Ratio Analysis: Meaning

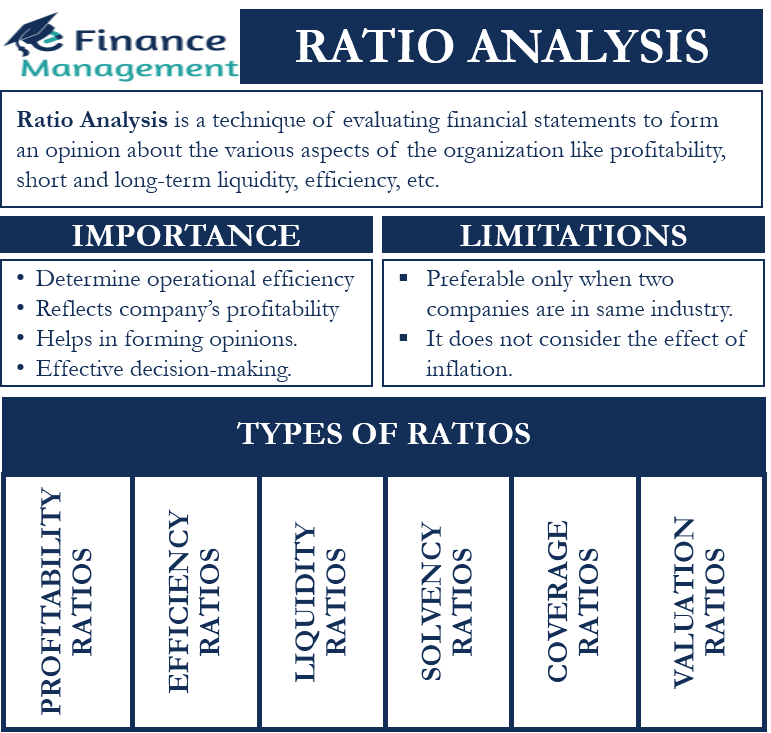

Ratio analysis is a technique for evaluating financial statements or, to say, for detailed analysis of the financial statements presented by the firm. The analysis or evaluation is done to form an opinion about the various aspects of the organization, like profitability, short and long-term liquidity, efficiency, potential, etc. Moreover, this analysis is done and utilized by both internal and external stakeholders. Internal stakeholders primarily include managers. External stakeholders include creditors, investors, lenders, etc.

Ratio analysis is the most commonly used technique among all the methods of analyzing a financial statement. And it enhances the usability of financial statements.

Explanation with Example

The profit and loss statement states the profit or loss of the company in a particular year. In ratio analysis, various profitability ratios are calculated, like gross, net, or operating margins. Often comparison with peers help us know where we stand. A point to note is that absolute figures of the P/L statement are not comparable. But the calculation of the margin by way of ratio analysis makes it possible to compare the status or trend of margin with past years as well as with the competitors. This helps us judge the overall efficiency of the business and its management.

Let us look at various other pointers where financial analysis is important.

Importance of Ratio Analysis

Ratio analysis is a very important tool widely utilized by existing shareholders, prospective investors, suppliers, lenders, competitors, customers (at times), equity research analysts, government agencies for evaluating tenders, etc. The following are the main reasons for such wide usage.

Also Read: Importance of Ratio Analysis

- Provide abstract of operational efficiency.

- Reflects the profitability of the company.

- Helps in forming opinions and making further decisions.

- Helps in inter and intra-company comparisons.

- To learn more about the importance of ratio analysis, please refer: Importance of Ratio Analysis

Applications of Ratio Analysis

There are various applications of ratio analysis depending on the purpose and need of the analyst. Following are some of the major applications of ratio analysis.

- Assess the liquidity position.

- Helps in determining optimal capital structure.

- Depicting the efficiency of the company.

- Determining long-term solvency.

- Refer to Advantages and Application of Ratio Analysis to learn more

Types of Ratios

Ratios are classified into the following types:

Profitability Ratios

Profitability ratios help analyze returns a business is generating from its business operations and investments. Not only this, but it also analyzes the kind of margins that the business can generate from its turnover/revenue. Profitability ratios are useful to most stakeholders. Because every commercial organization wants to earn profits and improve its profitability consistently.

There are 2 types of ratios under profitability ratios:

- Margin ratios: these ratios include gross profit margin, net profit margin, expense ratios, etc.

- Return ratios: The return ratios include return on equity, return on assets, earning power, return on capital employed, etc.

Please read more about All the PROFITABILITY RATIOS.

Activity/Efficiency/Turnover Ratios

Turnover ratios, also known as asset management ratios, efficiency ratios, or activity ratios, judge the efficiency in the management of assets of the business. Management invests in assets to generate sales. And these ratios determine if the utilization of these assets is efficient. Moreover, how does that compare with other similar entities as also within the industry segment? Or how efficiently the capital in the business rotates.

Important activity/ efficiency/turnover ratios are:

- Inventory turnover ratio

- Receivables turnover ratio

- Fixed assets turnover ratio

- Total asset turnover ratio

- Payables turnover ratio

- Working capital turnover ratio

To learn more about these, please refer to EFFICIENCY RATIOS

Liquidity Ratios

These ratios are calculated to find out the liquidity position of an organization in the short term. Liquidity means the ability to make payments as and when some obligations turn due. It is the lifeblood of any business organization because lacking it can lead to bankruptcy, interruption in the manufacturing cycle, and so on.

Also Read: Advantages and Application of Ratio Analysis

The important liquidity ratios are:

- Current ratio

- Acid-test ratio

- Quick ratio, etc.

please refer to LIQUIDITY RATIOS for more understanding

Solvency/Leverage Ratios

Leverage in finance means the use of debt in its capital structure. Leverage ratios help in determining the debt portion in the capital structure of a business. Along with this, these ratios also assess the risk of bankruptcy or repayment capacity for the organization. These ratios are also known as solvency ratios. It involves:

- Debt-equity ratio

- Debt-asset ratio, etc.

please read more on LEVERAGE RATIOS

Coverage Ratios

Coverage ratios judge the debt servicing capacity of a business by comparing its debt obligations with resources used for honoring them. These include:

- Interest coverage ratios

- Fixed charge coverage ratios

- Debt service coverage ratios, etc.

please refer to COVERAGE RATIOS for more

Valuation/Market Value Ratios

Valuation ratios or market value ratios mainly help to analyze the worth of stock in the share market or the value of a company as a whole. Valuation ratios include:

- Price-to-earnings ratio

- Dividend yield

- Market value to book value, etc.

To learn more about these, please refer to MARKET VALUE RATIOS

Limitations of Ratio Analysis

Amongst various uses, advantages, and applications of ratios, these have certain limitations too. These includes:

- Non-consideration of the inflationary effect.

- Variation in the industry to industry standards.

- The difference in accounting practices.

- Please refer to Limitations of Ratio Analysis, for in-depth learning.

Conclusion

Stakeholders cannot rely on financial statements alone to take any decision relating to their stakes in the organization. Ratio analysis is a very useful method to analyze financial statements that help stakeholders in making well-informed decisions.