Cash Flow Adequacy Ratio, as the word suggests, helps in determining if the cash flows that a firm generates are sufficient enough to pay for the ongoing expenses or not. It is mainly a solvency ratio. This is because it helps to determine a firm’s capability to meet its cash outflow needs (investing and financing activities). And that is by using the cash flows from operations.

Along with determining the present financial health of a business, this ratio has one more use. One can also apply this ratio to determine if a potential project is worth considering or not. Moreover, lenders can also use this ratio to ascertain if a borrower will be able to meet its ongoing and future commitments. So, it will not be wrong to say that this ratio also helps in deciding the borrowers’ credit rating.

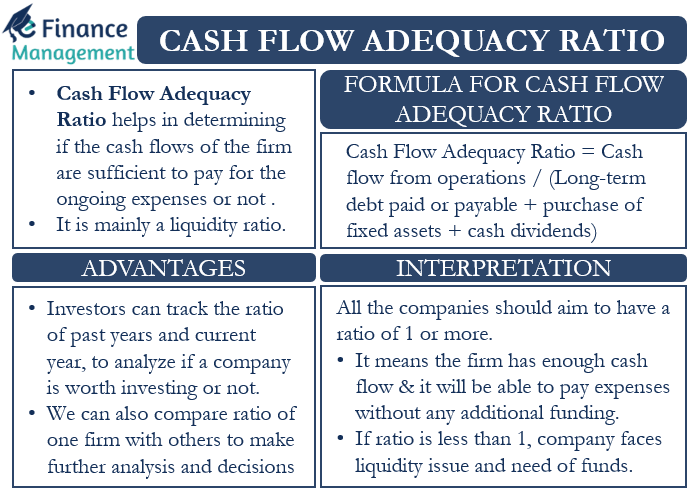

Formula for Cash Flow Adequacy Ratio

This ratio basically compares the cash inflows against some cash outflows. The cash outflows here include dividends, acquisition of fixed assets, and payments towards the long-term debt.

So, the formula is:

| Cash Flow Adequacy Ratio = Cash Flow from Operations / (Long-term Debt plus Purchase of Fixed Assets plus Cash Dividends) |

We can get cash flow from operations from the cash flow statement. Or calculate it using the profit or loss statement. We can easily reach other items, including the purchase of fixed assets, dividends, and long-term debt, from the balance sheet.

If the resultant number is more than 1, it means the firm is making enough cash flow from its operations. And it will be able to pay for its expenses without needing any additional funding. However, a ratio of less than 1 could mean that a firm may be facing some liquidity issues and may have to resort to some fire fighting. In other words, the firm may need additional short-term funding to meet this liquidity crunch to pay for its operational needs. Or slash its fixed assets expenditure, reduce or avoid dividends, or delay vendor payment.

Now, let us take an example:

Company A generates a cash flow of $500,000 in a year. During the year, the cash outflows were $225,000 for debt payments, $175,000 for acquiring a machine, and $75,000 towards dividends.

Now, putting the values in the formula to get Cash Flow Adequacy Ratio:

= $500,000 / ($225,000 + $175,000 + $75,000) or 1.05

Since the ratio is greater than 1, we can safely conclude that Company A generates enough cash flow to pay for its other expenses.

Interpretation of Cash Flow Adequacy Ratio

As said above, a ratio of 1 or more suggests the company is financially sound. Hence, all the companies should aim to have a cash flow adequacy ratio of 1 or more.

We can also compare the ratio of one firm with others in the industry to make further analyses and decisions. Even for the same company, one can compare this ratio with the past years to conclude if the performance shows an improving trend or not.

Also Read: Cash Ratio

If the ratio shows an increasing trend, it could mean that the financial position is improving. This also serves as a positive sign for positive future performance. On the other hand, if the ratio is decreasing, it could serve as a potential warning flag. It also raises questions about the company’s future performance.

Final Words

Investors can track the cash flow adequacy ratio of past years and current years to analyze if a company is worth investing in or not. Even though the ratio is very useful, it suffers from one major drawback. One can not solely rely on this ratio to assess the full performance of a firm. Moreover, this ratio does not consider other factors that may impact the company’s future performance, such as the working capital. Thus, an investor is recommended to take the help of other tools to evaluate the company’s performance. Nonetheless, this ratio is important and needs to be considered when making any investment decisions.

Visit Leverage Ratios to learn more about other types.

Frequently Asked Questions (FAQs)

The cash flow adequacy ratio is mainly a liquidity ratio that helps in determining if the cash flows that a firm generates are sufficient enough to pay for the ongoing expenses or not.

A ratio of 1 or more suggests the company is financially sound. It means the firm is making enough cash flow from its operations to pay for its expenses without any additional funding.

– it helps in comparing the ratio of one firm with others in the industry to make further analysis and decisions.

– comparing it with the past years to conclude if the performance shows an improving trend or not.