The total debt to total asset ratio is a solvency ratio that evaluates a company’s total liabilities as a percentage of its total assets. It determines the extent of a company’s leverage. It is calculated by dividing the total debt or liabilities by the total assets. This ratio aims to measure the ability of a company to pay off its debt with its assets. To put it simply, it determines how many assets should the company sell to pay off the total debt.

How to Interpret Debt to Total Asset Ratio?

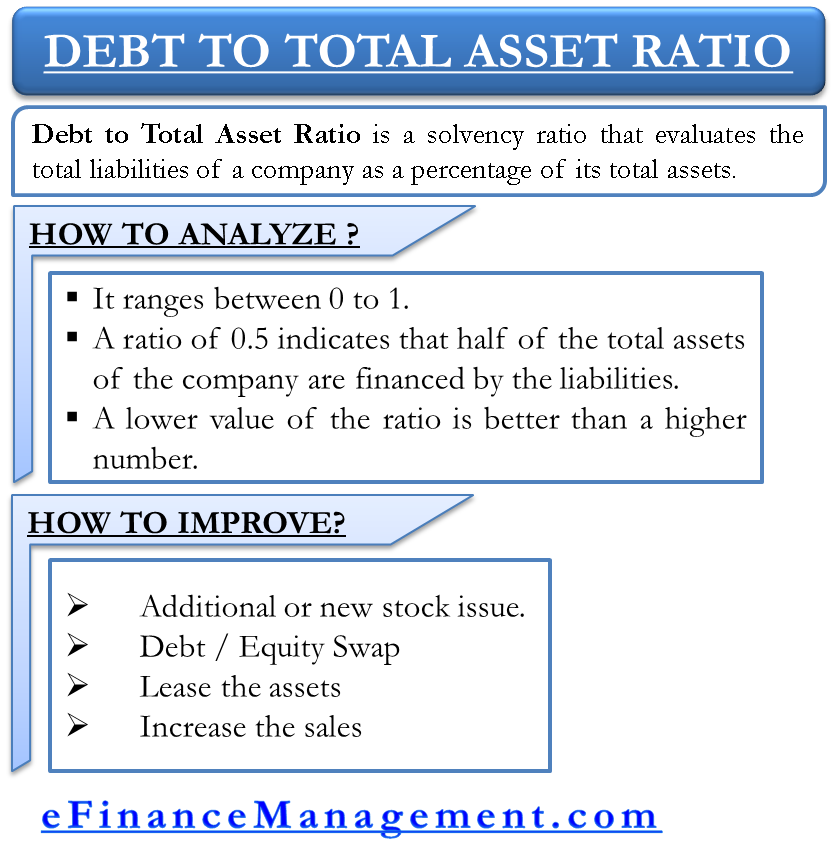

There is a general practice of showing the debt to total asset ratio in decimal format ranging from 0.00 to 1.00. A ratio of 0.5 indicates that liabilities finance half of the company’s total assets. In other words, the debt is only 50% of the total assets. A ratio of more than 1 is very bad for a company’s financial position.

A lower debt-to-total asset ratio is considered better as a sign of the company’s financial stability. This is because if the value of this ratio is low, it suggests that the company has borrowed fewer funds than its total assets. On the other hand, if the company has a high value of this ratio, it suggests that the company has borrowed huge funds and, therefore, has higher financial risk.

A high debt-to-total asset ratio does not go too well with investors. It suggests that creditors have claims on a high portion of the company’s assets. Also, if a company has high debt, it will end up paying a huge chunk of its operating profits on interest. This signifies a higher risk associated with the company’s operations. Companies with higher debt-to-total asset ratios should look at equity financing instead.

Also Read: Debt to Total Asset Ratio

Let’s look from a longer and more futuristic perspective. A high debt-to-total asset ratio also suggests that the company is risky to invest in because it would not be able to secure loans for its future projects due to an already higher ratio resulting in lower borrowing capacity.

This is a highly useful ratio for investors, creditors, financial analysts, company management, etc. There can be two angles of looking at this ratio – Financial Leverage and Bankruptcy Risk.

Financial Leverage

We all know that the infusion of debt capital by trading on equity will improve the equity shareholder’s return on investment. This theory is subject to the condition that the cost of debt is reasonably lower than the return that the company generates. Why should it be reasonably lower? Economic and business cycles are a reality. These may badly impact the return generated by the company. If there is a cushion, the benefit of leverage may sustain. On the contrary, if the cost of debt overruns the business returns, the business will start diluting the value of the shareholders.

Bankruptcy Risk

If the financial leverage is too high, the risk perception of the investors and lenders will increase. This has various drawbacks, like raising additional funds becomes very difficult. The higher fixed obligation in terms of higher interest costs approaches bankruptcy very fast, even when there is a temporary liquidity crunch in the company

Also Read: Debt Ratio

At this juncture, the open question here is ‘What are the right levels of this ratio?’ as we have already mentioned that the benefit of financial leverage and bankruptcy risk the opposite components on the same scale. Ideally, a balance between the two factors should be established. Industry norms can also guide to a great extent as the norms of this ratio may differ from industry to industry.

Why is it Necessary To Improve Debt to Total Asset Ratio?

A higher debt-to-total asset ratio is very unfavorable for a company.

- Firstly, it indicates that the debt has financed a higher percentage of assets. This means that the creditors have more claims on the company’s assets.

- Secondly, a higher ratio increases the difficulty of getting loans for new projects as the lenders will see the company as a risky asset.

- Thirdly, a higher debt-to-total asset ratio also increases the insolvency risk. The company might not be able to pay off all the liabilities with its assets in case of liquidation.

Therefore, the company must work towards improving the debt-to-total asset ratio.

How to Improve Debt to Total Asset Ratio?

If a company has a higher debt-to-total asset ratio, it needs to lower it. The company should reduce the debt proportion to lower the ratio. However, it can also follow several other options to improve the debt-to-total asset ratio:

Issue Additional/New Stock

The company can issue new or additional shares to increase its cash flow. This cash can be used to repay the existing liabilities and, in turn, reduce the debt burden. The debt reduction will lower the debt-to-total asset ratio.

Debt-Equity Swap

By implementing a debt-equity swap, a company can make a debt holder an equity shareholder in the company. This will cancel the debt owed to him and, in turn, reduce the company’s debt and improve the ratio. If planned, convertible debentures can be issued.

Lease Assets

The company can sell its assets and then lease them back. This will induce a cash flow that can be used to pay off some debts.

Increase the Sales

The company can focus heavily on increasing sales but without any increase in overhead expenses. The increase in sales can be used to reduce the debt and improve the debt-to-total asset ratio.

Conclusion

The debt-to-total asset ratio is an important solvency ratio. The company needs to monitor this ratio regularly, as creditors will always keep an eye on this ratio. The creditors are worried about getting their money back, and a higher debt-to-total assets ratio will translate into no loans for new projects. Thus, the company should always aim to keep the ratio in an acceptable range.

I truly enjoy looking through on this web site, it holds superb content.