of ROE with Equity Multiplier. The higher the EM, the higher the potential for ROE and vice-versa.

Why is there a directly proportional relation between ROE and EM? Since the higher debt in the overall capital reduces the cost of capital with the basic assumption that debt is a cheaper source of capital. Taxes safely defend the assumption, i.e., the interest on the debt is a tax-deductible expense. If the rate of interest is 10% and taxes are 40%. The effective cost of debt is calculated as 6% .

Advantages and Disadvantages of Equity Multiplier

Both higher and lower EM can have their share of benefits and disadvantages.

Higher EM

High debt proportion in capital structure may have the following issues

- Higher debt means a higher risk of insolvency. If the profits decline under any circumstances, the chances of not meeting the financial and other obligations increase.

- The ability to borrow more debt becomes tough since it is already leveraged high.

Lower EM

On the other hand, lower EM can signify inefficiency in creating value for shareholders through tax benefits due to leverage.

Ideal EM

There can’t be one ideal equity multiplier. It should be part of the overall strategy of the business. This may depend a lot on industry and other factors such as the availability of debt, project size, etc.

Problems with Equity Multiplier Metric

There are certain issues that can dilute the use of equity multiplier for analysis. Cautionary measures are advisable.

Variations in accounting practices

Different accounting practices can impact the calculation of the EM. For example, the treatment of off-balance sheet items or lease obligations can affect the total assets and equity values used in the calculation. It’s important to ensure consistent and accurate accounting data when comparing EM values across companies or periods.

Potential for misinterpretation

A higher EM does not always indicate a positive outcome. While financial leverage can magnify returns during favorable economic conditions, it can also amplify losses during downturns. Excessive leverage can increase the financial risk and vulnerability of a company. Thus, a high EM should be assessed in the context of the company’s ability to service its debt and manage financial risks.

Industry differences

Different industries have varying capital structures and debt requirements. Comparing the EM of companies across different sectors may not be meaningful as their capital needs and risk profiles can differ significantly. It’s important to consider industry norms and benchmarks when interpreting EM values.

Visit for other types of Leverage Ratios.