What is Equity Ratio?

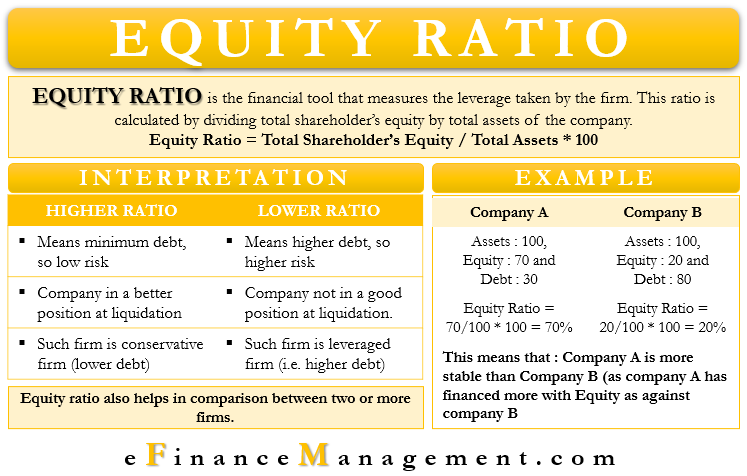

Financial ratios are one of the essential tools for the company’s stakeholders to judge the company’s performance. It not only helps to compare two different companies but also helps to monitor the performance of the same company over the years. One of the essential financial ratios is the “equity ratio.” It is a financial tool that measures the leverage taken by the firm.

This metric tells us about the asset financing of the firm. There are two major sources of finance, i.e., Debt & Equity. Equity is the amount invested by the owners/shareholders of the company & debt is the amount borrowed by the company. In other words, the Equity Ratio tells us how much percentage of a firm’s asset funding is through the equity contribution.

Equity Ratio Formula

The formula of Equity Ratio = Total Shareholder’s Equity * 100 / Total Assets

To derive the equity ratio, we need to divide the total equity by the Total Assets of the firm.

It is the reciprocal of Equity Multiplier.

Total Shareholder’s Equity

The term equity is anything that belongs to the shareholders (owners) of the company. Equity is the amount invested by the shareholders of the company. And it also includes retained earnings of the business so far. The shareholders have a residual claim on the assets after the claims of the debtors are over.

Total Assets

An Asset is an economic resource expected to generate future benefits. Total Assets of the firm include both current assets & non-current assets.

All these three terms, Equity, Debt & Assets, are interlinked with each other through an equation.

Shareholder’s Equity (E) + Liabilities (L)/ Debt (D) = Total Assets (A)

Thus, the total of Equity & Debt should be equal to the Company’s Total Assets.

Interpretations of Equity Ratio

Riskiness

A high ratio means minimal use of the debt for financing the company’s assets, making it less risky. In contrast, a lower ratio shows the use of more debt to fund the assets, making it riskier as continuous interest payments would be due.

Also Read: Debt to Equity Ratio

Liquidation

A higher ratio means the company would be in a better position at the time of liquidation. At the time of liquidation, the distribution of available funds happens in a sequence – first, it is unsecured priority debts like wages, taxes, etc. The second turn remains of the secured debtors. And next comes the unsecured debt. Once the debts are over, the equity shareholders have the right to distribution over the remaining funds. However, within the shareholders first, it is the turn of preferred stockholders in full, and then the balance money in a proportion of shareholding goes to the equity shareholders. So higher the ratio, there remains a chance of getting back the money from the equity shareholders.

Conservative & Levered Firm

If the Equity Ratio is more than 50%, meaning the company’s capital structure has either half debt & half equity or equity is more than debt. And such a firm is a “Conservative Firm.” “Levered Firms” are those firms having an Equity ratio of less than 50%, i.e., more debt.

Subject to a few exceptions, conservative firms may be less risky than levered firms because interest payments on debt are compulsory irrespective of profits or loss, while dividend payments are not binding. Therefore, conservative firms are flexible.

Lower/Higher Cost of Equity

Every resource used for financing has a cost. The cost of arranging equity is the Cost of Equity, and the cost of arranging debt is the Cost of Debt. There is a difference of opinion among the analysts on whether the cost of equity is cheaper or the debt. According to a few analysts, since there is no direct and compulsory cost for equity, they consider the cost of equity less expensive than the debt. And therefore, they prefer a higher equity ratio.

Also Read: Debt Ratio

On the other side, a few analysts consider the effective cost of debt as cheaper due to the taxation benefits. Hence, they prefer to have a lower equity ratio to generate a higher return on equity through leveraging.

On the other extreme, there is a theory by Modigliani-Miller, which suggests that capital structure (ratio of debt and equity) generally does not affect the Cost of Capital, and it remains the same irrespective of the proportion of debt and equity.

Equity Ratio for Comparison

In the same industry, we can compare the equity ratio of one company with others. It will not be appropriate to compare the equity ratio across sectors. Every industry has its own set of standards, and all financial ratios vary with the nature, requirements, and practice of the industry. So the same benchmark across the industries may not be workable.

Preference by Investors & Creditors

Analysts say that many times investors & creditors prefer a higher Equity ratio. Because firstly, it shows higher commitment from the owners (shareholders). Moreover, lower debt means the creditors would get priority in the settlement at the time of liquidation. A higher ratio also means relative flexibility to the firm to use the funds for better business opportunities like expansion, etc., instead of distributing the same as dividends.

Debt Ratio

As discussed above, the debt ratio is the opposite of the equity ratio. In other words, it is the remaining value of the total funds after deducting the equity ratio. The formula for calculating this ratio is the same as the equity ratio; only we need to replace the total equity quantum with the total debts. The formula is as below:

Debt Ratio = (Total Debt / Total Assets) * 100

Thus it is clear that Equity Ratio = 100 – Debt ratio.

Not a Benchmark across Industries

As we discussed above, the ratio varies across industries and businesses. What is suitable for one may not be right for others depending upon the quantum of investment, time to generate a return, gestation period, risk and uncertainties involved, technology issues, etc. So a standard benchmark across industries is not preferable. Still, a one-third equity ratio (33%) is the minimum benchmark for high investment businesses and start-ups. And from this minimum, the ratio can go up to 1:1 (50%) or even two-thirds (66%).

Example

Let’s take an example to understand it better.

| Company A | Company B | ||

| Particulars | Amt | Particulars | Amt |

| Assets | 100 | Assets | 100 |

| Equity | 70 | Equity | 20 |

| Debt | 30 | Debt | 80 |

Company A= 70/100 * 100 = 70%

Company B= 20/100 * 100 = 20%

Thus, Company A has financed most of its assets by equity rather than borrowing. On the other hand, Company B has financed its asset more by debt. Thus it may be said that Company A is more stable than Company B.

Conclusion

Thus Equity Ratio is one of the fundamental ratios which shows how much levered the firm is. It also shows what percentage of assets have been financed by equity & what by debt.

Analysts prioritize a higher Equity ratio because of lower financial commitments (fewer interest payments), but this is not a thumb rule. They also consider a firm good to have a lower equity ratio if interest liability is less than the return earned on the asset.

For analysis and investment decisions, this ratio alone is not enough. This ratio should be used in conjunction with other financial tools.