Debt to Asset Ratio

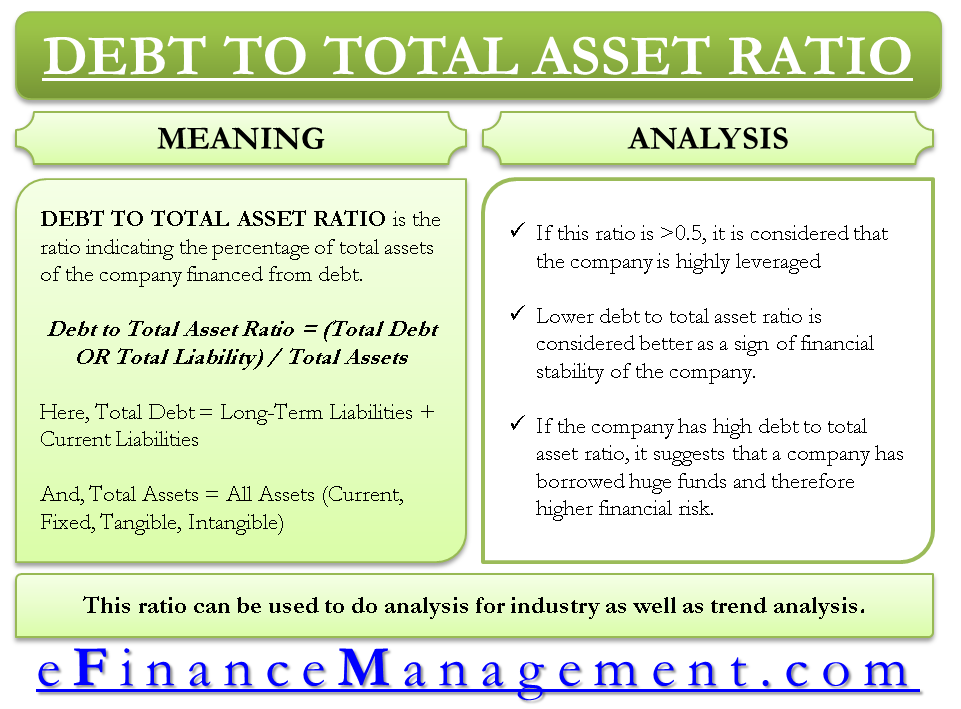

The debt to total asset ratio indicates the percentage of total assets of the company financed from debt. It is a broad financial parameter for measuring what part of assets are served by liabilities (debt), signifying financial risk. And it is one of the solvency ratios and helps measure how far the company is capable of meeting its long-term financial obligations.

It is also known as the Debt Ratio.

Debt to Total Asset Ratio Formula

The formula is as below:

| Debt to Total Asset Ratio = (Total Debt OR Total Liability) / Total Assets |

Where,

Total Debt = Long-Term Liabilities + Current Liabilities (i.e., Long-Term Debt and Short-Term Debt but does not include capital of shareholders)

Total Assets = All Assets (Current, Fixed, Tangible, Intangible)

Users of Debt to Asset Ratio

The total debt-to-asset ratio is a financial metric that is commonly used by a variety of stakeholders, including:

- Creditors: Creditors, such as banks or bondholders, use the debt-to-asset ratio to evaluate a company’s creditworthiness and assess the risk of lending money to the company.

- Investors: Investors, such as stockholders or potential investors, use the debt-to-asset ratio to evaluate a company’s financial health and risk profile.

- Management: Company management also uses the debt-to-asset ratio to monitor the company’s financial health and assess its ability to meet its debt obligations.

- Analysts: Financial analysts use the debt-to-asset ratio as part of their analysis of a company’s financial statements. By comparing a company’s ratio to industry benchmarks or historical trends, analysts can gain insights into the company’s financial performance and identify potential risks or opportunities.

Debt to Total Asset Ratio Example

Consider the following figures.

Current Liabilities = $50,000

Non-Current Liabilities = $250,000

Shareholder’s Equity = $100,000

Thus, we have,

Debt to Total Asset Ratio = 300000/400000 = 0.75

Thus, it implied that about 75% of the company’s assets are met by debt. If a majority of this 75% of lenders start claiming their money, the company may face cash flow mismatch problems leading to bankruptcy.

For Calculation, you can also use our Total Debt to Total Assets Ratio Calculator.

What is a Good Debt to Asset Ratio?

There is no single “good” debt-to-asset ratio that applies to all companies, as an ideal ratio can vary depending on the industry, the company’s business model, and other factors. Generally speaking, a lower debt-to-asset ratio is often considered better, as it indicates that a company is less reliant on debt financing and has a stronger financial position.

However, a “good” ratio can also depend on the specific circumstances of a company. For example, companies in capital-intensive industries, such as utilities or oil and gas, may have higher debt-to-asset ratios due to the significant investment required to fund their operations.

Also Read: Total Debt to Total Assets Ratio Calculator

As a general rule of thumb, a debt-to-asset ratio below 0.5 is often considered favorable, while a ratio above 0.6 may indicate that a company has a higher level of financial risk. However, it is important to remember that there is no one-size-fits-all approach, and investors and analysts should consider a company’s debt-to-asset ratio in the context of its specific industry, business model, and other financial metrics. It is also important to compare a company’s debt-to-asset ratio to industry averages or benchmarks to gain a better understanding of its financial position.

Visit How to Analyze and Improve Debt to Total Asset Ratio? to gain more insights.

Why Debt to Asset Ratio is Important?

This ratio is important for several reasons:

Assessing Solvency

The debt-to-total-asset ratio is a measure of a company’s solvency, or its ability to meet its long-term financial obligations.

Industry Analysis

It is important to compare the debt-to-asset ratio of various companies within the same sector. The nature of some industries may require a company to borrow a lot of money. E.g., the infrastructure sector. Thus, comparing this ratio of companies in different sectors might give you a misleading picture.

Trend Analysis

One can also use the debt-to-total asset ratio to gauge a company’s financials over a period of time with trend analysis. If the value of this ratio has increased significantly over a period of time, it may ring warning bells for the company and thereby for its investors.

Investment Decisions

The debt-to-total-asset ratio is an important consideration for investors when making investment decisions. Companies with high debt-to-total-asset ratios may be riskier investments, as they have higher levels of debt and may be more susceptible to financial difficulties.

Learn more about other types of Leverage Ratios